How do you measure your online store’s success? Do you typically focus on things like sales and revenue?

While these metrics are useful for tracking the short-term performance of content and campaigns, they don’t always paint a complete picture of your business’s future. Even looking at your current sales numbers can sometimes leave you with just a fleeting glimpse of your true financial situation.

Customer lifetime value (CLV) is one of the most important factors in determining your business’s present and future success. It’s an often-overlooked metric that can accurately predict how valuable customers actually are.

By measuring the net profit that you’ll take in over the course of your entire relationship with a customer, you’ll be able to narrow down exactly how valuable they are to your business.

Table of Contents

Why is calculating customer lifetime value important?

CLV gives you insight into how much money you should spend on acquiring your customers by telling you how much value they’ll bring to your business in the long run.

Rather than just racing to keep your head above water, you’ll be able to understand which customers you should be focusing on and, more importantly,为什么you should be focusing on them.

Customer lifetime value is a clear look at the benefit of acquiring and keeping any given customer. Not all customers are created equal.

Understanding your CLV has three main benefits:

- It drives repeat sales and revenue.CLV uncovers the existing customers that spend more in your store. It helps you understand what products they enjoy and what products improve their lives. You can use CLV to find high value customers, improve customer satisfaction, and strategize ways to increasecustomer retentionrates.

- It boosts customer loyalty.The tactics you use to increase CLV can improve customer support, products, pricing, referrals, and loyalty programs, which leads to a bettercustomer experience. Retained customers buy more often and spend more than newer ones.

- It reduces your lifetime value (LTV) tocustomer acquisition costs(CAC) ratio.Our research shows that average customer acquisition costs between $127 and $462, depending on your industry. A good LTV/CAC ratio is 3:1, which signals the efficiency of your sales and marketing. By improving your customer lifetime value, you can benchmark how marketing impacts customer profitability.

As a business owner, you need to be able to focus your efforts on acquiring the right customers—the customers who will take your business from being a flash-in-the-pan success to a household name.

While it’s an important metric, customer lifetime value calculation is difficult. If you’ve tried to uncover your CLV in the past, you’ve probably found yourself knee-deep in complicated algorithms and formulas.

Thankfully, there are much simpler ways to calculate your CLV, but don’t let the simplicity fool you— the complexity of other formulas isn’t without good reason. Customer behaviors are very difficult to predict and can seem completely random at a glance, which makes CLV an inherently complex measure to track. Some companies include gross margin and operating expenses like COGS and shipping costs in their CLV calculations, too.

With this simplified approach to customer lifetime value, you’ll easily be able to take a snapshot of your customer journey and flip it into a widescreen forecast of their future actions.

How to calculate the lifetime value of a customer

- Segment customers with RFM

- Determine average order value

- Figure out average purchase frequency

- 计算客户tomer value

- Multiply customer value by average lifetime value

1. Segment customers with RFM

Before we dive into customer lifetime value, let’s take a look at the foundational elements of analyzing customer value: recency, frequency, and monetary value (RFM).

RFM is a technique for organizing your customers from least valuable to most valuable by taking into account the following factors:

- Recencyrefers to the last time a customer made a purchase. A customer who has made a purchase recently is more likely to make a repeat purchase than a customer who hasn’t made a purchase in a long time.

- Frequencyrefers to how many times a customer has made a purchase within a given time frame. A customer who makes purchases often is more likely to continue to come back than a customer who rarely makes purchases.

- Monetary valuerefers to the amount of money a customer has spent within that same time frame. A customer who makes larger purchases is more likely to return than a customer who spends less.

By segmenting your customers with RFM, you’ll be able to analyze each group individually and determine which set of customers has the highest CLV.

To use RFM to organize your customers, you’ll need to grab three pieces of data about every individual customer: the date of their most recent transaction, the number of transactions they’ve made within a consistent time frame (a year will work best), and the total amount they’ve spent during that same time frame.

If you own a Shopify store, you’ll be able to find all of this data in theReports sectionof your Admin.

Head to Reports and click Sales by Customer Name. You’ll be able to find data like order count and total sales for every customer.

For RFM calculations, each of these variables needs to be given a scale. The simplest way is to use a scale of 1 to 3. Remember: this scale is just a way to help you visualize which groups of customers are most valuable.

Assign a value of 1 to 3 for each of your customers’ recency, frequency, and monetary value. Think of these three values as categories:1being the least valuable,2being somewhat valuable, and3being the most valuable.

So, when you sort your data, your least valuable one-third of customers will get assigned a score of 1, the third above that will get a 2, and so on.

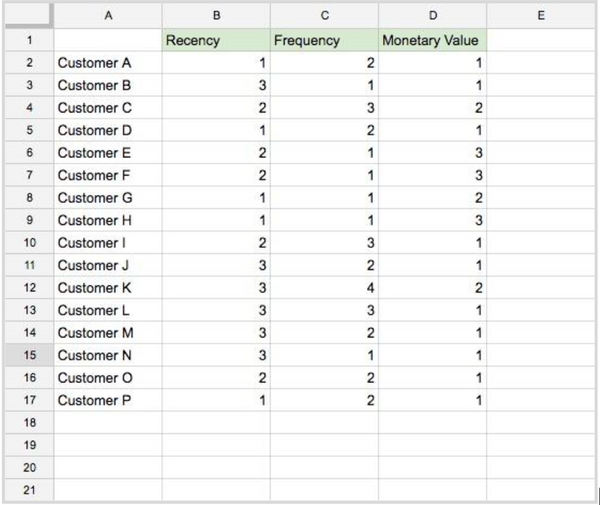

To help you get a better idea of how this might work, let’s take a look at an example spreadsheet.

For this spreadsheet, I’ve already collected my customers’ information and broken down each variable into three categories based on my data. To do this, I’ve taken the range of data for each variable and divided it into three equal segments.

As an example, for recency, customers who have made a purchase within the past four months are given a 3. Customers who have made a purchase within the past four to eight months are given a 2. And customers who have made a purchase within the past eight to 12 months are given a 1.

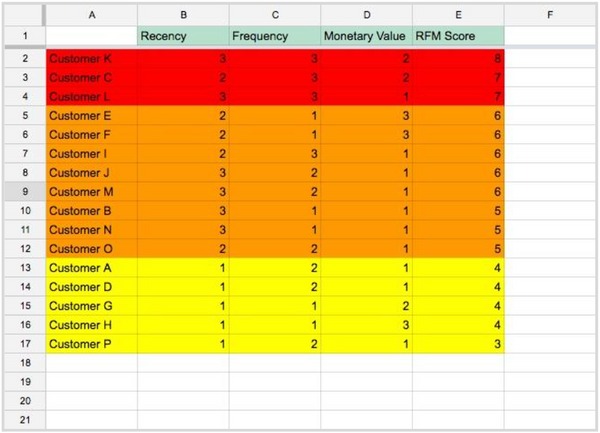

Now, we’ll add up the score for each customer and list a total under RFM Score.

Finally, sort your chart by RFM score and divide your results by highest (shown here in red), middle (orange), and lowest score (yellow).

Your highest scoring results will be your most valuable customer segment—be sure to dive into the data to try and find common threads between these customers that could indicate why they provide more value and how you can target them better.

2. Determine average order value

Average order value, or average purchase value, represents the average amount of money that a customer spends every time they place an order. To get this number, take your total revenue and divide it by your total number of orders.

If you own a Shopify store, you can find this information by heading to theReports sectionof your Admin and taking a look at your sales by month. You’ll just need to divide your total sales by your order count for the past year.

Note: To get a more accurate number, be sure to click Define under Total Sales and uncheck everything except for Subtotal.

Average Order Value = Total Sales / Order Count

3. Figure out average purchase frequency

Purchase frequency represents the average amount of orders placed by each customer. Using the same time frame as your average order value calculations, you’ll need to divide your total number of orders by your total number of unique customers. The result will be your purchase frequency.

商店ify store owners can also find this data in their Reports under Sales by Customer.

Purchase Frequency = Total Orders / Total Customers

4.计算客户tomer value

Customer value represents the average monetary value that each customer brings to your business during a time frame. To calculate your customer value, you’ll just need to multiply your average order value by your purchase frequency.

Customer Value = Average Order Value x Purchase Frequency

5. Multiply customer value by average lifetime value

Now that you have the customer value for each segment of your customer base, calculating the CLV is as simple as taking your customer value and multiplying it by the average customer lifespan.

Your average customer lifespan is the length of time that your relationship with a customer typically lasts before they become inactive and stop making purchases permanently.

When it comes to customer lifespan, it’s important to understand the difference between being acontractualandnon-contractualbusiness.

Most online stores arenon-contractual, meaning that once a purchase is made, the transaction is effectively over. The difficulty with these types of businesses is in identifying when an active customer (someone who makes purchases and will continue to make purchases) becomes an inactive customer (someone who will never make a purchase from your business again).

然而,一些在线商店,欧宝体育官网入口首页subscription-box-based businesses, fall into thecontractualcategory. With a contractual business, you know exactly when a customer becomes inactive because they announce it when they end their contract or subscription. With a contractual business, it’s much easier to identify your average customer lifespan.

If your store is brand new or has only been around for a few years, you might not have access to enough data to determine the average lifespan length of your customers. But don’t worry—there’s a quick way to work around this and still get some actionable results from your calculations.

Putting your CLV to work

CLV is vital for building smarter, more efficient marketing campaigns to optimize your spending and target customers more accurately. Here’s how you can put it to work:

Minimize cost per acquisition

使用你的CLV降低成本收购(CPA). If you’re unsure of your acquisition costs, divide your total marketing/sales budget for a particular period by the number of new customers gained during that same period. The result will be the average amount you spend on acquiring a new customer.

Maximize return on investment

Identify your return on investment (ROI) by subtracting your CPA from your CLV. This represents the net profit from each customer after accounting for the acquisition costs. For continued profitability, your focus should be on maximizing this ROI.

Set budget for paid ad campaigns

Understanding your CLV will allow you to determine how much you can afford to spend on paid ad campaigns, such as those on Google and social media platforms like Instagram or TikTok.

Calculate maximum bid for campaigns

Based on your CLV and conversion rate, determine your maximum bid for a campaign. For example, if your CLV is $100 and your campaign’s conversion rate is 10%, then your maximum bid should be 10% of $100. In this case, you could bid up to $10 per click without going over budget.

Identity upselling opportunities

Understanding your CLV helps you sell more. Customers with a high CLV are typically more engaged, more loyal, and more likely to respond positively to upsell initiatives.

Focus your upselling efforts on customers with high CLV. Use the data that contributed to the CLV calculation to personalize your upsell offers. This could include purchase history, preferences, or customer behavior, helping you to tailor offers that are more likely to be appealing and relevant.

寻找忠诚的客户对你的业务

Whether you’re an ecommerce store or SaaS startup, success isn’t about finding customers—it’s about finding therightcustomers.

Now that you can calculate the value of your customers, you’ll be able to start crafting campaigns that target and win over those customers that really make the difference for your bottom line.

Ready to create your business? Start your free trial of Shopify—no credit card required.

Calculating customer lifetime value FAQ

What is the customer lifetime value formula?

What are the five steps to calculate customer lifetime value?

- Calculate the average purchase value by dividing total revenue by the number of purchases during a time period.

- Determine the purchase frequency by dividing the number of purchases by the number of unique customers who made purchases during that time period.

- Calculate the customer value by multiplying the average purchase value by the purchase frequency.

- Determine the average customer lifespan, which might require analysis of churn rates.

- Multiply the customer value by the average customer lifespan.