If you’re an ecommerce entrepreneur, you’ve thought about raising money.

Whether you want to run your business full-time, build a team, buy inventory, or just have capital to grow, adding cash to your balance sheet can take your business to the next level.

At Blank Label, we’d been bootstrapped for five years, gaining traction along the way, and we were confident we could become a major player in a growing market, so recently raised our first outside money, to the tune of $1.1 million.

These are the exact steps we took to do it.

Step 1: Build a Spreadsheet of Potential Investors

Fundraising is a sales process and you need to have a lot of leads. We spent the first two weeks of the process building a list of 25 entrepreneurs who had recently raised money in ecommerce, as well as 25 venture capitalists who had recently invested in ecommerce.

We put those names in a spreadsheet, and looked everyone up on LinkedIn to find mutual connections. Because our connections introduced us to other potential investors, we ended-up talking to well over 100 people.

Step 2: Find Allies in Other Entrepreneurs

OB欧宝娱乐APP从企业家首先开始。创始人曾经raised money understand the challenges of the process, so they’re often happy to help out.

We went toTechCrunchandAngelListand searched for “ecommerce” to try to find news of companies who’d raised money, or who were listing their companies to raise money. If we didn’t have a mutual connection on LinkedIn, we sent a cold email to the effect of:

恭喜融资公告!希望这ngs are going well. We’re Blank Label, an award-winning custom clothing company, and we’re in the beginning stages of doing our first fundraise. Given you’re in the ecommerce space, I’d love to ask if you have 15 minutes to spare so I can learn a little bit about your experience.

Recently funded entrepreneurs are more likely to help you if they think you’ll have a decent shot at raising money, so we included validating statements like ‘award-winning’ or 'New York Times featured,’ to give some assurance that we’re not a waste of time.

我们伸出的企业家,约60 -70% got back to us and agreed to chat. The conversation wasn’t focused on being introduced to their investor, but on learning about their process. We asked questions about what kind of terms they got from investors, what their valuation was, and what their investor presentation looked like. Ultimately, the goal was to get warm introductions to investors, but why not take the opportunity to learn from someone who recently pulled it all off and is doing well?

We wanted to really sell the entrepreneurs we were meeting with, so we actually made trips to startup hubs San Francisco and New York from our HQ in Boston. This was an effective call to action because we could say:

We’re in San Francisco next Wednesday to Friday meeting with ecommerce entrepreneurs, I’d love to come to your office and buy you coffee if you’re around next week.

Through this process of meeting with entrepreneurs, we were able to understand what types of documents investors were looking for. Many even shared their documents with us.

Step 3: Prepare Your Materials

When you start meeting with investors, and have them interested, they’re going to ask for materials. Don’t kill the momentum by taking a week to work on them.

The materials we prepared were:

- An investor presentation (Powerpoint)

- Historical financials (Excel)

- Projected financials (Excel)

- Legal term sheet (PDF)

Note that we used historical financials, because we had bootstrapped to the point where we needed to take outside investment in order to grow.

It’s incredibly difficult to raise money from people you don’t know with just an idea, or without any kind of meaningful traction. Unless you’ve started a company before and successfully exited, the investor will most likely be looking at thetrajectory of your business.

Step 4: Show Them Their Money Will Turn Into More Money

In essence, you’re presenting a story that things have been going well, even though you’ve been extremely resource constrained. But with some money, you’d be able to do X and Y,which would open the door wide open for explosive growth.

The investor presentation should be very clear about this.

It’s 10 to 15 slides and covers high-level topics, including the market you’re going after, or the problem your product solves. It should also include your go-to-market or marketing strategy, your team, and use of funds.

In our investor presentation, we opened with talking about how men today care more about the way their clothes fit now than five or ten years ago, and why we were better at providing it.

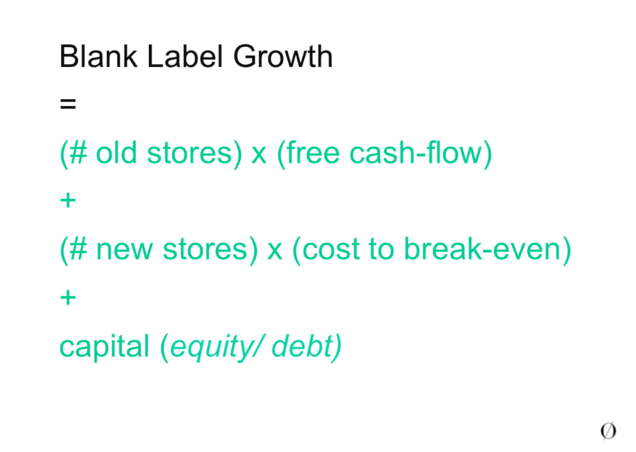

We showed examples of advertisements Brooks Brothers, Nordstrom and Banana Republic had ran over the last few years talking excessively about fit. The presentation went on to talk about how our business had one store, how it was working, and how we believed we had the opportunity to open many more, and that the investors funds would go specifically go toward that.

Step 5: Memorize the Key Metrics

Even if you’re extremely passionate and you have a really good product, you’re still running a for-profit business. Not knowing the underlying economic drivers of your business will have most investors concerned.

Head of startup incubator, Y-Combinator, Sam Altman,says, “One particularly bad one is misunderstanding or misusing basic financial terms.”

If you don’t have a math or economics background, I’d strongly recommend spending a lot of energy with other entrepreneurs to understand how to build a good projected model to incorporate into your presentation.

Step 6: Understand the Different Investor Types

Since we were seeking to raise around $1 million, we expected we would need to raise money from a venture capitalist, rather than a group of angel investors. After meeting with a dozen venture capitalists in Boston, New York and San Francisco, the feedback was very consistent: we invest in technology companies, not in apparel businesses.

Now, there are definitely exceptions, includingJack Erwin,Tracksmith,Ministry of Supply, andEllie. Then you have Bonobos, which has raised $127 million to-date. But in general, I’ve heard from other entrepreneurs also that it’s very hard to raise venture capital selling clothes.

We decided then to focus on angels. The first 20 angel investors we talked to were all introduced to us by other entrepreneurs who we were excited about our business.

Step 7: Turn Customer Evangelists into Investors

As we started getting commitments from these first group of angels, we sent out an email to the top-spending, most loyal segment of our customer base. We thanked them for their support and alerted them to the fact we were raising money, and we already had good investor interest. This worked incredibly well, and ended up driving the majority of our funds.

As a young company, you’ve got the benefit of being the underdog, and many customers will gravitate to that. They also liked the validity of knowing other ‘professional’ angels had already looked at the business and have decided to back it. We had professional angels who had backed other successful companies, so this helped further validate the investment opportunity to our customers.

The additional benefit of raising angel money, from both professional angels and customers, is you have a long list of brand ambassadors. The professional angel becomes a customer, and the customer turns to an even more fanatical customer. There’s no greater feeling with an investor copies you on an email to fifty friends telling them how great your company, that they need to shop from you, and that she’s a proud investor.

Step 8: Leverage Fundraising Platforms to Close Your Round

Maybe you’ve read about or seen one of the new equity-fundraising platforms that have popped up over the last couple of years; two of the biggest are AngelList andGust.

We used AngelList and it introduced us to angels we’d never otherwise been able to get access to (including people in London and Taiwan!). With any of these platforms, one of the key markers they’ll be looking for is if you’ve already got fundraising momentum. Based on our experience, the sweet spot for them is if you’ve raised 70 to 80 percent of your round already.

We got lucky that someone from the AngelList team picked up our listing, and blasted their entire email list, altering them of the fundraising opportunity. The lesson here is to connect with someone who works at one of these platforms — that can go a very long way. Another platform we’ve seen more recently that could be an even better fit isCircleUp, as it focuses on physical goods companies.

Fundraising is challenging. In addition to the rejection you’ll inevitably receive along the way, you have to continue to operate your day-to-day business. If there’s any way I can be helpful, please ask questions in the comments.

Read More

- 14 Video Ads That Blew Our Minds In 2015

- 消费者心理学:卖给背后的人Persona

- What Global Ecommerce Companies Can Learn from the Top 10 International Ecommerce Sites

- Warning: Most Conversion Optimization Tips Are BS (Here's Why!)

- The 1 Rule for Building a Billion-Dollar Business

- Artificial Intelligence: Armageddon or Nirvana? Experts Predict What Happens Next

- Shopify vs. Salesforce Commerce Cloud

- Shopify vs. Magento 2023 — Which Platform Is Best for You?