Last holiday season marked the first timeNuggetsold out of all of their stock in one fell swoop. It was exciting—the furniture-toy hybrid company, which makes a colorful, pliable, frame-free couch that doubles as an imaginative playscape, had never done any paid advertising. It was all word of mouth, and still they’d made it onCNBC’s 2019 list of the hottest gifts for kids.

2019年12月,金块时缺货订单y put plans in place for a brand new factory. Then the pandemic hit and Nugget sent everyone home with pay for two months, says co-founder and CMO Ryan Cocca. It was a stressful time: The people who’d ordered Nuggets back in December weren’t going to get them until mid-May. Operations were slowly starting back up but not fast enough to meet an avalanche of demand—lockdowns and school closures meant a slew of harried parents were desperate for a product that would keep their kids educated, entertained, and out of their hair.

So they decided to lean into product drops. “These dates are tattooed into my brain,” Cocca says. December 19th. March 27th. June 30th. August 14th. “These are the only days this year we’ve been on sale.”

This came with its own set of challenges, namely bots and resellers capitalizing on their hot commodity and eager shoppers jumping online and in the queue only to be disappointed when they instantly sold out. Then, as their new factory finally opened its doors this fall, Cocca & co had an idea to help manage their customer service relationships and keep bots at bay: They’d run a lottery.

“The number one thing we want to eliminate is the feeling of rushing through checkout and feeling like the order could be taken from under you,” Cocca says. Interested customers would enter the lottery with their phone numbers rather than email (emails are too easy for resellers to create en masse) and be notified when they “won.” They’d receive the details for how and when to buy their coveted Nugget, Cocca says, and hopefully have a smoother and far less frustrating shopping experience.

The pandemic has upended the shopping experience as we’ve long known it—so much so that time-honored selling seasons like Black Friday Cyber Monday (BFCM) will look a lot different this year, devoid of door crashing lines, crowded big box stores, and 24-hour clocks. Instead, major retailers likeWalmartandBest Buyare closing their brick-and-mortar locations and selling exclusively online. All signs are pointing to a protracted period of sales, with BFCM sales potentially stretching out into a week-long or even month-long affair.

部t as brands contend with strains on the supply chain, price-conscious shoppers are flooding the ecommerce marketplace—73% of U.S. planned holiday shoppers say they will shop online more for the holidays.

Instead of relying on traditional selling seasons, more and more ecommerce brands are trying outflash sales, product drops, and embracing the broader idea of driving their own demand on their own timeline. The “drop” model of generating product excitement and brand loyalty is a hallmark of fitness brandGymsharkand Kanye West’sYeezy, who make millions in a single product drop event, while cult makeup brands headed up by influencers Kylie Jenner and Jeffree Star shore up mega marketing excitement ahead of each product drop. The sales are getting bigger and bigger, with Gymshark’s fourth-quarter peak hitting nearly $50 million in 2019. Despite delaying it by months thanks to the pandemic, Amazon’s Prime Day October 13-14 wasprojected to rake in more than $10 billionin worldwide sales, besting the nearly $7 billion it made in 2019. That positions Prime as one of the biggest global flash sales ever.

Shopify is now home to more than 100,000 businesses who sell this way—marketing a limited run product for a low price during a short window of time. These brands are taking advantage of the unprecedented control product drops can give them over scale, supply and demand, and in building customer loyalty.

What is drop culture?

Low-ish supply + high demand x hype = major sales.

Just think back to one of the most iconic examples of a product drop frenzy: In 1996, Tyco Toys’ Tickle Me Elmo caused such a stir when it hit shelves the day after Thanksgiving, that multiple store clerks were injured in stampedes of shoppers lunging for the hard-to-get Sesame Street toy. Its original retail value of $28.99 shot to $1,500 among resellers by the end of the next year, and the entire stock was sold out within weeks.

While that was more of a shopping phenomena, sneaker brands have done this by design for decades now, banking on their rapt audience just waiting for the latest, greatest kicks (there’s a reason sneakerhead sites like Complex post a list of drop dates forAir Jordans). Later, Adidas and Yeezy brought the product drop and drop marketing into the online age.

There is a lot of psychology involved in this sales approach, says Alex Murphy, product manager at Shopify. “The [product drop] is all about the moment and experience and the race and the excitement,” he says. “Then [the product] sells out quickly and there’s a fear of missing out. The FOMO makes interested customers who indeed missed the boat be all the more motivated to buy next time,” he says.

It’s not unlike snapping up concert tickets the day they go on sale, Murphy continues, knowing there are only so many available. There’s always a scramble for the best tickets, not to mention the bragging rights you can claim from having secured them. Particularly now that a pandemic has stolen our ability to have many in-person experiences, shopping has replaced the dopamine hit you get when you’ve bought an item you’re excited about, he says.

Interestingly, this sales model tends to do well in times of economic stress. The birth of online flash sales can be traced back to 2004 when the site Woot.com launched, offering a deal of the day that lasted only 24 hours. The tiny window of opportunity added a thrill to the buying experience and so by the time the economic recession hit in 2008, sites like Groupon and Living Social were raking it in (by 2010, Groupon launched its IPO valued at $13 billion). But the excitement led to inevitable fatigue, as shoppers got smarter and the economy recovered. Instead, flash selling evolved into a sales technique—not so much an overall identity—to help push product while artfully maintaining and nurturing the brand’s relationships with customers.

Now we’re seeing those product drop artists, such as Yeezy, build hype, deploy secrecy, and exclusivity into their product drops, leading hype culture with their drop strategy.

How do you promote a product before launch?

Murphy has another great analogy to explain how brands approach a product launch: It’s like a wedding. “There’s a save the date, so you know when the sale will be,” he says.

由于有很多之前创建兴奋d it, which might involve media interviews or influencer engagement over social media (everyone who saw Jenner’s Instagram posts about her lip kits wanted them). All the while, there is a ton of behind-the-scenes work to ensure every detail is covered—the dress, the suit, the napkins, the centerpieces would stand in for procurement, supply, marketing materials, operational and customer care systems all ready to go when the date of your sale arrives. Once the “wedding” or sale actually happens, it’s often over in minutes, sometimes even seconds. “You never remember how long someone's wedding was, but you do remember the great moments of it,” Murphy says. It’s important that a sale ends as quickly as it begins because it maintains that adrenaline rush post-sale that creates urgency and anticipation around the next one.

Why it’s better than relying on a selling season

Product drops are all about managing your own destiny. “It gives merchants a very good way of controlling demand,” says Christian Mackie, a technical service delivery manager at Shopify Plus. “It helps them control when they release certain items and how much [of a certain product] they release. If they know it’ll never be available again, they can control how much they actually have to spend upfront in producing those products.”

Beyond the actual logistics of managing product availability, running your own product drops on your own time helps you control your narrative, whereas the holiday selling season tends to own that conversation, Mackie says. “If the merchant plans their sales for the entire year, it’s very deliberate—they don't react to the holiday.”

And all of those lineups outside of big box stores on Black Friday? If a merchant has the capacity, that crowd can grow exponentially online translating to massive sales. “Large brands can easily see over 100,000 checkouts during a [product drop],” Murphy says. “That’s enough people to fill five Madison Square Gardens.” This kind of sales action would be literally impossible in a physical store, even during the busiest day of the year.

How to build hype with product drops (now that COVID’s changed it all)

Thanks to public health advice to limit social interactions, online shopping has become more popular than ever. And while shoppers are glued to their phones, eager for experiences they can safely have through online commerce, the excitement of product drops is amplified. It’s meant a flooded ecommerce landscape where it’s more important than ever to differentiate your product and cultivate a loyal customer base. “COVID has been amazing for ecommerce and it’s meant that [product drops] are sometimes just a byproduct of your demand,” Murphy says. “You can’t buy that product anywhere else, you can only buy it online.”

It’s also meant bots and reseller communities have been very, very busy. This was the issue Nugget encountered during their last product drop, CMO Cocca says—legitimate customers were bumped out of line by bot algorithms and“cooking” community resellers(组织经销商,收藏家加入说cuss upcoming releases, monitor drops, and compare bots) swooping in to snatch up their in-demand product and reselling it elsewhere for a higher price. Murphy has had to explain to brands the importance of counteracting these bots by adjusting prices and being strategic—and secretive, if necessary—about product drops to avoid being targeted by bots. One accessories brand he worked with ran a 24-hour unlimited pre-sale in which they took orders for a custom-made bag. “They destroyed the excessive demand and brought equilibrium price down and now the resellers have fled. They were like ‘We’re not playing this scarcity game.’”

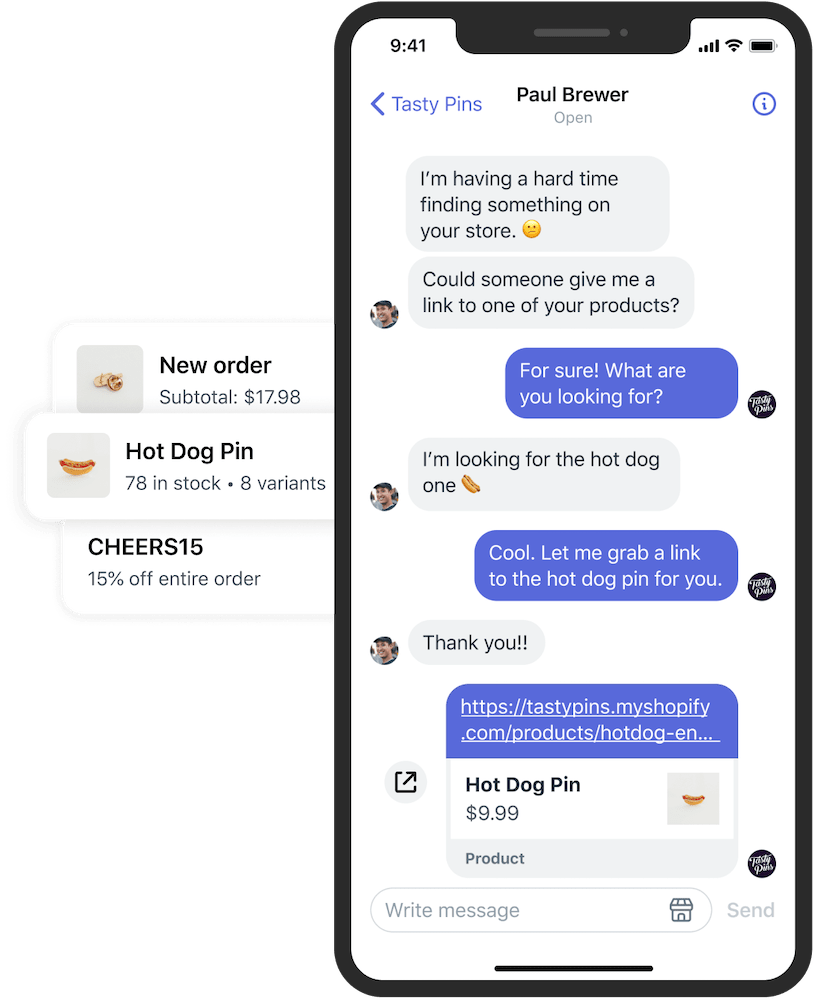

The busier ecommerce landscape has seen more diverse brands trying product drops and flash selling. And it’s meant that the ecommerce platform has to be treated like a physical store as much as possible, Mackie says. “Before COVID, the online store was really just check out, buy what you want, have a good search function,” he says. “Where we’re seeing a shift with COVID is that online is now considered as physical an experience as any other. We need to treat it like a door that anyone would walk into.” This means great customer service chats, an intuitive website, lively community, and engagement on social media channels. This infrastructure will be critical in facilitating a good, loyal customer base that will be eager to engage with your limited edition drops and snap up supply as soon as products are released.

How is scarcity used in marketing?

As much growth as this trend is seeing, brands can be shy in acknowledging their use of product drops as a sales strategy. Cocca, for one, says their lottery and product drops have been purely a function of managing supply and demand and the relationships with their customers. Throughout the pandemic, Nugget has shared many dispatches on its blog, explaining its decision-making and inner machinations: Transparency, Cocca says, helps maintain their stellar reputation as an authentic business that really cares about their customers. A super-exclusive sneaker-style sale or drop wouldn’t work for Nugget’s customer base of millennial parents who just want to invest in a solid, reliable product.

部t there can be a broader perception that product drops are merely a strategy to capitalize on scarcity. Mackie points to arecent dissertation from Germany-based Europa-Universität Viadrinawhich found an inextricable link between product scarcity and more eager consumer behavior. Customers don’t, however, ever want to feel like they’ve been taken advantage of. So long as you’re respecting your customer by ensuring a smooth shopping experience and giving them that great product at an even better price, the potential for scaling, moving merchandise, and gaining better control of your sales calendar is endless.

Product Drop FAQ

How to do a product drop on Instagram?

- Choose a date and time for the product drop. Make sure it is a time when your target audience is likely to be online.

- Create an eye-catching Instagram post to announce the product drop. Include details such as the product name, price, and any discounts or promotions associated with the drop.

- Encourage your audience to engage with the post. Ask them to leave comments, like the post, and tag friends who might be interested.

- Send out reminders about the product drop leading up to the date. You can do this through stories, posts, DMs, and emails.

- On the day of the product drop, post several photos and videos of the product. Give your audience a behind-the-scenes look at how it was made and why they should want it.

- Offer exclusive discounts or incentives for those who purchase the product during the drop.

- Follow up with your audience after the drop. Ask for feedback, share customer reviews, and thank them for their support.

What does it mean for a product to drop?

A product is said to have “dropped” when it becomes available for purchase. A product drop is a marketing strategy where a retailer builds anticipation in advance for the release of a new product.

What is a drop in marketing?

Drop in marketing is a type of marketing strategy where a company releases a new product or service with little to no warning or prior marketing. It is designed to create a sense of urgency and excitement around the product or service, and encourages customers to act quickly. The goal is to generate a large influx of sales in a short period of time.