In 2021, the total value of retail trade ecommerce sales in the United States reached$870 billion. As online sales continue to climb, retailers need to ensure they’re offering customers the best possible payment experience.

Recent dataconfirms an overwhelming customer preference for making payments via debit cards, credit cards, and online payment services—all of which require payment providers and payment gateways.

Payment providers have one goal—make it as quick and easy as possible for customers to pay you. But not all payment providers are created equal.

Payment gateways are the last step shoppers complete before making payment—they can make or break your online store. At their best, they optimize the checkout experience; at their worst they can cause a customer to abandon their cart at the last minute.

As a result, choosing the right payment provider is important. But many retail business owners are unsure about which type of payment provider will help them increase sales and save on unnecessary costs.

本指南股票零售商需要了解的一切w about payment providers, payment gateways, and payment processors.

Table of Contents

- What is a payment gateway?

- Parts of ecommerce payment processing

- How does a payment gateway work with a payment provider?

- Why do merchants choose third-party payment processors?

- Common issues with ecommerce payment processors

- How to switch to Shopify Payments

- Streamline online payment processes with Shopify

What is a payment gateway?

A payment gateway is the technology that reads and relays payment information from a customer to a merchant’s bank account.Its function is to receive payment data, check sufficient funds are available, and take payment.

Online stores use a cloud-based software payment gatewayproviders to connect customers to the merchant.

In physical stores, a payment gateway is built into a point-of-sale (POS) system or card readerwhen a customer uses their card to make a payment.

Any business that takes online and card payments will need a payment gateway provider. The technology passes on financial data to the necessary organizations to approve payments and move funds from a customer to a seller.

How do payment gateways work?

The best payment gateways include these key participants:

- Cardholder: The customer making the purchase.

- Merchant: The business making the sale.

- Card schemes: The card networks that control the card. For example, Visa, Mastercard, or American Express.

- Issuing bank: The bank that manages the customer’s account, either a checking account linked to a debit card or a credit card account.

- Acquiring bank: The bank that manages the merchant’s account.

Different types of payment gateways

Retailers can choose from different types of popular payment gateways. Each one is best suited for certain types of businesses.

There are three main types of payment gateway services:

- Redirect:This payment gateway takes a customer to a payment processor like PayPal or Stripe to process payment.

- Hosted (off-site payment):Customers make a purchase on your online store, or at your physical location, and the payment details go to the payment provider’s servers for processing. This is how the Shopify POS system works.

- Self-hosted (on-site payment):The whole transaction happens on your servers.

The simplest way to get a payment gateway for your online or brick-and-mortar retail business is to sign up with a payment service provider.

Payment service providers like Shopify handle the transaction end-to-end and act as a merchant account too. That way you don’t need to manage so many moving parts. Merchants just need to sign up for an account, add the required buttons or code to their site (if it’s not already built in), and start taking payments.

Parts of ecommerce payment processing

Ecommerce payment processing can seem like it’s made up of multiple complex steps. But it’s easy to summarize it inthree key parts.

Confusingly, you may see the terms “payment gateway” and “payment processor” mistakenly used interchangeably. They are not the same—each performs a separate task.

1. Payment gateway

Payment gateways read and relay payment data from customers to a merchant’s bank account.They work as the delivery service between your online store where the customer enters their payment details and your payment processor.

2. Payment processor

A payment processor receives payment information from the gateway, confirms that the customer has sufficient funds, and moves the money between the issuing and merchant account.

3. Merchant account

A merchant account is a type of business bank account that lets businesses accept and process electronic card payments.

All online businesses require a partnership with a merchant account to take digital payments. Brick-and-mortar businesses that don’t want to accept card payments aren’t required to have a merchant account.

Different merchant accounts have varying transaction fees. Merchant-acquiring banks and businesses form merchant accounts through a detailed merchant account agreement that specifies all of the terms involved in the relationship.

These terms include:

- 为成本的银行将收取

- Established fee structures with the network of card processors

- Monthly or annual fees the bank charges

How does a payment gateway work with a payment provider?

A payment gateway is the middleman between customers and the merchant.It ensures that each transaction is carried out securely and efficiently. The best payment gateways encrypt sensitive major credit card details so that all information is passed securely.

A payment service provider (PSP)provides digital payment services to businesses that accept online payments.

Depending on the PSP, these online payment types might include:

- Credit cards

- Debit cards

- Prepaid cards

- Amazon Pay

- PayPal

- Stripe

Payment service providers use payment gateways to process transactions from online purchases.The payment gateway acts as an interface between the merchant’s website and a payment-processing (acquiring) bank.

Why do merchants choose third-party payment processors?

Third-party payment processors let businesses bypass having their own merchant account at a bank.These companies let brands use their merchant account to process online transactions.

Examples of third-party payment processors include:

- Authorize.net

- GoCardless

- Stripe

- PayPal

The third-party processor reviews the customer’s payment information and runs it through anti-fraud measures. It then approves the transaction data and delivers funds to the merchant account.

Merchants often choose third-party payment processors because they appear to have simpler setup processes with fewer fees. But it’s important to look at the bigger picture before you decide whether a third-party payment processor is right for your business needs. In many cases, it’s better to use a different payment solution.

Benefits of third-party payment processors

Here are some of the benefits merchants associate with using third-party payment processors:

- No upfront fees

- Quick to set up

- Flexible terms

No upfront fees

Small businesses that process a very low volume of customer card payments may not want to pay for the cost to set up a merchant account. So they choose a third-party payment processor that’s usually free to set up.

But while there are no upfront fees, third-party payment processorscharge a per-transaction percentage fee.This fee is much higher than it would be with a dedicated merchant account.

Businesses that process a high volume of online payments find the per-transaction percentage fee to be more expensive than the upfront cost of setting up a merchant account.

Quick to set up

Third-party processors have quick set-up processes. They only require limited information from your business, like your bank details. Merchants can get up and running in a matter of clicks.

Flexible terms

而商人服务提供商往往需要公共汽车inesses to sign contracts of a few months, third-party processors are usually more flexible and don’t require monthly fees or a contract.

What are the drawbacks of using a third-party payment processor?

Third-party payment processors may work well for startups or small brands that don’t process many online payments. But they’re not right for all brands, especially when they’re processing increasing volumes of card payments and online transactions.

Here’s why a third-party payment processor may not be the best payment solution for your business:

- High transaction percentage fees

- Lack of security features

- No end-to-end solution

High transaction percentage fees

Unlike merchant accounts with bank accounts, most third-party payment processors don’t charge a set-up fee. They do charge a percentage of each transaction though. Depending on the third-party payment processor,this percentage is usually between 2% and 4%, plus a set fee. For example:

- Stripe paymentscharges 2.9% plus 30¢ per transaction to accept card payments online and 2.7% plus 5¢ to accept in-person payments.

- PayPal paymentscharges between 2.59% and 3.49% plus 49¢ per transaction.

Over many transactions, this percentage cut adds up and can be a significant drain on your revenue.

This cost of processing individual transactions is often higher than the pricing associated with merchant accounts. Depending on the size of your business and the number of transactions you process per month, the fees charged per payment may not be the best solution for your business.

Lack of security

Working with third-party payment processors opens your business to security risks.

As theFederal Deposit Insurance Corporation (FDIC)states, “Deposit relationships with payment processors can expose financial institutions to risks not present in typical commercial customer relationships, including greater strategic, credit, compliance, transaction, legal, and reputation risk.”

A third-party processor may not comply with governing laws, regulations, or rules required for your area, the regions of your customer, or the location you conduct business from.

Depending on the third-party payment processor you choose, customers may not trust it right off the bat, which can reduce sales. Third-party processors may not offer the best user-experience either.

Customers may abandon their shopping cart if they feel dissatisfied with the choice of a third-party payment processor. In fact,18% of customersabandon their orders during the checkout process if they don’t trust the site with their credit card information.

If your third-party payment processor suffers a data breach and leaks your customers’ sensitive data, your brand may also suffer damage to its reputation and customer relationships.Sixty-six percent of customerswill stop buying if companies experience a data breach.

- Image source:Adobe

Plus, if a third-party payment processor believes you have fraudulent transactions, it can freeze your account and hold your funds while it conducts an investigation—you’re stuck without your funds for the duration. There are no guarantees surrounding merchant support from providers either.

保护持卡人数据是至关重要的。没有to meetPCI compliance requirementscan have serious consequences for retailers, including fines and bans. Tokenization and encryption help ensure secure payments and should be key features of your provider.

当你有自己的专用的商家帐户,your business receives better fraud protection. Businesses have to go through the underwriting process and be PCI compliant. That gives both businesses and customers peace of mind. Customers know their sensitive financial data is secure and can more easily trust your brand.

No end-to-end payment solution

Third-party payment systems simply provide you with their merchant account.They don’t integrate with your brand as an end-to-end solution.

Most large brands find they need an end-to-end payment solution that seamlessly integrates with their ecommerce provider.

But, once you’re already set up with a third-party processor, themigration processcan seem long and complicated. When business owners hear the word “migration,” they naturally assume the process will require some downtime. For retailers, shutting down your site for a few seconds or minutes may mean missing out on hundreds of thousands of dollars in revenue.

Fortunately, migrating to an end-to-end payment provider like Shopify is seamless. Even the largest brands can get up and running with the platform in under five minutes, and there’s no downtime. You’ll also save time in the long run.

Shopify Plus customers spend up to 80% less on their online stores than with legacy systems, so you can invest more of your money into your brand and optimize yourcustomer experience, rather than managing ineffective IT processes.

Common issues with ecommerce payment processors

Online retailers need a payment processor that does the job efficiently while providing protection from fraudulent orders. Customers want to make payments quickly and feel confident that their data is secure.

The most common issues with ecommerce payment processors fall underthree core categories:

- Slow checkout process

- Inefficient processes

- Murky payment terms

1. Slow checkout process

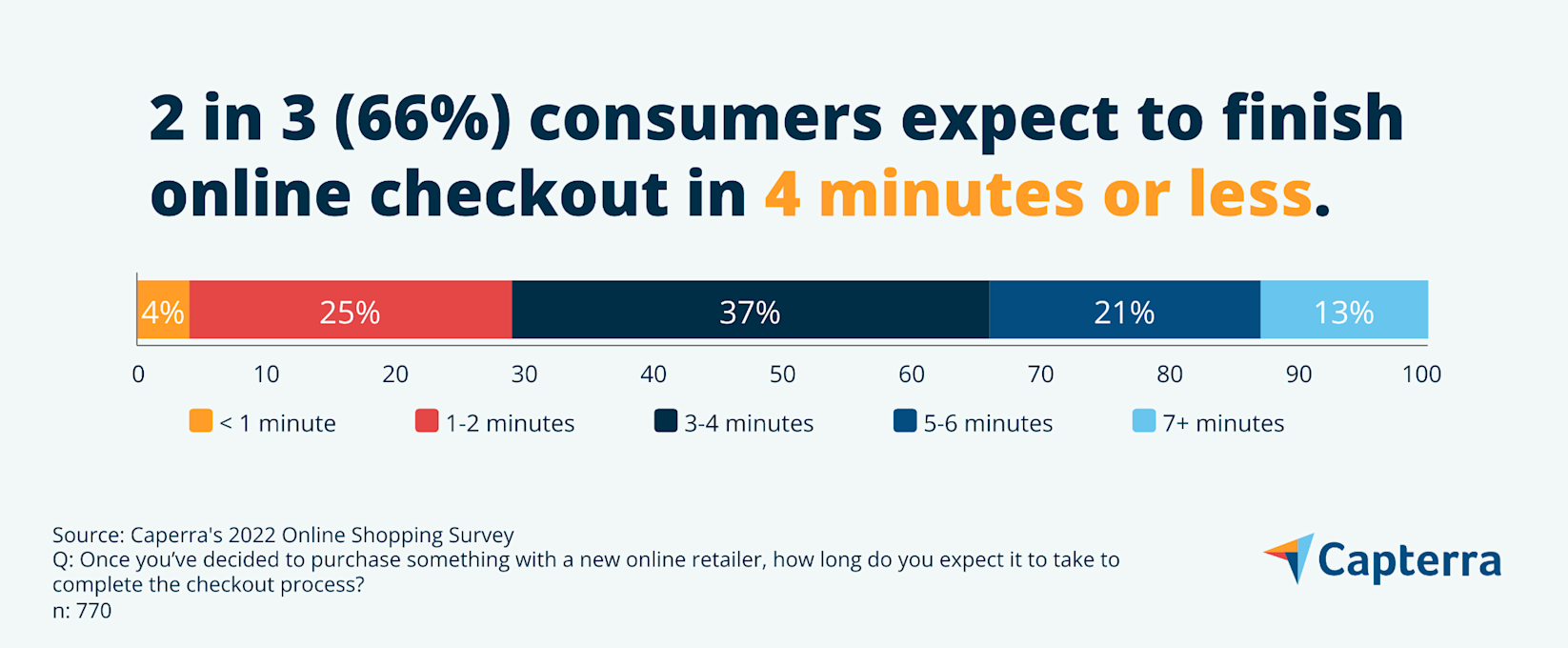

Lagging checkout processes frustrate customers and may cause them to abandon their cart. It’s vital to offer customers a fast, safe, and reliable checkout experience—29% of consumersexpect to complete online checkout in under two minutes.

When you offer a poor checkout experience your conversions drop, leading to a loss in revenue. To avoid leaving money on the table, retailers must make the checkout experience seamless.

Rich Mehta, founder ofRigorous Digital, a web development agency, says, “Retailers should avoid handing customers over to the third-party card processor’s hosted payment page, as they’re often poorly designed, leading to customer confusion and a decline in sales.”

Large brands need integrated conversion-boosting features in their checkout, and Shopify Payments is proven to be the best gateway to choose if you want higher conversion rates.

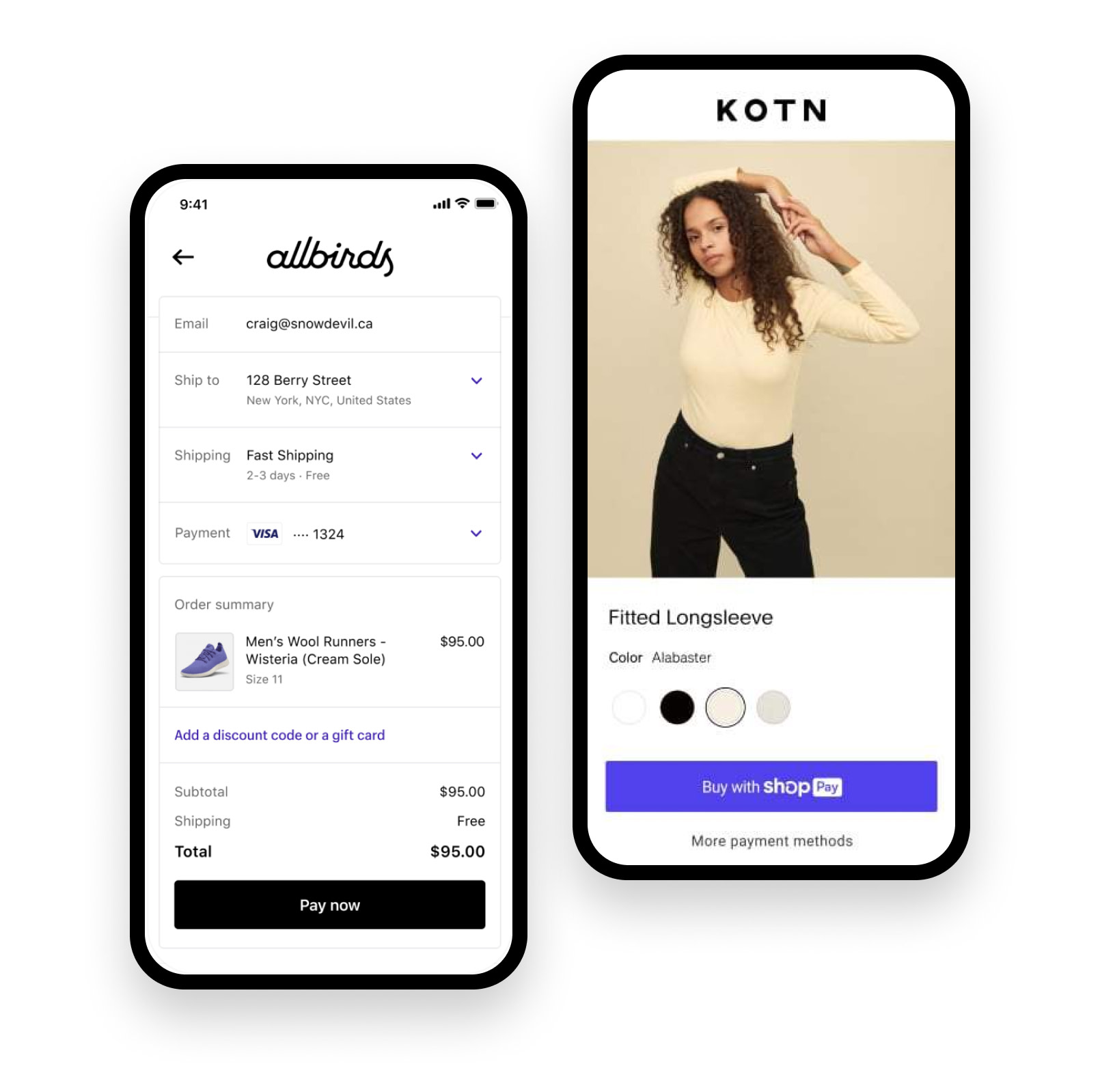

Look for payment providers that help you simplify the customer checkout experience.Shop Payis a one-tap checkout exclusive to Shopify that leads to super-fast and frictionless conversions—converting 56% higher on desktop and 91% higher via mobile payments compared to a standard checkout.

“The majority of our customers today are discovering new products on the go on their mobile devices, and if they have to fill out a form, we’ve lost them,” says Benjamin Sehl, co-founder ofKotn.

“Enabling Shop Pay in our checkout has really made the most painful point of the customer experience delightful, and since it’s tied into the million-merchant ecosystem, even new customers can check out in one click.”

Similarly, byusing Shop Pay, menswear brandUNTUCKitsaw an increase of10% in average order valuewhen compared to the brand’s other checkouts. The brand also saw a33% increase in 30-day customer repurchase rateand a64% increase in customer lifetime value.

Napon Pintong, UNTUCKit’s senior manager, says,“One-tap checkout provides an optimal experience, especially for our returning customers on the go shopping via mobile.”

2. Inefficient processes

Retailers who use a third-party payment processor need to manage two separate platforms—one for orders and another for payments.

With two different platforms, things can get complex and inefficient fast. You’ll need to integrate your online payment gateway with your ecommerce platform, manage two sets of data, and reconcile orders with your payments. These additional processes take valuable resources away from the rest of your business.

Rather than switching between multiple platforms, choose an ecommerce solution where you can manage everything in one place.

Shopify Payments lets you handle everything under one digital roof. That includes your2022欧宝娱乐苹果下载 if you useShopify POSin your physical retail locations.

Customers have multiple options including:

- Browsing in-store and buying online

- Buying online and picking up in-store

- Buying store and getting their product shipped

Plus, you can unify everything in the back end. You won’t need to deal with multiple tech stacks filled with different add-ons for multi-currency and buy now, pay later functionalities. Instead, you can streamline your payment processes with just one app.

3. Credit card chargebacks

The benefits of a one-stop-shop solution also apply to performance issues and payment disputes. Chargebacks, also known as friendly fraud, are one of the most common types ofecommerce fraud—they account for39% of global fraud attacks.

They’re also costly and time-intensive to resolve—in 2020,$17.5 billionwas lost due to chargebacks and criminal activity or fraud. It’s important to choose an online payment processor that has support features to address these issues immediately.

For example, Shopify’s engineers can spot conversion drops and jump in within the first hour of the problem to fix it. Plus, by combining Shopify Payments andShopify Shipping, you’ll get our Automatic Dispute Response, which can boost your win rate from unnecessary or fraudulent chargebacks by 85%.

With payment processing, it comes down to trust. The more complicated the payment platform, the higher the possibility that important issues will get missed. You need a payment processor you can trust to track orders effectively, flag fraudulent orders, and fix performance issues before those little dips turn into massive drops in revenue.

4. Murky payment terms

许多第三方付款处理器提供cost-plus payment terms. These often include hidden costs like merchant account fees, gateway fees, and PCI compliance fees. Even though paying per transaction may seem less expensive, these additional hidden fees add up quickly.

These processors also reject 4.6% more of total transactions than Shopify Payments. That represents a significant revenue loss in addition to all of the money spent on processing fees.

协调事务和梳理ly statements is tedious and time-consuming. It’s best to use this time for more pressing tasks. Aim to use a payment provider that’s as simple, inclusive, and transparent as possible.

Integrated payment providers usually provide large or growing retail businesses with a better deal. Businesses that use Shopify Payments only pay the credit card processing rate and transaction fees. That’s it.

5. Unclear liability policies

Third-party processors often vary wildly in their liability policies too. Rich Mehta, founder ofRigorous Digital, points out that it can be hard for retailers to figure out what exactly they’re liable for and how to limit their liability.

“Often, it’s not immediately clear for a given situation who holds liability,” he says. “Some of the payment card processors shift an unnecessarily large amount of the liability to the retailer. In addition, it can be hard to know what you need to set up to limit your liability (as having some features turned on will often mean you’re less liable for fraud).”

How to switch to Shopify Payments

It’s quick and simple to switch toShopify Payments. You can do it in just a few clicks. You only need to provide some basic business information and your banking details, and then the platform can start sending you funds.

The best part? There’s no downtime to your checkout so you won’t miss out on any sales during the switch.

Here’s how to set up Shopify Payments:

- From your Shopify Admin, go toSettings>Payments.

- Activate Shopify Payments in one of the following ways:

- If you haven’t set up a major credit card payment provider on your account, clickComplete account setupin theShopify Paymentssection.

- If you have a different credit card payment provider enabled, clickActivate Shopify Paymentsin theShopify Paymentsbox, and thenActivate Shopify Paymentsin the dialog. This removes any other credit card payment provider from your account.

- Enter the required details aboutyour store and your banking information, then click Save.

Following these steps means you can still collect payments while setting up Shopify Payments on the back end.

Streamline online payment processes with Shopify

The best payment providers help you provide a quick, secure, and seamless checkout experience for customers. They’re also transparent about data security and payment terms.

Fortunately, Shopify does all that and more. Boost your conversion rates by up to 91% with Shop Pay, manage your orders and payment in one place, and gain the peace of mind of knowing your transactions and customer data are secure. Save on unnecessary fees too—you only have to pay a credit card rate and a flat per-transaction fee.

Ecommerce payment gateways and payment service provider FAQ

What is an ecommerce payment gateway?

An ecommerce payment gateway is software that reads and relays payment information from a customer to a merchant’s bank account. It ensures there are sufficient funds available for payment and transfers sensitive payment data securely and efficiently.

What is a payment service provider?

A payment service provider (PSP) is a third-party company that lets businesses accept a variety of online payment methods, like online banking, credit cards, debit cards, e-wallets, and more. They make sure customers’ payments arrive at the merchant’s account safely. Some examples of PSPs are Amazon Pay, PayPal, and Stripe.

What is an ecommerce payment processor?

An ecommerce payment processor verifies payment information from the payment gateway. It acts as the middleman between the issuing bank and the merchant account. Its job is to check if the customer has sufficient funds available in their account before it deposits them in the merchant account.

What is Shopify payments?

Shopify payments lets retail business businesses accept online payments. It removes the hassle of setting up a third-party payment provider or merchant account and having to enter the credentials into Shopify. With Shopify Payments, you’re automatically set up to accept all major payment methods as soon as you create your Shopify store.

What are the benefits of using a payment service provider for an online store?

All online stores will need to use a payment service provider. The key benefits of using a payment service provider include:

- Accept multiple online payment types

- Process secure transactions

- Faster checkout experience

- Integrate online payments with your ecommerce platform