Editor's Note:This post was originally published in May 2018 and has been updated for accuracy and relevancy.

The age of the ecommerce subscriptions has arrived in a big way.

It’s a主要的商业模式for businesses like Netflix and Spotify, which offer a Software-as-a-Service, or SaaS model, and now subscriptions have begun to spread to other industries such as fashion and beauty. For example,Birchboxsends its subscribers a selection of cosmetics, skincare products, perfumes, and organic products monthly. And men’s lifestyle brandManscapedsells grooming replenishments via subscription. Done right, ecommerce subscriptions can be a powerful driver of growth for your business.

At its basic form, a subscription business model is one that charges customers a recurring fee—usually monthly or yearly—for access to a product or service.

But on a deeper level, ecommerce subscriptions are about strong customer relationships. Subscriptions turn customers, who already see the value your company provides, into loyal followers who become reliable sources of recurring revenue. In fact, the longer a customer uses your product or service, the more valuable they become to you. Plus, higher customer retention rates mean lower acquisition costs in the long term.

In this article, we’ll look at the value of subscriptions from a revenue perspective, the outlook for the subscriptions industry as a whole, and how you can turn any product or service into a subscription.

What are ecommerce subscriptions?

Ecommerce subscriptions are a business model that allows customers to continuously receive a product or service for a period of time. Subscriptions can increase an online store's revenue and customer lifetime value.

The revenue opportunity of ecommerce subscriptions

Consumer buyinghabits are trending towardhassle-free shopping experiences, free delivery, and instant gratification. The subscription model serves all those needs, providing value to the customer with low effort, and incredible growth opportunities for subscription-based businesses.

Traditional online retail is based on ad hoc purchasing and total revenues, whereas subscription modelsrely on pre-planned purchasing and recurring revenue.The value of a subscription is in this recurring, predictable revenue.

The recurring revenue of a subscription model can be a lifeline for your business through the ups and downs of the market and retail cycle and through the COVID-19 pandemic. This consistent, predictable revenue lets subscription-based companies order and manage inventory more efficiently. And understanding a customer’s lifetime value in a subscription business can help brands spend wisely on acquisition in slow-selling seasons. Given the closer, more targeted relationship you have with subscribers than with typical consumers, the most successful subscription businesses can see reduced churn rates in their customer base. As a benchmark,the average churn rate for B2C businesses is 7.05%.Voluntary churn can be caused by customer dissatisfaction, while involuntary churn points to payment issues.

Pricing also tends to be far more straightforward with subscription-based businesses, as stores focus on macro pricing with tiers, rather than individual prices on an array of products.

Ecommerce subscriptions likewise help brands increase repeat purchases since you don't have to win the business ad hoc every time if you have a loyal, subscribed customer base. You have a60-70% chance ofselling to an existing customer, versus a 5-20% chance of selling to a new prospect.

In addition, should you decide to sell your business, recurring revenue ultimatelymakes your company more valuableand attractive to investors or potential buyers.

Subscription-based business modelsenable companies to be heavily data-drivenwith customer targeting and acquisition, and pass the cost savings around distribution, marketing, and personalization on to their customers. The insights that subscription-based businesses have into their customer base createenhanced cross-selling and marketing opportunitiesthat simply aren’t possible for typical retailers.

Outlook for the subscriptions industry

The good news for retailers looking at offering a subscription model is that business is booming.

The latestprojections suggestthat by 2025 the global ecommerce subscription market will be worth $246.6 billion.

TheSubscription Economy Index(SEI), which tracks subscription businesses on the Zuora platform, reveals that subscription businesses grew revenues approximately five times faster than S&P 500 company revenues (18.2% versus 3.6%) and U.S. retail sales (18.2% versus 3.7%) from January 1, 2012 to June 30, 2019.

Subscription ecommerce businesses raised approximately$2.5 billionin venture capital funding over the past three years, including $400 million in the first eight months of 2019.

By 2023, 75% of businesses that sell direct to consumers (DTC) are expected to offer subscriptions.

Growth rates are even more impressive outside the U.S. Subscription businesses in Europe, the Middle East, and Africa (EMEA) havegrown 4% fasterthan their North American counterparts over the past three years.

And when we consider the benefits to consumers of the subscription model, it’s easy to understand why this segment is booming.

In many ways,it comes down to convenience.Gone are the days of running out of things and having to pop to the store last minute. Subscriptions are the ultimate example of “set it and forget it.” The customer makes the decision once when they sign up for the service, and then, like clockwork, they receive their goods or services without having to think about it again. And with the added benefit of low cost or free shipping, it removes the hassle of having to make a trip out to get something—which is of huge benefit now during pandemic lockdowns and restrictions.

The key to subscription businesses is customer retention and customer lifetime value (LTV). That's why churn rate, rate of customer acquisition, and the cost of finding new customers are important metrics when you run a subscription business.

Nearly40% of customershave cancelled an online subscription, with top-performing brands retaining more customers. Retention is especially crucial to subscription businesses that offer “cancel at any time” options, as they have to at least cover the cost of acquiring those subscribers. It’s5–25% more expensiveto acquire new customers than to retain existing ones.

Research suggests customers who do churn do so relatively quickly after signing up for a subscription.

More than one-third of consumers cancel their subscription in less than three months, and more than half cancel within six months. So efforts to reduce churn and keep customers are crucial.

The most popular industries selling via ecommerce subscriptions

In some ways, it’s difficult to tell what the most popular industries are for selling subscription products, as comparisons are tough to come by on an apples-to-apples basis. For instance, theSEItracks only the software-as-a-service (SaaS), internet of things (IoT), manufacturing, publishing, media, telecommunications, and business services industries. Others track subscriptions bysector(health care, groceries, beauty, etc.) or订阅的类别(replenishment, curation, or access).

Separately, some data curators track only thesubscription box industry, which don’t account for media services like Netflix or Amazon Prime. Thoughthis onedoes classify movies, television, and music as subscription boxes.

Patching together industry, sector, and category data provides a more holistic picture of the hottest subscription areas as well as those that are underpenetrated and ripe for disruption. For instance, the SEI suggests the IoT sector (healthcare, construction, energy, transportation, and technology), which sells recurring digital services through hardware, is the fastest growing subscription sector.

What’s interesting is how quickly new entrants rise to the top, regardless of the industry.

Top-performing subscription companies regularly experience year-over-yeartraffic declines.The silver lining here is that new retailers have an opportunity to enter the market and take share. Likewise, top-subscription brands that fall out of favor in any given year have ample opportunity to reclaim their top spots (like how HelloFresh climbed to the top).

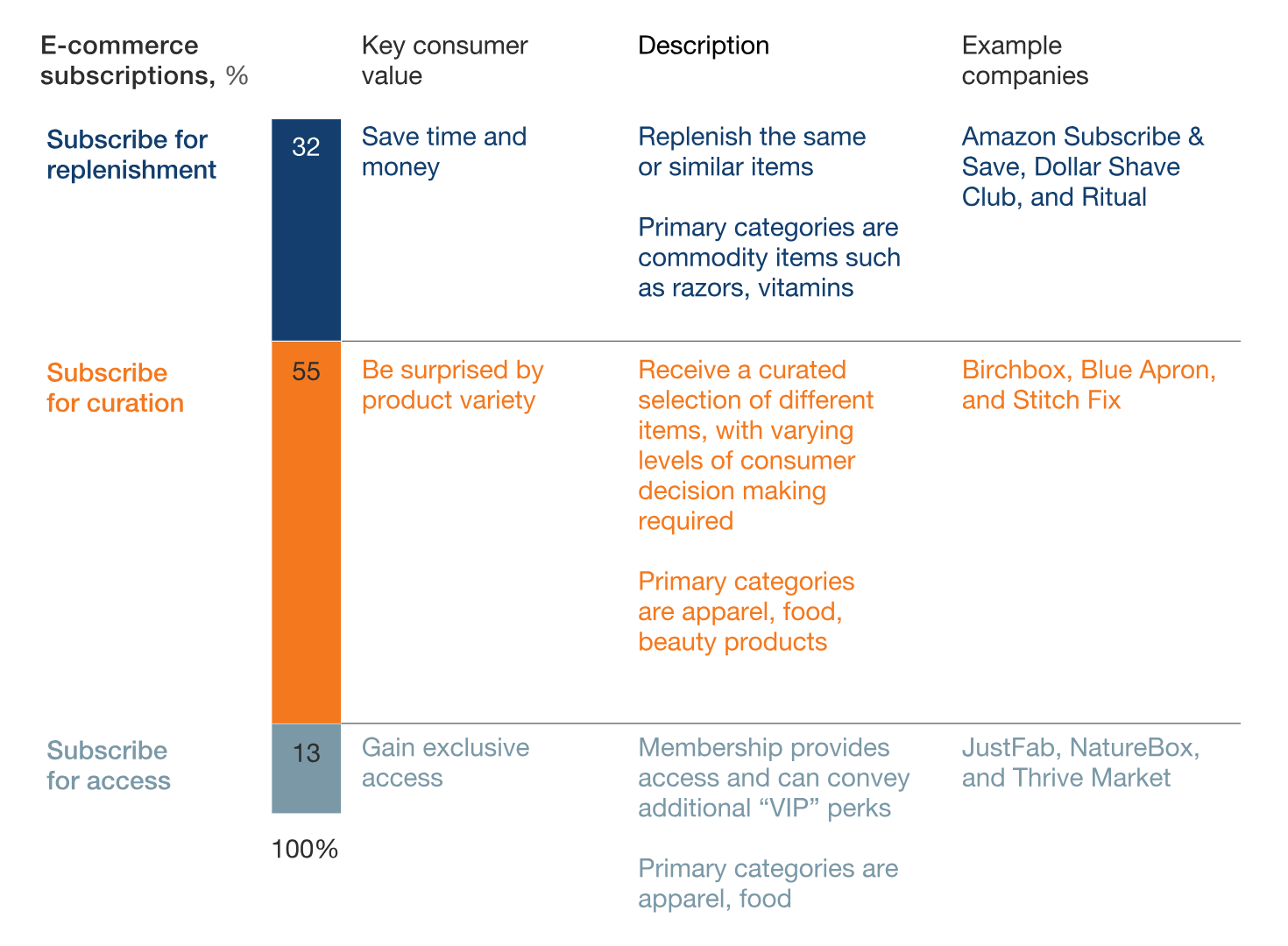

Beyond product types, McKinsey groups subscriptions into three key categories: curation, replenishment, and access.

Curation subscriptions(55%) look to surprise and delight. The majority of people subscribed to subscription services are looking for custom curation, which cannot be easily replicated by competitors. This creates a great opportunity for those looking to enter the space to supplement their current online strategy or curate something entirely new.

Replenishment subscriptions(32%)focus on “never running out” at a lower cost than retail price. The challenge here is that it can be a race to the bottom for price and easy to replicate.

Access subscriptions(13%) are member-only programs that cater to “VIP” perks, early access to new products, and exclusivity. Most businesses operating at scale already have some kind of loyalty program. By adding subscriptions, you can drive additional monthly or quarterly revenue while continuing to give your best customers a unique experience.

How to incorporate ecommerce subscriptions into your strategy

Before packing your products into a subscription box, it’s important to understand the reasons why brands incorporate subscriptions into their existing products.

- Differentiation:In a highly commoditized or saturated industry, like beauty, a subscription offering can set your brand apart and establishes you as a curator or influencer in your space

- Segmentation:With more information on subscription customers than a typical checkout, there is greater opportunity for upsells or cross-sells as well as to “surprise and delight”

- Stability:As subscriptions take root, you can more accurately predict inventory levels, reduce waste, and cultivate recurring revenue

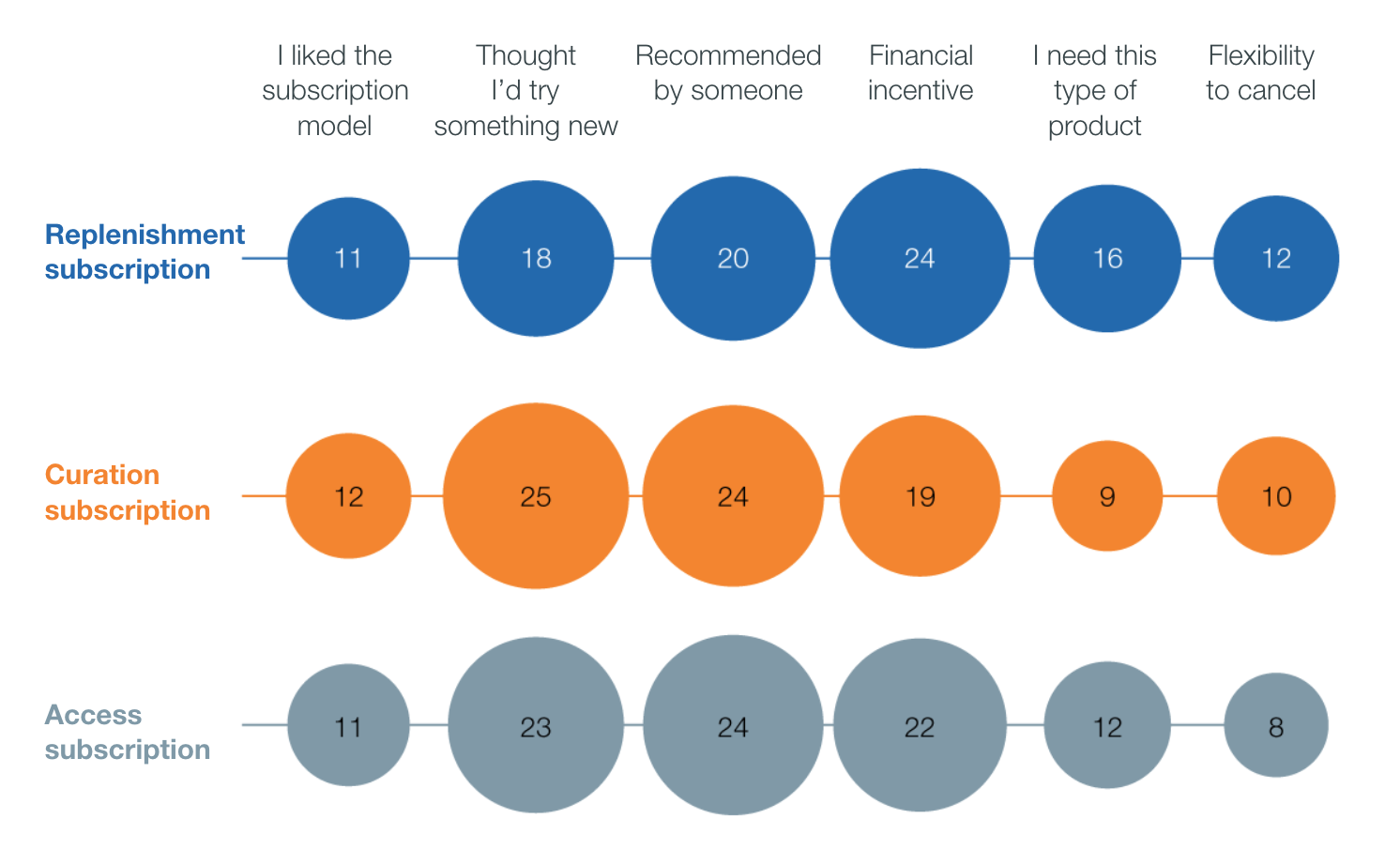

Customers don’t subscribe to products because they enjoy money exiting their bank accounts every month. So why do so many buyers subscribe to products?

- Exploration:With so much choice online, many buyers see subscriptions as a simple way to “try something new” that’s highly personalized

- Personalization:One of the main factors in the longevity of a subscription is increased personalization over time—this is something to keep in mind to minimize churn

- Value:Overall price is not the key factor here, but rather value for money; as one of the key reasons why someone subscribes and churns, it’s important to manage expectations with your buyers

Turn any product or service into a subscription

These days, you can turn any product or service into a subscription. While there have traditionally been subscription categories like home goods (e.g., razors or vitamins), apparel,food, or beauty products, today there are no rules—if you sell a product, you can make a successful entry into the world of subscriptions.

Consumers are increasingly subscribing to products that have historically not been offered as subscriptions. The trend is being driven by consumers who have multiple subscriptions:Of the 15% of consumers who receive subscription products, 35% subscribe to three or more services.Diving deeper within this group, 18% of men and 7% of women have six or more subscriptions.

Pretty Littersells what it calls the world’s smartest kitty litter. While the brand’s subscription keeps tabs on a cat’s health by changing color, the company’s Head of Business Intelligence, Joe Barger, suggests what Pretty Litter really sells is convenience and peace of mind.

- Convenience:no need to worry about when to refresh their litter

- Peace of mind:daily check that their feline friends are healthy

“There are millions of things on everyone’s minds these days,” Barger says. “We offer our customers fewer things to worry about when it comes to some of the most important aspects of their lives—their pets.”

Barger has agreed to share some of Pretty Litter’s most valuable insights to give other brands ideas to succeed with subscriptions.

Learn from power users

Pretty Litter has established a VIP hero group on Facebook, home to thousands of their top customers. The group not only allows Barger and his team to learn directly from power users by getting direct feedback, but it also gives the brand an opportunity to build brand ambassadors.

“Continuous adaptation is a key to success,” Barger says. “What works today may not work tomorrow and you need to always keep a pulse on what’s working or not and be ready to double down on wins while pulling back on poor performing channels.”

Build a unique value proposition

Consumers haven’t been conditioned to think of kitty litter as an ecommerce subscription. But saving customers time and knowing the kitty litter that arrives automatically every month is helping them protect and care for their pets is a value proposition the brand built for maximum product “stickiness”.

“We have built a clear and unique value-add that addresses the convenience of a continuity model,” Barger says. ”Especially for a product that is needed on a consistent and ongoing basis.”

Personalization increases retention

Offering online subscriptions allows Pretty Litter to tailor branded communications with the customer. Customers can revisit the Pretty Litter site on their own convenience and learn about the benefits, as opposed to when they’re already in a rush at the grocery store.

Even more important, personalizing the subscription experience helps Pretty Litter retain more of its subscription customers. Instead of a one-size-fits-all offering, Pretty Litter offers customers flexibility and choice.

“这是罕见的,对每个人来说都是一个解决方案,” Barger says. “Offering customers the ability to build their own flexible plan is key to retaining your customers. If you’re going to introduce other products, make sure that they’re a relevant fit to your brand. A random product that doesn’t tie back to your core brand could do more harm than good.”

Monitor cash flow

With customer acquisition costs and churn relatively high, ecommerce subscriptions require more attention than other businesses might. Paying close attention to the financial details of your subscription business is key. Especially when you consider that consumers are being conditioned to expect more.

Customer expectations, according to Barger, are rising continuously due to Amazon’s fast and free shipping. While matching Amazon’s expedited shipping is expensive, subscription brands must simultaneously meet customer expectations while intelligently managing the company’s finances.

“Cash flow management is very important to ensure a healthy business,” Barger says. “Subscription KPIs are very different from traditional retail models. Make sure you have the budget and cash flow to spend on acquiring customers.”

And kitty litter isn’t the only non-traditional good that works under a subscription model. Subscriptions can also work for items that traditionally are not immediately replenished.

How to implement subscriptions in your online store

If your store is powered by Shopify, you can build your own custom subscription solution usingShopify’s new Subscription APIsandProduct Subscription Extension.Shopify套件的啊f APIs and open-source templating language, Liquid, enable you to make Shopify work the way you need it to. Take a DIY approach and build in-house with your own developer team. Or, if you’d prefer, you can reach out to one of ourShopify Plus Service Partnersto help you plan a subscription strategy and develop a custom app to do what your brand needs.

Read More

- Ecommerce Marketing Strategies: A Comprehensive Guide for Growth

- Scaling a Global Ecommerce Business: Three Keys from $100M+ Enterprises

- Hypefest 2018: O2O Examples from the Forefront of Marketing & Retail

- Is Your Agency 'The One'? An Inside Scoop on Finding a True Partnership

- Multi-Channel Customer Acquisition: 7 Tips from $3.7M+ in Ad Spend

- The 4 Words at the Root of All Meaningful Client-Agency Relationships

- Rethinking Retargeting: Finding the Line Between Stalking and Solving

- A Strategy for Human Resources in our Current Climate

- How 3 Brands Scaled Their Ecommerce Subscription Model 100-350%

- A Crisis Communications Plan for Brands