Cost cutting is the process of minimizing expenses for your retail store. Reducing rent payments, saving time with automations, and limiting travel expenses all contribute to retail cost cutting.

The age-old question for most business owners is how to reduce expenses.

It’s an important, but not necessarily straightforward, issue to tackle. On one hand, cutting costs can happen in a variety of ways. But on the flip side, you could be sacrificing quality.

For many retailers, product quality is non-negotiable, even when cutting costs is necessary. And that’s a fair philosophy to stick to considering customer satisfaction and loyalty arehighly dependentupon product quality.

In fact, product quality is actually one of thebiggest concernsfor business managers across North America. But higher costs are often associated with higher quality, so retailers need to look at other facets of the business to reduce expenses that don’t affect their product.

Fortunately, there are cost-cutting methods retailers can lean on that don’t require a sacrifice in product quality orsecuring a loan. This guide shares 14 ways to do it.

Table of Contents

What is cost cutting?

Cost cutting is the strategy behind reducing the expenses associated with your retail store. There are various types of costs you can cut, from operating expenses for your location through to staffing and labor costs.

If you’re spending too much money on rent, for example, cost cutting might mean downsizing to a smaller store, reducing operating hours and the amount spent on labor, or renting a section of the store to another retailer. All three activities reduce costs associated with running the business.

Reasons for cost cutting

There are a number of reasons why retailers would look to cut costs. They include:

Economic downturn

Theretail apocalypseis nowhere near as disastrous as some people make out, but data does indicate a shift to ecommerce. The COVID-19 pandemic caused anincreasing numberof people to turn to online shopping instead of brick-and-mortar stores.

Nobody knows what the future holds. While it’s unlikely that retail will suffer as greatly as it has since 2020, there’s a chance in-store shopping may not bounce back to normal pre-pandemic levels within the next year.

If you cut rent costs by downsizing, for example, you’re not locking yourself into a year-long lease for a store people might only be able to visit on a limited basis. It helps retailers mitigate financial risk should periods of economic uncertainty continue.

Financial distress

Running a retail store is an emotional rollercoaster. For some small business owners, the financial pressure of commiting to a lease, paying salaries, and employee perk packages is overwhelming.

Cost cutting helps ease that pressure. By evaluating your biggest expenses and cutting them as much as possible, there’s less pressure to sell insane levels of stock to pay for them.

Increase profit margin

Every retailer wants to make a profit. By cutting costs, your profit margin becomes significantly higher as this reduces yourbreak even point. Fewer dollars spent on rent, salaries, or employee benefits means more dollars left in your business’ bank account.

This improved cash flow gives many retailers a sense of financial security. A healthyprofit marginmeans you don’t have to sell as much inventory to still have money in the bank after paying for business expenses.

Types of retail costs

然后再决定削减成本在每一个部分your retail business, take some time to categorize your expenses into one of these three categories.

Good costs

Good costs are expenses that you can’t avoid. Examples include operating expenses like cable, internet, and credit card processing fees. Most times, they’re unavoidable. But it’s a good cost if those operating expenses don’t eat a huge chunk of your profit.

PRO TIP:Shopify Paymentsis included in all Shopify POS plans, no sign up or setup fees required. Control your cash flow better and pay the same pre-negotiated rate for all credit cards, starting at 2.4% + $0.00.

Bad costs

Bad costs are retail expenses that eat profit. If you’re only using 500 square feet of your 2,000-square-foot retail store, for example, that’d be a bad cost. You’re wasting money on rent, lighting, and heating for most of the store. Consider renting that space or downsizing to remove the bad cost.

Best costs

Best costs are business expenses that drive maximum profit for your retail store. You might have negotiated the best possible price with a supplier, or used the cash for marketing strategies with a high return on investment.

说你每月花费500美元在Facebook上睡觉ertising to reach people in your local area. Sales data shows that Facebook is the biggest customer acquisition channel for you. Your store generates $10,000 in monthly revenue from people who’ve visited off the back of an advert. In that case, Facebook advertising is a best cost—one you can afford to keep.

Risks of cutting costs

Cutting retail costs does come with risk. Whichever expense you decide to reduce, consider the following impacts.

Diminished production

One risk of cutting retail costs is sacrificing production. This doesn’t necessarily mean product manufacturing; cost cutting can hinder the behind-the-scenes management of your store that produces the end product—a store your customers want to shop in.

Let’s put that into practice and say you’re striving for lower costs by reducing operational hours. The less time your retail staff spend in-store, the cheaper your monthly payroll will be, right? But removing a day from their schedule might leave your team with no time to complete other important tasks, likephysical inventory counting. The result: promising shoppers stock you don’t have to offer.

Decreased morale

Some people are conditioned to see cost cutting as anegative thing. This mission to reduce retail costs can reduce staff morale, particularly if the expenses you’re reducing directly impact them—like evaluating their benefits package.

If that’s the case, prepare to invest some of the money you’ve saved into team-building activities. For example, $30 of the $50 you’ve saved by cutting each employee’s pension contribution can go toward a game night to boost team morale.

Personnel issues

Speaking of cutting costs that directly affect your retail staff, always be aware of how cutting your expenses impacts your employment contracts. Avoid a wrongful termination suit by keeping the promises you made in your contract—specifically relating to business travel opportunities, paid training, and agreed working hours.

Some employees might vote with their feet and quit their jobs if costs are too restricted. In that case, consider the cost of any severance packages that keep you in good standing with previous employees.

How to cut costs and reduce business expenses

While it can be hard work, it’s worth going through the cost cutting process if you want to maximize profitability. Let’s take a look at 14 ways you can cut retail costs and reduce expenses for your store.

Table of Contents

- 关注客户保留,而不是收购

- Audit expenses and cut the unnecessary ones

- Rent your retail space

- Open an online store

- Reduce shipping costs

- Take advantage of business relationships

- Automate repetitive tasks

- Outsource time-consuming tasks

- Consider a smaller physical store

- Evaluate your marketing options

- Revisit employee perks and benefits

- Reduce operational hours

- Limit travel expenses

- Reduce printing costs

1.关注客户保留,而不是收购

For many retailers, customer acquisition is one of their biggest marketing goals. But turning efforts tocustomer retentioncould reap more financial rewards and, more importantly, be a more cost-efficient means of boosting sales.

It costs retailers more thanfive timesthe amount to acquire a new customer than to re-engage an existing one.

But that’s not the only monetary benefit. Repeat customers are likely to spend more, too, and that amount is likely to increase over time,according to Bain and Company. Profits increase and operating costs decrease with this additional spending.

Retailers can improve their customer retention rates throughloyalty programs, reaching out to customers who reach milestones (such as a year since their last purchase or an upcoming birthday), and improving customer service.

The Copper Bell, for example, uses acustomer loyaltyprogram to cut customer acquisition costs. Its founder, Katrina Bell, says, “By tracking my returning customer rate—31% in Q1, 39% in Q2, and 60% in Q3—I know people are happy and coming back to my website.”

“I first used general discount codes to encourage people to make repeat purchases but have really personalized this [program] withSmile. This loyalty app gives bigger rewards for more money spent, so my VIPs are getting bigger discounts than other customers.”

PRO TIP:Want to see how valuable repeat customers are to your business? View thereturning customers reportin Shopify admin to see the average order value of and lifetime value of returning customers.

2. Audit expenses and cut the unnecessary ones

有很多零售商运营费用incur. While some of these are essential, some are just nice to have. Take stock of these expenses and compare their cost to the value they provide to your retail business. That includes:

- Internet, phone, and cable subscriptions.Do you actually use these services? If so, how important are they to your daily business interactions? Check for cheaper packages, including promotions or special rates for small businesses, and research whether the same services are more affordable with a different provider.

- Credit card fees.Fees are associated with acceptingcredit card paymentsfrom customers, and these fees can eat into your profits. But don’t ditch this payment method altogether—especially considering the global trend ofmoving to cashless consumer spending. Take stock of the number of cashless purchases and what you’re paying to process those payments, then see if there’s a more cost-efficient alternative.

- Electricity and utilities.Brick-and-mortar retailers can find ways to reduce costs of maintaining their physical business. Can you lower the A/C during the summer? Do you have energy-efficient light bulbs? Small steps can add up to big savings over time.

- Other administrative costs.Depending on your business, this could includepayroll services, business travel expenses, benefits costs, etc. Determine which ones are essential and if there are ways to reduce them. And to further cut costs, considergoing paperless.

Fixed costs include rent, property taxes, insurance, equipment depreciation and maintenance, utilities, payroll, including benefits, payroll taxes in the U.S., etc.

“These are costs that remain the same regardless of how much business you do. If you sell nothing, you still have to pay them. If you sell everything in stock, you still have to pay them. These fixed costs need to be minimized to the lowest for better performance in your business finances, because it's unlikely to reduce the variable cost that varies with sales.”

Most retail leases are whats called "Triple Net" or "NNN". This means the tenant pays the taxes, insurance, maintenance and CAM (common area maintenance).

— Nick Huber (,) (@sweatystartup)January 27, 2021

They basically pay all of the landlord's expenses (except debt service on any loans he/she has, of course).

3. Rent your retail space

Rent can get pretty pricey. Data shows the average monthly rent for a shopping center store is$21.22 per square foot. To contribute to the cost of operating your shop, consider renting out your space for events or other retailers.

Perhaps you have a lot of space and there’s an easy way to make room for displays from other retailers or businesses. If you rent out that space, you may be able to improve profits even further by negotiating a portion of the sales.

If you have a community space, such as a lounge or area with lots of tables and chairs, rent it out for events or meetings. Depending on how your shop is set up, these can be held during or outside store hours.Peak Design, for example, has co-working spaces available to rent in its San Francisco showroom.

You can also considersponsoring eventswith other retailers in your space, which can, in turn, boost foot traffic to your store and boost your sales. It contributes to the cost of maintaining the space, and those individuals may be more likely to shop at your store, which can make notable improvements to your bottom line.

4. Open an online store

In-store shopping isn’t dead, but since COVID-19-related “stay at home” orders closed thousands of stores, consumers got more comfortable with online shopping. Ecommerce sales areexpected to growby 9.7% this year (compared to 4.8% for brick-and-mortar retail).

But people don’t use these channels in silo. The increase inmultichannel shopping—in-store, online, mobile—supports this trend, making it more important for retailers to have a digital presence.

Investigate your typical customer journey to see how shoppers interact with each channel and plan your network of retail stores to support their shopping behavior.

5. Reduce shipping costs

Shipping is a necessary expense, especially for retailers with an online store that coincides with their physical location. But there are ways you can minimize these costs:

- Reduce package sizes.“Many retailers who ship a lot of product can improve dimensional weight in their shipments, which can greatly reduce costs,” says Jim Burns, Director of Marketing of Products atShorr Packaging. “Reducing box height by just six inches could save up to $6 in shipping per package—and those cost savings really add up.”

- Use shipping bags or poly mailers.These are smaller in size and weight than cardboard boxes, and can also be cheaper and easier to store. Vendors likeSticker Muleoffer options for branded shipping bags that still look high quality but can cut your costs.

- Use one type of box that can be resized multiple ways.“This cuts down on the number of stock box sizes and can be a less expensive option,” says Tyler Dishman, President of ecommerce retailerDiscount Filters.

- Negotiate rates with shipping partners.Dishman negotiated a favorable freight rate with FedEx Smartpost. Though not as quick as ground delivery, it can be a good option if speediness of delivery isn’t going to be a detriment to the customer experience. “The freight savings from renegotiating our contract improved our bottom line by probably 25%,” Dishman says.

PRO TIP:Looking for a fulfillment partner? UseShopify Fulfillment Networkto take control of your order fulfillment workflows, get recommendations on which SKUs to restock, manage orders from Shopify admin, and more.

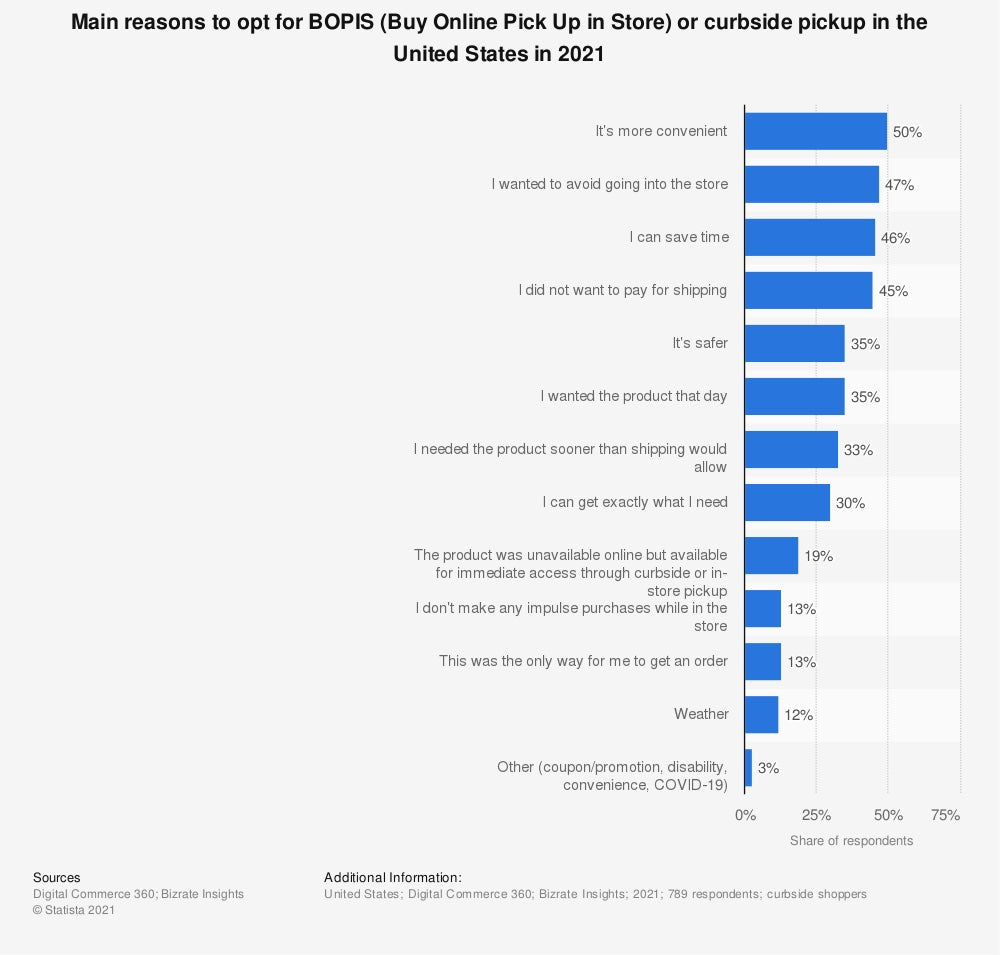

- Offer in-store pickup.Have customers within close proximity to your store? Ditch shipping costs entirely by offeringbuy online, pickup in-store(BOPIS) options.Half of shoppersprefer this option because it’s more convenient.

PRO TIP:Offerin-store pickupto incentivize more online shoppers to visit your store. Customers get fast and free shipping, while you save on shipping costs and get an opportunity to build rapport and increase order value. Everyone wins.

6. Take advantage of business relationships

Have you been a loyal customer to your vendors or suppliers for years? Oftentimes, retailers can negotiate a new, lower rate for the same products. Bulk pricing could be an option, or the vendor can throw in free shipping.

For retailers purchasing through a third-party supplier, see if you can get straight to the manufacturer.

Exert effort on looking for the best suppliers and distributors within the market. Make sure that you are getting the best deal from them. Even a single penny matters within this industry. We don't want to waste them.

Brian Anderson, Director of Marketing atMy Supplement Store, says, “Our company needed to cut costs due to the slowdown of traffic in our retail store since the pandemic. We wanted to keep all our associates, so we had to look to other ways of reducing our costs.

“We were able to do this by ordering more products in bulk that we sell. The more of each product we sell, the cheaper we get it for.

“While this is a risk, because we don’t want to end up with excess inventory, we were able to do this with our top 20% of products,” Brian says. “After one year, we cut our costs by about 15%, which was more than enough to keep from needing to reduce staff. We had to get creative, but it worked.”

7. Automate repetitive tasks

Cost cutting doesn’t just mean reducing business expenses. You can cut costs and increase profitability with automation—taking repetitive tasks off your retail staff’s plate, giving them time to focus on higher impact tasks.

Automation helps retailerssave time and effort, which ultimately results in reduced costs. It also frees up existing employees to contribute to the business in more impactful ways, helping grow instead of simply maintaining business.

Data entry—inputting receipts, uploading tracking numbers, and many other types of traditional manual entry can be easily automated. Doing this will spare you from having to continue hiring workers as you grow.

Data entry isn’t the only task that retailers can automate. If there’s a task that’s repeatable, there could be an opportunity to automate it. Choosepoint-of-sale (POS) softwarethat includes automations for (or integrates with) payroll, shipping, reporting, invoicing,inventory management,handling returns, and various administrative duties.

8. Outsource time-consuming tasks

Outsourcingis another way to cut costs and reduce time your retail staff spends on repetitive or low-earning tasks.

“An example would be using a third-party distribution channel, such as a shop within a shop,” says Courtney Albert, Manager at retail consulting firmThe Parker Avery Group. “This equals less overhead of a brick-and-mortar shop, but still gets your goods in front of the customer.”

You could also outsource:

- Order fulfillment.Instead of maintaining your own distribution center, partner with a third-party logistics (3PL) provider to pick, pack, and ship orders from in-store customers.

- Marketing and advertising.依靠一个机构的专业知识传播消息bout your store. They’ll handle everything from Facebook advertising campaigns to content marketing strategies.

- Administrative tasks.Bookkeeping, for example, is an important part of running a retail store. Outsource it to a professional bookkeeper or accountant to make sure your accounts are submitted correctly.

One thing you should be wary of outsourcing? Quality control. Courtney says, “This could be a mistake if [the] quality of product is a high priority.”

PRO TIP:ConsiderHiring a Shopify expertto help on your next project—from marketing campaigns to store merchandising and anything in-between.

9. Consider a smaller physical space

For retailers experiencing significant sales online, it might make sense to go online completely. But before doing so, make sure your online customers don’t depend on the in-store experience as part of their shopping.Almost a quarterof people prefer to shop in-store because they can interact with products before buying them.

In that case, consider alow inventory store. Reduce operational costs such as light, rent, and heating with a smaller store, showcasing just a handful of core items. The showrooming method allows customers to visit and interact with the product, then visit your ecommerce website to complete their purchase.

If it’s not feasible to maintain a brick-and-mortar all year, consideropening a pop-up shopto create the in-store experience your online shoppers crave. That way, you don’t miss out on the retail experiences many shoppers have while easing the financial commitment that comes with signing yearly leases for a permanent store.

10. Evaluate your marketing options

Marketing is essential for any store. You can’t expect people to visit if they don’t know it exists.

When trying to reduce costs for your retail store, consider the time versus dollar investment you spend on marketing. It might be free to post on Facebook, requiring 15 hours per week of your time to optimize the page, post content, and drive foot traffic to the store. Assuming thehourly rateof a retail associate is $13.54, that’s $200+ you’re spending on organic Facebook marketing each week.

Instead, invest your time and/or money in marketing channels that are low financial cost and take minimal time to manage in the long run. That includes:

- Social commerce.Create a Facebook or Instagram Shop for your store so when people see your content in their feed, they can click and check out without having to hunt for store opening times.

- Word-of-mouth marketing.Have a loyal customer base? Incentivize them to refer friends and family to your store. Give them a kickback when their network purchases something. That way, you only fork out on marketing costs when you make a sale.

- Scent marketing.While it might sound crazy, the smell of your retail store is proven to influence how your customers behave in your store. Spend a few bucks on reed diffusers, candles, or air fresheners and increase storesales by 11%.

11. Revisit employee perks and benefits

It’s great to reward your retail employees with perks. These benefits are what56% of millennialsfind influential when considering a new job.

Another 63% say the perks offered by an employer plays a role in whether they’ll stick around—something that’s important in the retail industry, known to have one of thehighest staff turnover ratesof all.

However, not all perks programs have to be lavish and expensive. Revisit the benefits package you’re offering to employees and see where cost savings can be made.

If you’re contributing to an employee’s 401(k), for example, reduce your contributions by 1%. What might sound like a small cost saving percentage quickly adds up—especially if you’re doing it for several employees.

The same applies to any personal expenses you’re offering as part of your benefits package, such as monthly stipends for health or fitness-related activities outside of work. Look to see if there are any local gyms that offer bulk discounts for monthly memberships. A negotiated $30 membership for a local gym is cheaper than a $50 stipend for staff to use (and potentially waste).

12. Reduce operational hours

Choosing your store’s opening hours is a tough decision. It’s tempting to be open all hours to capture passersby. But the longer your store is open, the more it costs your business. Lighting, heating, staffing, and labor costs all need to be considered.

Think about reducing youroperational hoursto drive down these costs. For example, instead of opening seven days a week, close on Mondays—the day historically proven to be physical retail’s least busy day. You could also open the doors at 11 a.m. to be ready for lunch break shoppers, instead of hanging around and serving the odd shopper that pops in by chance early in the morning.

Reducing your operational hours reinforces the importance of your ecommerce website. You don’t want to turn potential customers away and force them to come back later. Have a way for shoppers to purchase the item they would have done in-store with a sign on the door that points them to your website.

13. Limit travel expenses

The average business tripcosts $1,293. Transport, accommodation, and meals are all expensable when travelling for work. But while business-related events in the same state might not come close to that figure, you can cut retail costs by limiting travel expenses.

Take the bus instead of a private taxi. Fly economy on Tuesdays, Wednesdays, or Saturdays, when flight ticketstend to be cheaper. Stay in a hotel chain that gives you perks when you book through their site. They’re all small tweaks that make essential business travel cheaper.

Alternatively, if you’re going through a period where costs need to be cut dramatically, consider putting a short-term travel ban on for yourretail associates. You can give staff the same experiences with virtual events that cut travel costs entirely, such as online conferences or training sessions.

14. Reduce printing costs

Printing is a huge expense for retailers. Reduce the money you spend on printing—orgo completely paperless—with these low cost alternatives:

- Use QR codes.Save money on printing in-store advertisements with and createQR codesusing theShopcodes app. Shoppers can use their mobile phone to scan the code and view more information on your ecommerce website.

- Advertise in local magazines.Cut costs by securing an advert in a local magazine instead of sending bulk mail. Pay a flat fee for the magazine slot instead of printing, packing, and delivering your own leaflets.

- Rely on inventory management software.Barcode scannersand apps likeStockycan help you take stock without printing checklists or spreadsheets. Inventory is counted and recorded electronically.

- Email receipts to your customerinstead of giving them a flimsy piece of paper they’ll inevitably lose. You’ll cut printing costsandcollect important customer information—data you can use inemail marketing campaignsto nudge shoppers back to your store, recommending products similar to previous purchases.

I love it. In-store receipt paper isn’t recyclable because of the substance they’re coated with, so it’s a great step environmentally.

— Kimberlee Meier (@KimberleeMeier)July 6, 2021

Does your retail store need to cut costs?

The opportunities to cut retail costs vary depending on the size of business, type of product, sales model, and other characteristics.

通常情况下,没有统一的-all solution for cutting costs while maintaining product quality. Some retail stores have space to rent out to reduce operational costs; others see greater savings by automating the repetitive tasks their sales associates deal with on a daily basis.

解决问题的领域你的成本情况ating the least value so you have more capital to focus on growing your business. It’s the best way to cut costs and run aprofitable retail store.

This post was originally written by Alexandra Sheehan and has been updated by Elise Dopson.

Get a powerful POS system without breaking the bank

Only Shopify unifies your sales channels and gives you all the tools you need to manage your business, market to customers, and sell everywhere in one place.

How to reduce operating expenses in retail FAQ

How can operating expenses be reduced?

- Reducing staff costs by hiring fewer employees or using more part-time or temporary workers

- Reducing or eliminating non-essential expenses such as travel, entertainment, or office supplies

- Improving operational efficiency by streamlining processes or using more automation

- Purchasing cheaper or generic supplies instead of brand names

- Renegotiating contracts with vendors or service providers

What are operating expenses in retail?

How can you avoid high operating costs?

- Increase efficiency

- Decrease waste

- Use less expensive materials

- Streamline processes

How can retail operations be improved?

- Improving store layout and design

- Optimizingstock levelsand product mix

- Improving customer service

- Reducing shrinkage and losses

- Improving employee training and development

- Streamlining store processes and procedures