From showcasing your product catalog to shipping bulky orders, there are various steps in the process of selling goods to other businesses. And none of them are more important than collecting payment for the inventory you’re selling.

The issue? The business-to-business (B2B) payment process is vastly different from direct-to-consumer (DTC) orders. Wholesale customers pay after their shipment has been delivered. They also use different payment methods to pay for goods, and have an accounts payable team that manages outgoing finances.

This guide shares how to navigate the complexities of B2B payments—from the most popular payment methods to the B2B payment trends leading the industry in 2023.

B2B payments definition

一个B2B (business - to - business)付款过程s of transferring funds between businesses for goods or services rendered. It involves the exchange of payments through various methods such as bank transfers, electronic funds transfers, credit cards, or specialized B2B payment platforms, facilitating secure transactions between business entities.

The B2B payment market is growing fast. Sales are forecasted to hit$88 trillionin 2023, growing by 26%, to $111 trillion by 2027.

Types of B2B payment methods

One of the biggestdifferences between B2B and business-to-consumer(B2C) payments is the method a customer uses to pay for goods. Let’s take a look at the most popular payment methods used in B2B transactions.

Checks

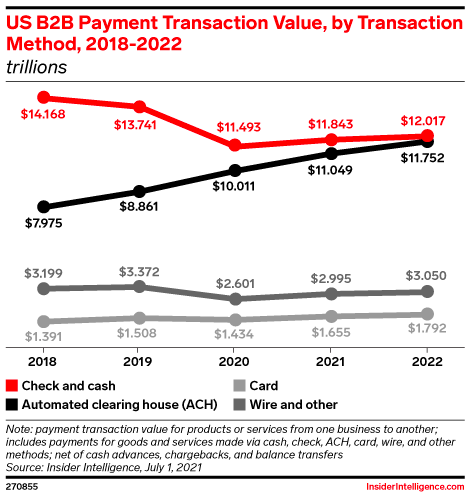

Despite B2B’s seismic shift to ecommerce, buyers are still defaulting to old-school payment types. Some40% of all B2B paymentsin the US are still made via check. Experts predict that check payments will top$12 trillionthis year.

To pay by check, most B2B companies require an invoice. They pass this invoice to an accounts payable (AP) department, which uses a paper checkbook prefilled with their bank details.

The AP team writes the dollar amount on the check and mails it to your business. Your accounting team would take the paper check to the bank (or scan it through a mobile app, if you’re using a modern fintech bank). The buyer’s issuing bank will then release the payment into your merchant account.

The advantage of accepting checks is that old retailers that haven’t yet embraced technological advances are comfortable with paper check payments. Forcing them to pay with another B2B payment method could be a confusing obstacle in their buying process, hence why moving toward electronic payments is thebiggest operational challengefor businesses.

However, the downside to using checks is huge—largely because paper checks risk getting lost in the mail. It’s also time consuming and involves manual labor. Customers need to receive an invoice, issue the check, and mail it to you. It’s then your job to take it to the bank.

It’s becoming increasingly more common for people to place wholesale orders online, so I think we’ll see more and more folks moving away from paper checks and, more importantly, purchase orders—good riddance.”

—Kelly Van Arsdale, co-founder and CEO ofSpinnaker Chocolate

ACH payments

Automated Clearing House (ACH) is an online network that helps businesses process large transactions. It’s the second-most used B2B payment method, often reserved for B2B payments between businesses and bigger retailers.

There are two methods to send a payment through the ACH network:

- An ACH credit transfer, in which a B2B customer pushes the money from their own business account.

- An ACH debit transfer, in which your company pulls the payment from a B2B customers’ bank account. (Theoretically speaking, this is the best way to take ACH payments, since you’re removing the reliance on your customers to send the payment.)

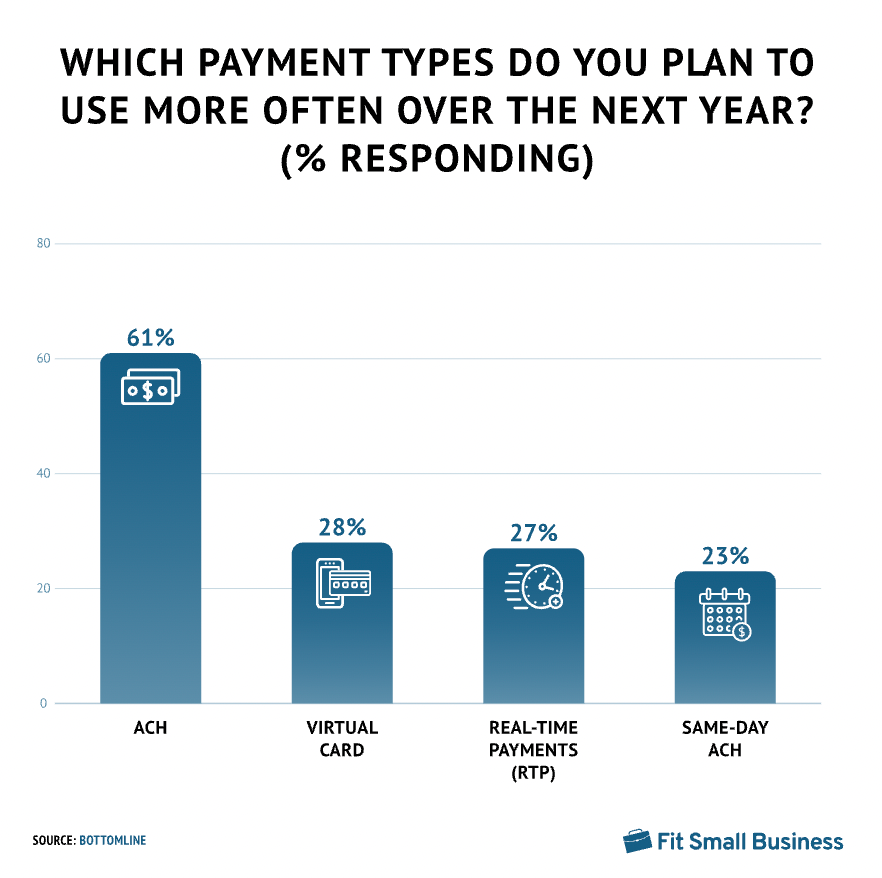

Caption: Despite the downsides of ACH payments,61% of businesses planto increase their use of ACH transactions in the coming year.

The downside to ACH payments is that it takes much longer to process a transaction, since payments are sent in batches throughout specific windows in the day. Plus, the ACH network is primarily available to businesses within the United States—you’ll need to find an alternative (such as wire transfers, which are quicker and easier than ACH transactions) if you process cross-border B2B payments.

Credit or debit card

The vast majority of B2C customers pay for online purchases using their credit or debit card. TheB2B电子商务industryis following suit—$3.05 billionwill be processed via B2B cards in 2022.

Some35% of businessessay high processing costs is a major challenge when dealing with traditional payment methods. Deloitte estimates it costs AP departments $8 to process a single supplier payment.

That quickly becomes a problem when processing B2B orders, which are larger than DTC by nature. It’s not uncommon for wholesalers to place high-value orders on a routine basis—be that every week, month, or quarter.

Wholesalers accepting B2B payments via American Express, for example, face a2.5% to 3.5%processing fee on each transaction. Assuming the higher rate on a $10,000wholesale order, you’d still need to pay $350 in transaction fees—while losing out on the extra profit you’d get from selling directly to the consumer.

That said, Michael Martocci, founder ofSwagUp, says, “Some credit card processors will actually give you lower processing fees as well, if you have B2B buyers, as the chances of default or chargebacks is much lower.”

Wire transfer

A wire transfer electronically moves money from one business bank account to another. You’ll provide your account details—including your business name, bank account number, and routing number—for the sender (i.e., your B2B customer) to initiate the transfer.

The biggest advantage of processing B2B payments through bank transfers is that money typically arrives the same day. However, it’s exposed to human error. The onus is on your buyer to enter your payment information correctly and initiate the payment before the payment due date provided on the invoice.

Digital payment services

A digital payment service allows business customers to pay for goods using a digital device in real time. Also known as electronic payments, examples of B2B digital payments include:

Kader Meroni, founder ofAtlas Tea Club, says, “We’ve found that our customers prefer to use PayPal for B2B transactions. The reason for this is that PayPal has a number of features that are useful for B2B buyers, such as the ability to add a note to the transaction, which can be useful for tracking purposes.

“In addition, PayPal makes it easy for sellers to manage their accounts and make sure they’re following the rules and regulations set forth by the payment processor.”

How to process B2B payments online

Choose a B2B payment processing solution

PYMNTSfound just 30% of businesses said their current solutions were very or extremely effective in addressing B2B payments frictions. Another third said their current solutions were slightly or not at all effective.

The B2B payments landscape is vast—there are several solutions designed to facilitate online B2B transactions. If the one you’re currently using isn’t fit for your purpose, evaluate other options.

Popular B2B payment providers include:

We use Shopify checkout and create a draft order—that works best for us. Shopify provides us with very competitive B2B payment processing rates compared to other carriers. Plus, it streamlines the order process.”

—Varun Sharma, co-founder ofLaumière Gourmet Fruits

When choosing a B2B payment processing platform, confirm it accepts your buyers’ preferred payment methods. Will Stewart, owner ofCedar Spring Recreation, says, “We offer multiple payment options to make it as easy as possible for our wholesalers.”

Similarly, if B2B ecommerce forms part of your international expansion plan, confirm your B2B payment processor supports cross-border transactions.

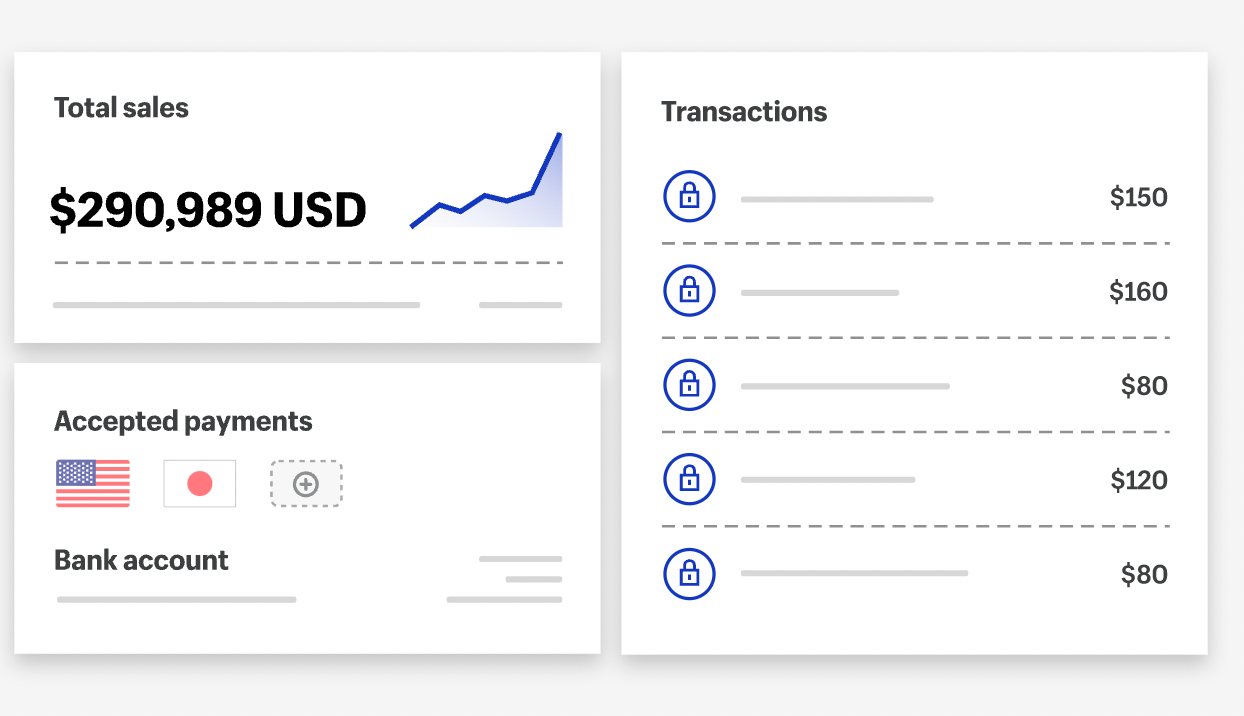

Use Shopify’s B2B ecommerce platform and get access toShopify Payments. Accept more than 130 global currencies from a range of different payment gateways—all without investing in a separate back end from the one already powering your DTC store.

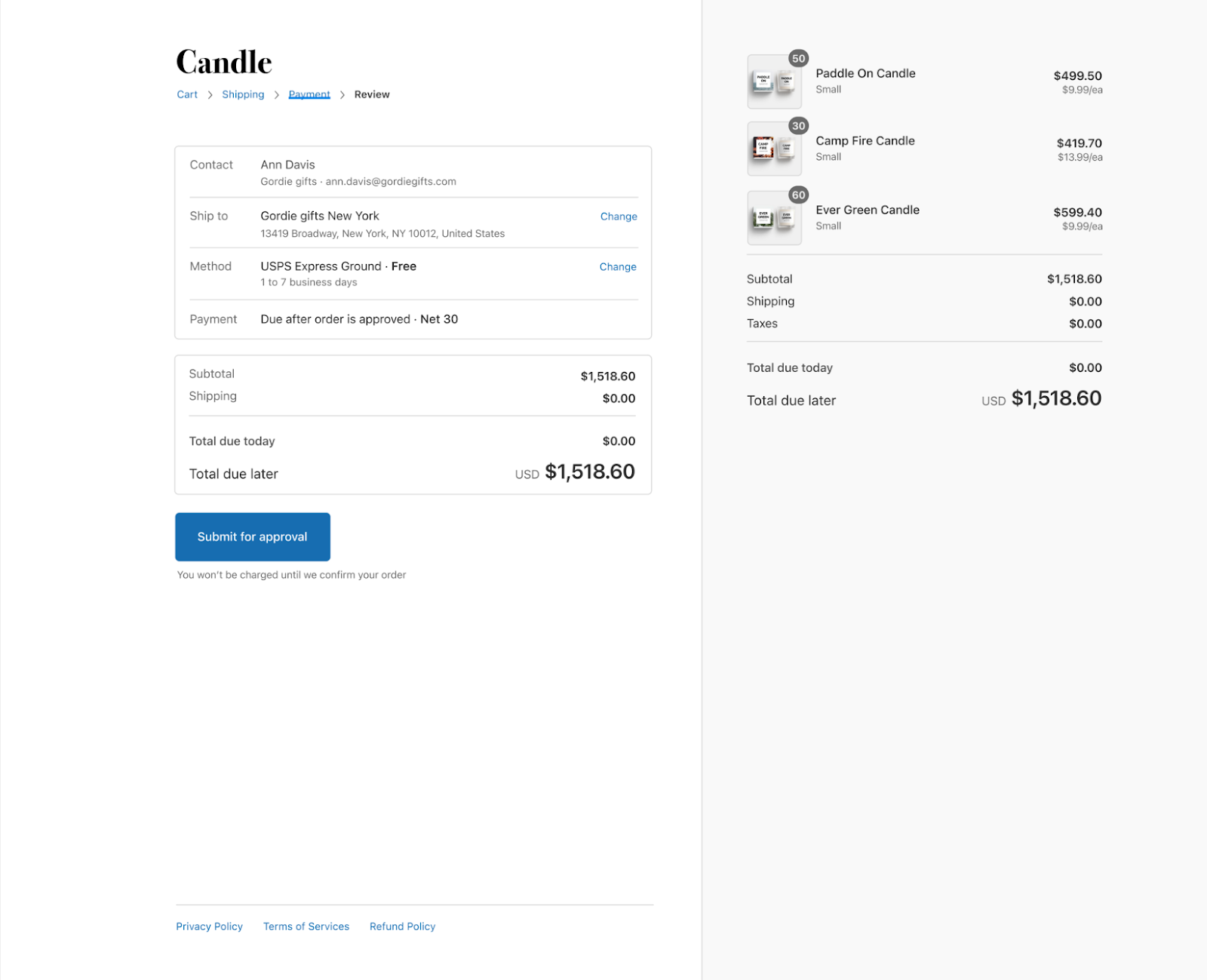

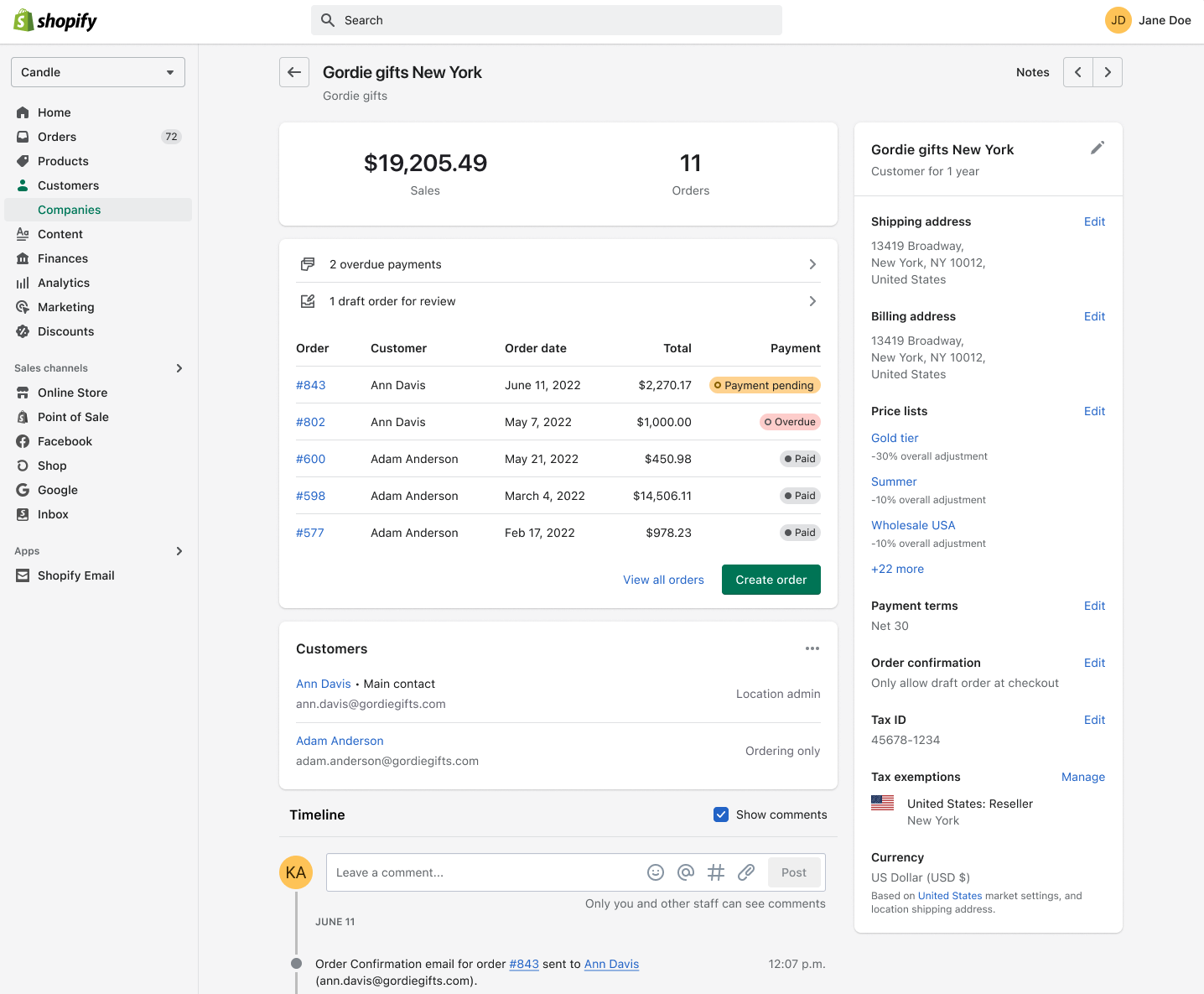

Business customers get the DTC treatment they’re craving. They can log in to their online portal and view assigned payment terms, tax exemptions, and purchase history.

At S’wheat, we use Shopify to create custom orders, as it allows us to invoice the customer with a direct link to Shopify checkout. It also allows our international customers to pay via card payments, which is quicker and easier than international BACS payments.”

—Sophie Gibson, PR and communications atS’wheat

Take your wholesale business online with B2B on Shopify Plus.Learn more.

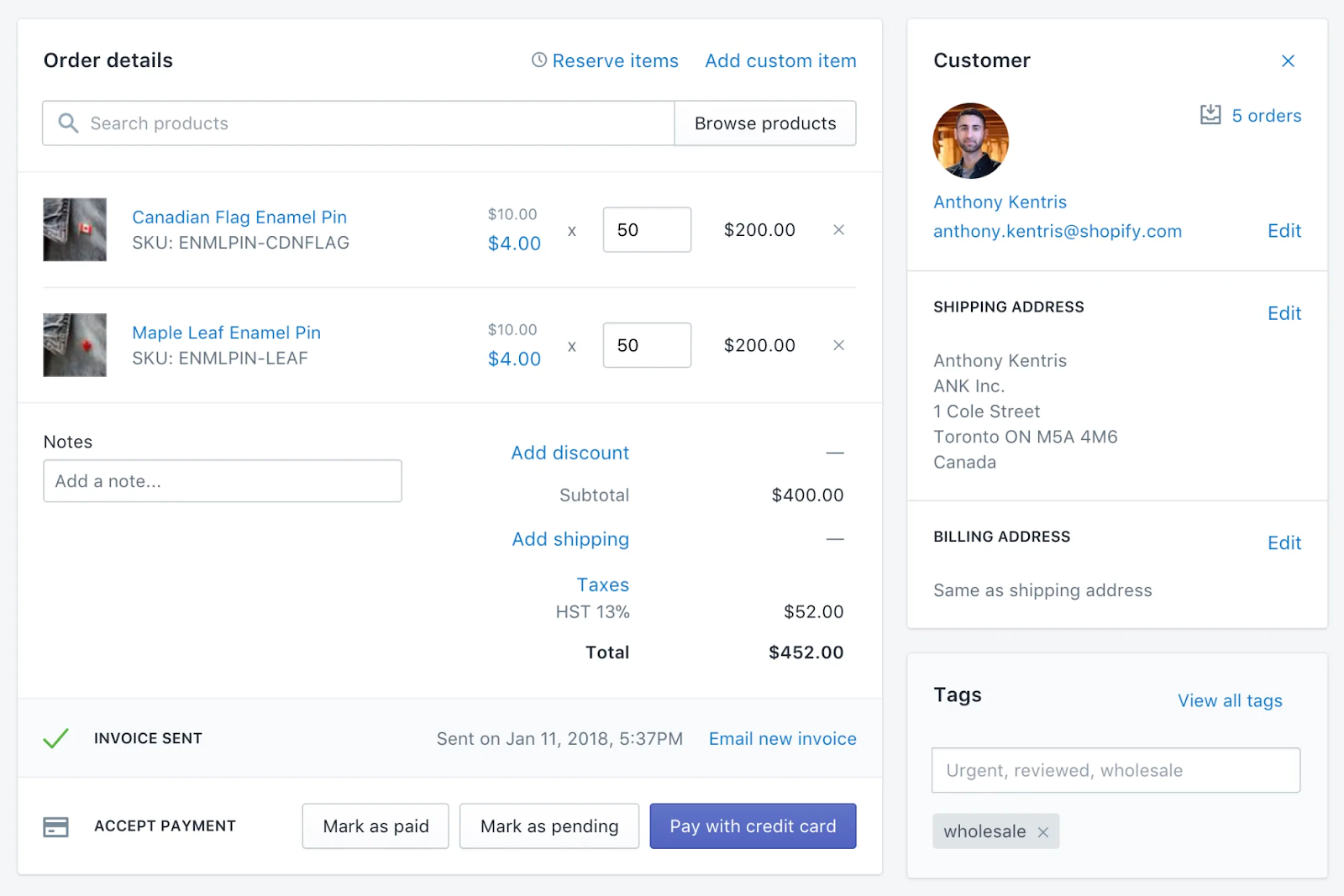

Create invoices for B2B customers

Invoices display key information about a buyer’s order, including the SKU they’ve purchased, the quantity, any tax, and the final amount owed. Many retailers require the invoice before paying for goods. Their accounts receivable team will also need it to reconcile the business’s accounts.

Electronic invoicing is a slow process that causes big challenges for B2B buyers.PYMNTSreports that 42% of buyers think invoice reconciliation is a source of friction when paying suppliers, with 9% citing it as the most important.

Resolve the issue for the41% of B2B buyerswho think the absence of a supplier portal causes payment friction, withB2B on Shopify. Review draft B2B orders before invoicing for negotiated deals from the same back end that powers your DTC store.

Buyers can also sign in to their password-protected online portal to download invoices for previous orders, view their payment history, and get automated invoice reminders when their payment is due. They’ve also got the ability to modify their order pre-shipment and pay using the credit card stored on file, removing as much friction as possible throughout the B2B buying process.

Not only does this give buyers the self-serve B2B ecommerce experience they want, but it saves resources too. There’s no need for a B2B customer support rep to handle the request.

Negotiate B2B payment terms

B2B buyers have greater bargaining power when purchasing goods from another business. They order items in bulk, at a discounted price, and aren’t accustomed to paying for their purchase upfront.

Cash flow is a notoriously difficult issue for small businesses—some82% of businessesfail due to poor cash flow management. According toDeloitte, it takes an average of 30 days for B2B buyers to complete a payment. Almost half of those suppliers are paid late for their products or services.

Take a small retailer that’s purchasing inventory to stock in their own store, for example. If their supplier offers flexible payment terms such as net 30, 45, or 60, they have upward of a month to sell their stock before paying for it.

Michael Martocci, founder ofSwagUp, adds, “When you work with larger companies, they like to process payments through their procurement processes: issuing POs and billing against them and paying 30 to 60 days from invoice. This can be very tough for a small business and is why many factoring companies have popped up.”

Immediate payment terms can discourage first-time B2B customers from purchasing from your brand. Negotiate delayed payment terms with buyers throughout theB2B salesprocess, and upload your agreed terms to their company profile. The payment date for any future purchase is set according to your agreed terms.

Prevent B2B payment fraud

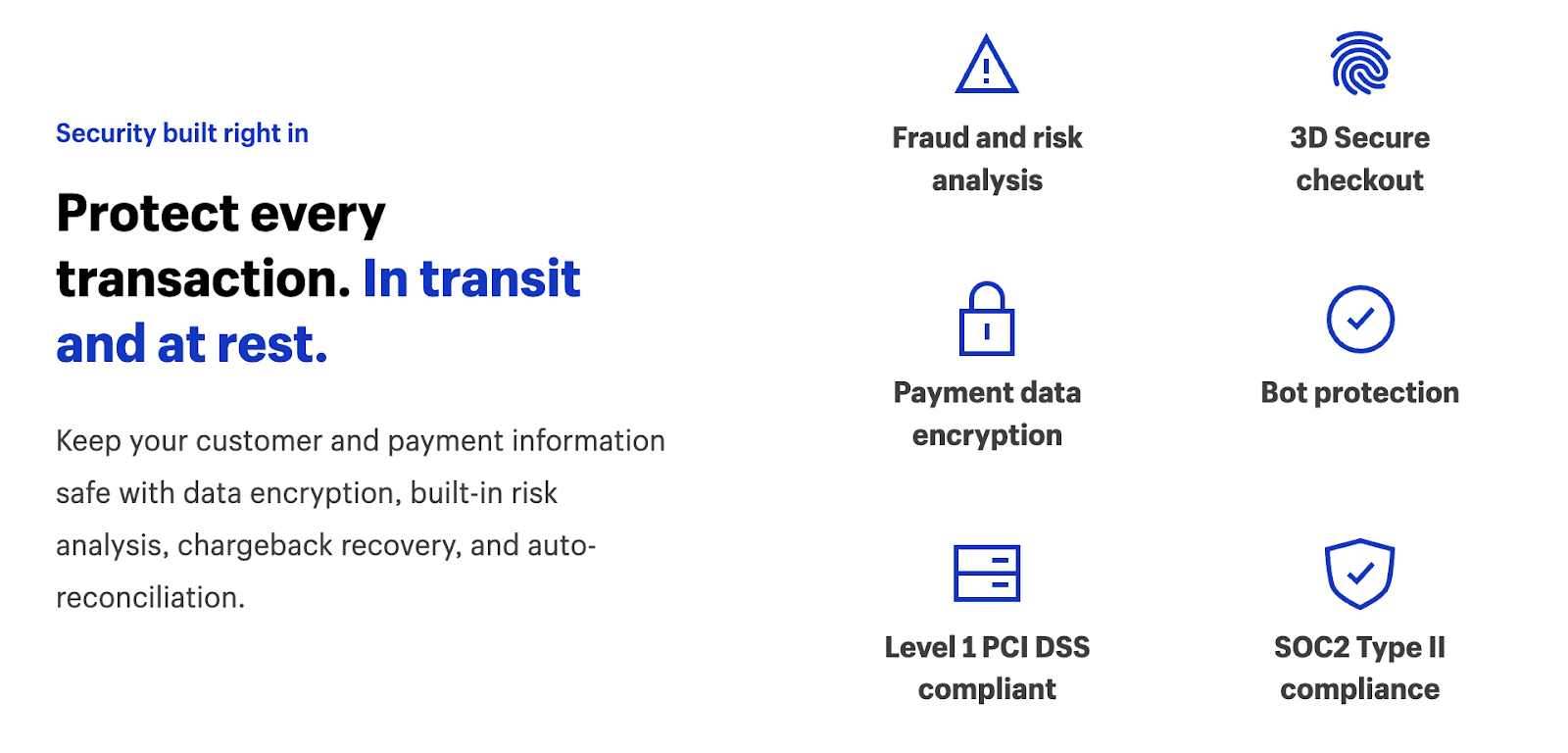

Online payment fraud is an issue for any ecommerce business—B2B brands included. Organizationslose 3.5%of their annual revenue to fraud-related concerns, largely because brands ship items to customers with already-agreed delayed payment terms. The retailer receives their inventory and disappears before the payment date arrives.

Brands also fall victim to B2B payment fraud through:

- Account takeovers.This happens when a company’s profile is compromised and a fraudster uses the business’s saved credit card to make fraudulent purchases. Encourage buyers to use strong passwords andenforce two-factor authenticationon their account to prevent this from happening.

- Credit card fraud.Much like end consumers, businesses are at risk of having their credit card details stolen. Scammers often use stolen credit cards to make fraudulent B2B purchases. Verify a buyer’s payment card and check that the billing address matches the cardholders before processing new B2B orders.

- Document forging.Invoices, purchase orders, and receipts within paper-based B2B transactions can easily be forged. To alleviate this issue, encourage buyers to switch to electronic payments, where financial data is encrypted and saved with a secure paper trail.

Shopify Plushas built-in fraud protection that verifies payment cards with a next-generation data algorithm. Plus, should B2B customers request a fraud-based chargeback,Shopify Protect涵盖了订单总成本和退款费用you don’t leak extra money through B2B payment scams.

B2B payment trends

Automate the B2B payment process

The traditional B2B payment process is time consuming. Taking paper orders, issuing invoices, and cashing checks costs time your business can’t afford to lose.

The average organization spends upward ofsix hours per monthprocessing B2B payments, and loses between 6% and 10% of revenue to inefficient payment processes. But 60% of those that have already digitized the process said it’s had a positive impact on supplier relationships. (It’s those strong relationships that encourage retention and makeB2B电子商务highly profitable.)

Streamline the B2B payment process byautomating as much as possible. That means:

- Setting price lists for B2B customers.Offer bulk discounts to B2B customers with wholesale price lists. When they sign in to their online portal to reorder, their already-agreed discount is automatically deducted from their invoice.

- 收费信贷cards on file.Encourage B2B customers to store their credit card information in a secure online portal, especially if they’ve committed to a recurring payment. When payment is due, you’ll automatically charge their card on file—no payment reminders required.

- Automating invoice reminders.If B2B buyers are hesitant to move toward online payments, create a workflow that sends automated invoice reminders as the due date approaches. Brands using manual processes take67% more timeto follow up on overdue payments than those that use automation.

Laird Superfoodtook this approach when moving its wholesale channel online. The retailerused Shopify Plusto build a password-protected online portal. Now, instead of forcing customers to contact a support rep to pay for B2B orders, they could sign in to their online account and pay when it was most convenient.

Laird’s CMO, Luan Pham, says, “Being able to automate the wholesale process changes how we build our team. It prevents us from missing 2 a.m. orders and keeps our customers from having to wait to place an order until we’re in the office. It just solves so many problems.”

It’s fair to say that having the wholesale portal will save us the equivalent of one employee a year. That’s $50,000 to $60,000 a year, and covers the cost of Shopify Plus several times over.”—Paul Hodge, CEO of Laird Superfood

Mobile payments and digital wallets

Mobile commerce has taken the B2C world by storm—and B2B is catching up. Studies show that by 2024, a whopping 292 million people willown a mobile device. Business buyers are already using them throughout the purchase process: mobile influences more than40% of revenue在领先的B2B组织。

This shift to mobile is driving a change in preferred payment methods for business customers. Kader Meroni, founder of Atlas Tea Club, says, “The biggest B2B payment trend I’ve noticed recently is the rise of mobile payments. It’s not just the number of people using their phones to pay, it’s also how they’re using them.”

“In the past, we saw most people using their phones as a digital wallet, where they kept all their credit cards on one app and used it for each purchase,” Kader says. “But now we’re seeing more and more people use their phones to make purchases directly from their bank account or credit card accounts. This means that merchants need to be ready to accept multiple types of payment methods from customers in addition to cash and checks.”

Mobile payment systems also offer built-in biometric authentication, which protects your business from credit card fraud. When buyers purchase through Apple Pay, for example, they’re required to pass Face ID or fingerprint checks before the payment goes through.

UseShopify Plusto enable mobile payment methods on your B2B online store. That includes:

- Mobile payment appssuch asShop Pay, PayPal, or Venmo

- Mobile walletslike Apple Pay, Google Pay, or Samsung Pay

- Virtual card paymentsthrough banks likeWise,Chase,andCapital One

Cryptocurrency payments

Cryptocurrency is a digital currency that allows business customers to pay for online goods. It’s aB2B电子商务trendon the rise;experts predictB2B跨境支付将达到35美元下三角阵lion in 2022, with 58% of multinational companies having already used one type of cryptocurrency within the last year.

However, they present risk—cryptocurrencies are volatile. On an episode ofThe Rebound, Shopify’s APAC marketing lead, Bertie Ocampo, said, “Nobody knows what Bitcoin’s value will be tomorrow, and that’s important to keep in mind. There are also operational considerations, such as administration—tracking trades, payments, and receipts—and then custody, which is how to store the currency securely.”

Weigh up whether it’s worth offering popular crypto currencies on your B2B online storefront. Payment platforms likeCrypto.com,Coinbase Commerce, andBitPayallow ecommerce merchants to accept popular cryptocurrencies like:

- Bitcoin

- Ethereum

- Dogecoin

Take the stress out of complex B2B payments

Regardless of the sales channels you’re using to connect with B2B customers, one thing’s for certain: you need to offer B2B payment functionality that business customers are already accustomed to using.

That said, you don’t need to let inefficient payment cycles cause operational headaches within your business. Use Shopify’s B2B ecommerce platform to accept credit card payments from B2B customers, automatically assign wholesale price lists to retail customers, and set flexible payment terms for your business buyers, so you have more time to do what you do best: scale.

B2B payments FAQ

What are B2B transactions?

B2B transactions happen when a business purchases something from another business. Part of the transaction includes exchanging money for goods or services—also referred to as a B2B payment.

What payment method is most commonly used by B2B?

Paper check is the most popular payment method used in B2B. Data shows 40% of all B2B transactions are made via check.

Does Stripe do B2B payments?

Stripe facilitates B2B payments through its payment processing platform. Extra features that come with its B2B offering include invoicing, automated sales taxes, and custom due dates.

Which is the best B2B payment platform?

Shopify Paymentsis one of the best B2B payment solutions for both B2B and B2C orders. Accept more than 130 currencies, use built-in risk analysis, and allow customers to pay with a variety of payment methods—including Apple Pay, PayPal, and credit card—through your ecommerce back end.

Additional research by Michael Keenan

Read More

- B2B Ecommerce: Everything You Need to Know to Get Started

- B2B Ecommerce: Why Taking Your B2B Business Online is a Smart Strategy to Scale

- 12 B2B Ecommerce Trends To Shape Your Business in 2023

- What Is Wholesale B2B and How To Sell To Customers in 2023

- B2B Marketplaces: What They Are, How to Succeed, and 8 Marketplaces to Consider

- Find the perfect domain name

- Website Builder 2023: Create a Website in Minutes