Some23% of small business ownerssay inflation is the second most important problem for their business in 2023. (Quality of labor is number one at 24%.)

毫无疑问,税收法案,到达the end of each financial year—is thethird-mostimportant problem for small businesses in the US at 17%.

Managing your taxes for your retail store doesn’t have to be a headache. This guide shares how taxes impact your business, with 15 tips on how to navigate a stress-free tax season.

How taxes impact your business

Every small business owner in the US needs to pay taxes. While the exact amount you’ll pay varies by state and business structure, taxes are one of the biggest costs associated withrunning a retail store. The average small business pays a19.8% tax rateon their income.

Along with being one of the largest business expenses, taxes are one of the most important bills. Small business owners who file their taxes late, inaccurately, or abandon them altogether face fines—or in extreme cases, criminal prosecution.

好消息吗?小企业的税收没有薪酬lex as you might think. A certified public accountant (CPA) can help you reduce your tax liability so you’re not left with a huge bill to pay at year's end.

15 small business tax tips

The last thing you want to feel is frazzled when tax time rolls around. Here are 15 tax saving tips to help prepare and manage your small business’s accounts throughout the year.

- Know your financial jargon

- Separate business and personal finances

- Keep accurate records

- Use accounting software

- Pay estimated quarterly taxes

- Set aside cash for payroll taxes

- Track inventory accurately

- Know what’s tax deductible

- Contribute to your retirement account

- Make a charitable donation

- Use section 179

- Use bonus depreciation

- Apply for the qualified business income reduction

- Prepare for tax season in advance

- Hire an accountant

1. Know your financial jargon

Many taxpayers think they need a new dictionary to understand their tax return. The world of accounting comes with its own specialized terminology. Spend some time learning jargon that will help you understand your business’s financial position.

Here’s a quick explainer for some common phrases you might see on your balance sheet:

- Revenue: The amount of money earned through product sales.

- Cost of goods sold(COGS): The cost of producing products sold by your business.

- Gross profit:The money left over after subtracting the COGS from total revenue.

- Net sales:Total profit made after deducting all expenses from total revenue.

Lily Will, founder and CEO atNiaWigs, puts this into practice, “Small business owners frequently overlook the difference between their net and gross income.”

“For example, if your product costs $100 to create and sells for $150, your gross profit is $50. However, after deducting your expenses, your net income might be as little as $10. So it’s critical to understand your gross and net profits to increase profitability and expand your company.” Lily says.

PRO TIP:To see your net sales, cost of goods sold, and gross profit, view theFinances summary pagein Shopify admin.

2. Separate business and personal finances

The first thing you should do when starting a small business is open a new bank account.

One of the simplest ways to get in tax trouble is having personal expenses recorded as business expenses. The more on top of your business and personal tax records you are, the less likely the IRS will find anything wrong with your records.

Having separate bank accounts for both business and personal transactions makes tax time easier. Not only will you have clean, accurate records for the expenses you’re writing off, but personal transactions will be kept private.

3. Keep accurate records

Speaking of clean data, tax season will be much easier to navigate if you have accurate reports. Pull bank statements to reconcile income and outgoings with receipts orinvoices. You can use an accounting software that does it for you (more on this later), or a free tool like Shopify'sinvoice generator.

Free samples are a common misrecorded expense, as Dan Luthi, partner at点燃的地方,explains, “Sometimes people will just adjust out and mark it off as inventory shrinkage when, in reality, it was actually a marketing expense.”

Making sure it’s reported correctly on your financial statements is crucial. It helps you to understand what your business comparability is, so when you’re evaluating at the end of the year in preparation for taxes, [people are] looking at the right information. You know what you are actually utilizing for marketing spend versus just inventory adjustments.

Credit card points are frequently misrecorded, too. Scott Scharf, CTO of Acuity and co-founder ofCatching Clouds, and Acuity company, says, “When you’re buying $1 million of inventory, that’s a hell of a lot of points. And when small business owners actually take a vacation, they can go and be first class the whole way—everything covered all by points.”

“Very few people track rewards points as profit to the business. The only time that would come up would be in an audit. It should be listed as income.”

Free Download: 6 Steps to Get Your Business Ready for Tax Season

Tax season is stressful for any business owner. This guide will go through the process of filing income taxes in America and provide you with checklists to keep you organized and prepared.

Get your free guide

Almost there: please enter your email below to gain instant access.

We'll also send you updates on new educational guides and success stories from the Shopify newsletter. We hate SPAM and promise to keep your email address safe.

4. Use accounting software

Still using a spreadsheet to manage your small business’ taxes? The risk of mistakes is much higher. Human error can make tax returns inaccurate—a situation you never want to deal with.

丹说:“Excel不会为你提供completely accurate information. It’s not going to create financial statements for you. It’s not going to tell you who your biggest vendors are or what you bought from your biggest vendors this year.”

You should never file your company tax return without consulting a competent tax professional or using a tax software program that can assist you in calculating deductions.

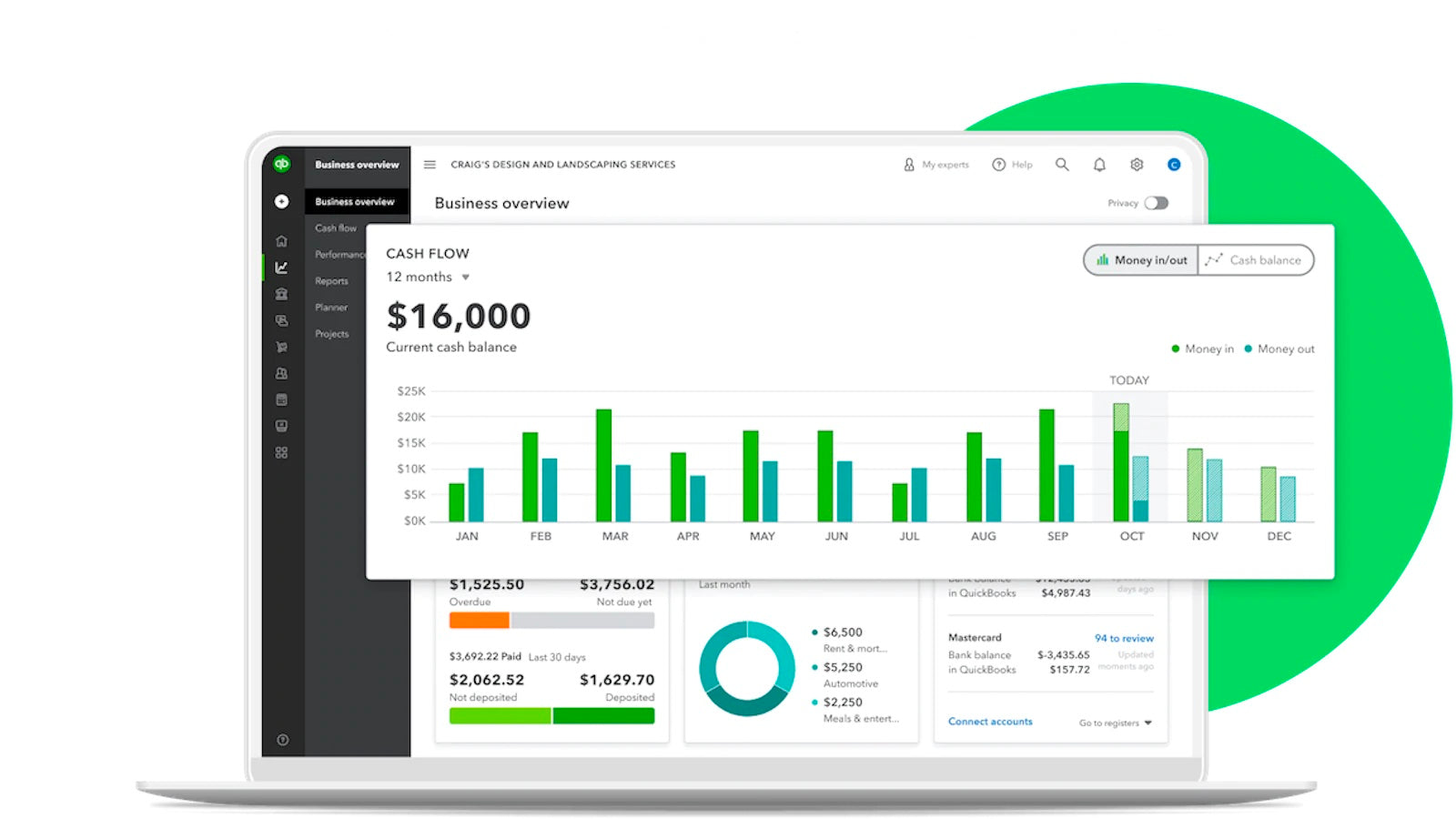

Accounting software exists to solve those problems. Platforms likeQuickBooks,Xero, andSageintegrate with your ecommerce store—saving time, reducing errors, and automatically creating reports that’ll help you understand your business’ finances.

From our own data, we saw an uptick in searches for ‘cash flow’ apps in the Xero App Store between February and July 2020 as small businesses dealt with the effects of the global pandemic. We’d expect to see these apps remain popular, as they really help small businesses like retailers understand how their business is doing, and what might be coming up in the future.

5. Pay estimated quarterly taxes

The IRS requires small business owners that predict to owe more than $1,000 at the end of the financial year to make quarterly payments. Estimate your year-end tax bill and contribute to your year-end accounts by filingForm 1040-ESon these dates:

- April 15

- June 15

- September 15

- January 15

“This is important, since there is no tax withheld on business income flowing through to your individual return,” says Tim Yoder, Tax and Accounting Analyst atFit Small Business. “Sole proprietorships reporting business income on Schedule C should make quarterly payments that include both self-employment tax and income tax.”

6. Set aside cash for payroll taxes

As a small business owner who employs staff, you have a legal obligation to report, withhold, and pay employment taxes.

There are various types of tax to consider per employee:

- Social security tax:Employers pay half (6.2%) of employee earnings.

- Medicare tax:Employers pay half (1.49%) of an employee earnings.

- Federal income tax:Varies depending on their salary and personal expenses.

Payroll apps likeGusto,ClockedIn, andHomebasecan assist you whenmanaging payrolland paying employment tax. You’ll see when payroll time is approaching, track employees’ working hours, and stay compliant with employment laws, all within one dashboard.

People that use payroll solutions that are less involved—a lot of times they miss out on what their liabilities are with those and who they owe money to, whether that’s the IRS, the state, or their benefits organization.

“At periods of time, especially if they reported their taxes on an accrual basis, they should be able to actually deduct those expenses in the period that they were referenced, versus actually reporting them when they actually paid them out two or three months later.”

Related:Three Steps to Optimizing Cash Flow During a Crisis

7. Track inventory accurately

Another metric you’ll see on your small business’ tax return isinventory value—the dollar amount you have tied up in unsold inventory.

“Retailers must determine the cost of the merchandise they sell during the year,” says Tim Yoder, Tax and Accounting Analyst at Fit Small Business. “Doing this calculation by hand is very time consuming and prone to errors. Invest $50 to $80 per month for a quality bookkeeping package with inventory accounting, like QuickBooks, Zoho Books, or Xero.”

Plus, if you’re operating several retail stores, it helps to choose aninventory management systemthat acts as one source of truth for inventory-related data.

If you’re not using one centralized place like Shopify to manage that inventory, or even the retail sales that are going along with it externally, it’s going to create more complications for you because you have to reconcile that information together.

Scott Scharf from Catching Clouds, an Acuity company says, “At minimum, you should record the quantities in stock each month—be that your own garage, a warehouse, 3PL, at Amazon FBA—wherever.

“An accurate inventory count and an accurate value of that inventory—those two numbers and reasonable financials (even if they’re a little messy), will get you fairly close to what should be listed as total profit or loss on your tax return.”

Related:Open-To-Buy Retail Planning: How to Plan Inventory Budgets Using the OTB Formula

8. Know what’s tax deductible

The lower your profitability is, the less tax you’ll be liable to pay at year end. One way to sensibly reduce profit is by claiming business-related items as an expense.

According to the IRS, businesses can write off any expense that meets this criteria:

- Ordinary:One that’s commonly used by other businesses in your industry (i.e., other retail businesses).

- Necessary:One that’s helpful or assists you in growing the business.

“A lot of times, small business owners will say, ‘I ate lunch with this person, so that’s a marketing expense,’” says Dan. “In a lot of cases, it’s not. You have to make sure that you’re evaluating expenses correctly.”

Allowable expenses for brick-and-mortar retailers include:

- Inventory

- Marketing

- Payroll

- Utilities (i.e., heating and lighting)

- Commercial lease

- Accounting and legal services

- Insurance

- Shipping and delivery costs

- Retail packaging

- Home office deduction

- Equipment

The petrol you used to drive fetch supplies? Mark that as a business expense. The hotel you paid for while on a business trip? Mark that as a business expense. Anything that is a legitimate business deduction should be submitted to the company for a business report.

9. Contribute to your retirement account

Small business owners often feel like their financial future is in their own hands. Prepare for it—and get a legal tax break—by contributing some of your business’ profits to your own 401(k).

The same concept applies to your store employees. Contributing to their retirement plan is an attractive perk for someretail store employees. Any contributions you do make are tax deductible, making it a win-win for everyone involved.

10. Make a charitable donation

Whether you’re donating cash to a local non-profit or supporting a cause in your community, small businesses can reduce their tax liability by making charitable contributions.

There arelimitson how much money you can donate through the tax year:

- Individuals can donate and write off up to 100% of taxable income.

- Corporations can donate and write off up to 25% of its taxable income.

This isn’t just a tax-saving tip—it’s a way to connect with your target customers. Our data shows consumers arefour times more likelyto purchase from a company with strong brand values. Supporting local causes is a great way to do that.

11. Use section 179

Purchased expensive equipment throughout the year? Be that high-grade lighting systems or store security cameras, use section 179 tax deduction to write off the full purchase price and reduce your tax liability.

Again, there are strict rules around how section 179 can be claimed. Equipment must be used for business purposes more than 50% of the time, actively used in the current financial year, and purchased outright. There’s also a $1.08 million limit on the amount you can write off.

PRO TIP:The cost of yourShopify POSplan, apps, and hardware you purchased for your retail store qualify for Section 179 tax deductions.

12. Use bonus depreciation

Bonus depreciation is another way to write off expensive equipment you’ve purchased for your store. Unlike section 179, the purchase price is deducted from business profits over the time it’s used.

For example: a high-grade security system cost the business $50,000. Instead of writing that off in your first financial year using section 179, bonus depreciation might see you writing off $5,000 for each year it’s in use.

红利折旧的主要优势是,there’s no limit. Riley Adams, licensed CPA and founder ofYoung and the Invested, says “The depreciation can create a net loss, allowing you to offset future taxable income.”

Depreciation isn't a real expense that comes out of your checking account.

It’s a form of tax deferment and is written off as an expense on your taxes. It lowers your tax liability.

— Nick Huber (@sweatystartup)January 22, 2022

13. Apply for the qualified business income deduction

“Starting with tax year 2018, a new law passed that allows a new 20% tax deduction on your QBI [qualified business income] that reduces your taxable income,”Gail Rosen, CPA, PC, explains.

There are many provisions that change your eligibility for this deduction, including what type of service you offer, your income level, wages you pay and/or assets you own. Brick-and-mortar retailers can be eligible for this tax deduction.

To qualify for QBI deduction in 2022, a single filermust haveless than $170,050 in taxable income. This increases for joint filers, such as partners running a retail business, to $340,100.

14. Prepare for tax season in advance

Tax season is a stressful time for many store owners. But it doesn’t have to be. By getting your financial ducks in a row before tax time rolls around, you’ll meet (or beat) deadlines—instead of scrambling around to reconcile a bank statement from six months ago.

Here are two important dates to keep on yoursmall business’ tax calendar:

- March 15:S corporation and partnerships tax return

- April 15:Personal or single member LLC tax return

Sarah York, enrolled IRS agent and writer atKeeper Tax, advises, “The best time to think about taxes is mid-November. The bulk of the year is over, so you can get a realistic forecast of your tax situation while there’s still time to plan for it.

“This window of opportunity is where the most effective strategic tax planning happens, so be sure to mark it on your calendar now! Once the year closes, even the best CPA won’t be able to do much.”

Small businesses should be meeting with their CPAs to do tax planning and adjust over time–preferably quarterly, but at least in Q4. In October, November, and December, you should be meeting with your accountant and saying, ‘Here are my rough numbers. What can I do legally and properly to reduce my profitability?

15. Hire an accountant

“Small business owners usually didn't get into business to be accountants,” says Dan. “They got into business to make money. They got into business to sell something that they love and that they’re passionate about.”

Free up time to focus on other parts of your business and offload your tax filing to a CPA—someone who can give you personalized tax advice based on your business structure. C corporations, sole proprietors, partnerships, and limited liability companies all have different tax preparation and filing requirements, so it’s hard to find one-size-fits-all advice online.

But with more than1.44 millionbookkeeping, accounting, and auditing clerks to choose from, Scott Scharf also recommends choosing a CPA with an understanding of inventory-based businesses.

“You want to make sure that they understand cash versus accrual for an inventory-based business. And to look at things if they’re using landed cost versus buy cost, which can have a huge impact on the profitability of the business,” he says.

Not doing landed cost means you’re writing off all of your shipping as it comes in—even if it takes six months to ship all of your product—and that reduces your profitability.

Dan continues, “But if your CPA is on it, they might say, ‘Wait, what’s the landed cost? Why didn’t you move this over to the balance sheet?’”

Get your taxes right

Tax time is a stressful season for small business owners who file, prepare, and pay their own taxes.

Use these tips to prepare yourself for the upcoming tax season. Whether you’re checking if yourbusiness tax deductionsare allowed or consulting with a CPA on tax laws in your state, the best time to start planning is now.

Stay on top of your finances

With Shopify POS, it’s easy to create reports and review your finances including sales, returns, taxes, payments, and more. View your financial data for all sales channels from the same easy-to-understand back office.

Small business tax tips FAQ

How do I maximize my small business tax return?

- Take advantage of all available deductions: Make sure to take advantage of all business deductions that are available to you. These can include deductions for business expenses, supplies, equipment, travel, meals, and entertainment.

- Track your business expenses: Keeping accurate records of all of your business expenses can help you maximize your deductions and reduce your taxable income.

- Take advantage of tax credits: There are many tax credits available for small businesses, such as the Work Opportunity Tax Credit, the Low-Income Housing Tax Credit, and the Small Business Health Care Tax Credit. Make sure to research what credits your business may qualify for and take advantage of them.

- Review your filing status: Make sure that your business is filing under the correct filing status. Depending on the type of business you have, you may qualify for filing as a sole proprietorship, partnership,S corp, orC corp.

- Hire a professional: Tax laws can be complicated and ever-changing. Consider hiring a professional to help you with your tax return to ensure that you are taking advantage of all available deductions and credits.

What can I write off as a business expense?

- Employee salaries, wages, and benefits

- Advertising and marketing

- Rent and utilities

- Office supplies and equipment

- Travel expenses

- Professional services, such as legal and accounting fees

- Insurance

- Interest payments

- Taxes

- Depreciation

- Start-up costs

- Home office expenses

- 食物和娱乐

- Vehicle expenses

Can I do my own small business taxes?

Do I have to file taxes for my small business?

Note: This guide is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax, or financial advice from a professional accountant.