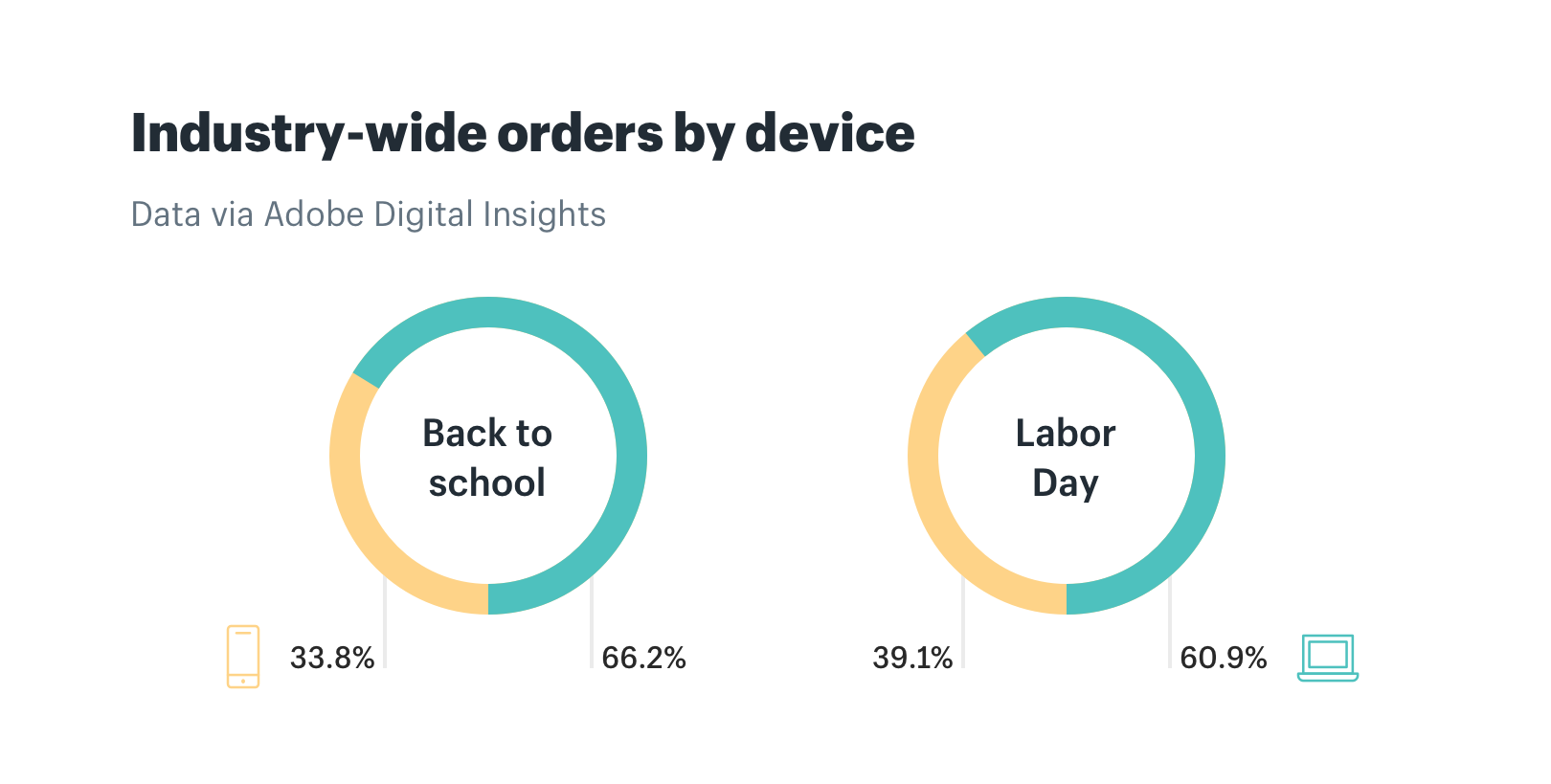

- The 2018 back-to-school shopping season generated $58.1 billion in online revenue with the majority of orders (66.7%) made on desktop

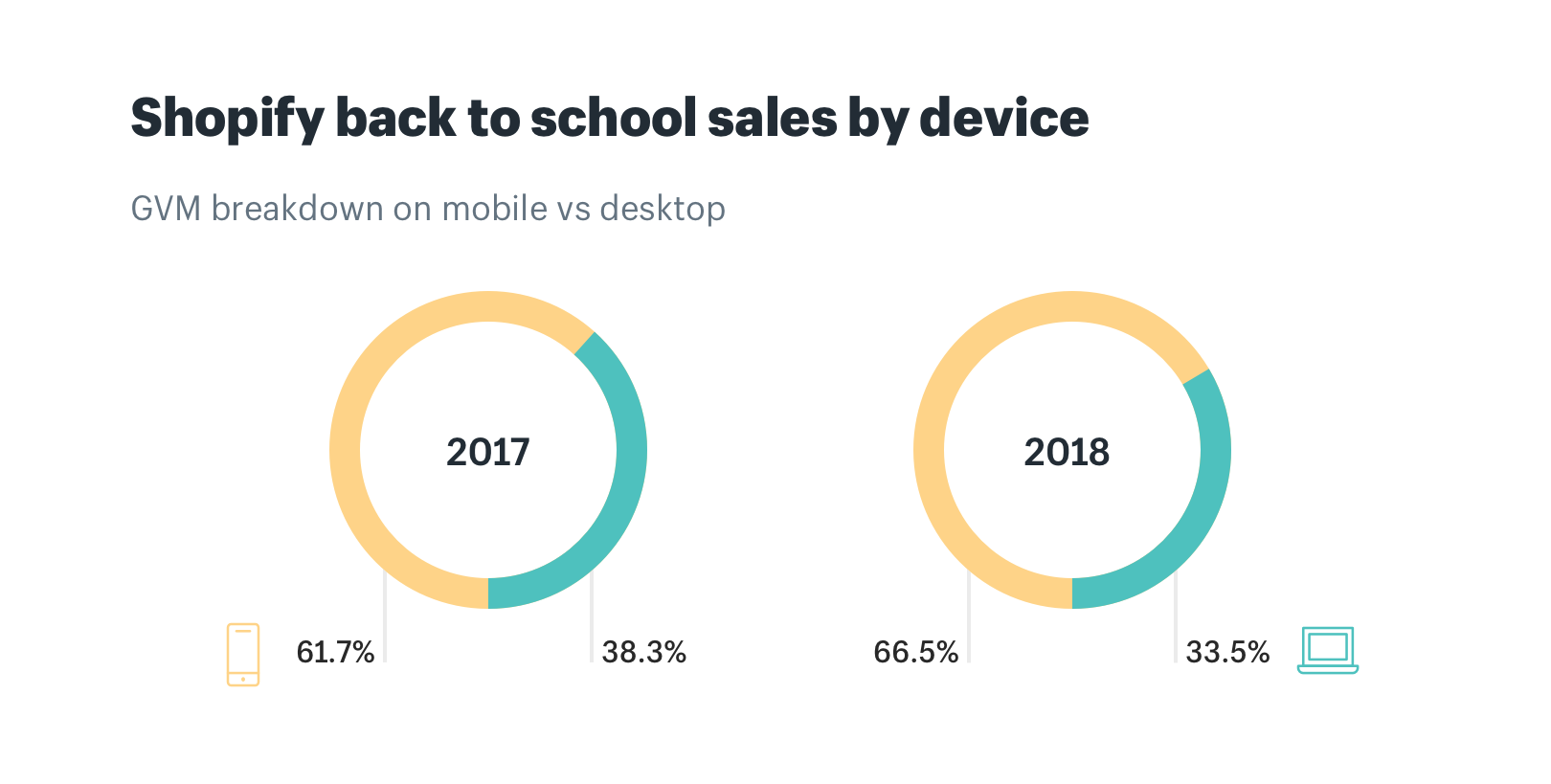

- On Shopify, 2018 mobile sales (66.5%) outpaced desktop (33.5%); likewise, total mobile orders grew 59% YoY with desktop orders increasing 29%

- Businesses on Shopify saw consistent surges each weekend over the shopping season with peak buying on Aug 31st and Sept 3rd (Labor Day)

School is back in session …

And the 2018 ecommerce performance results are in.

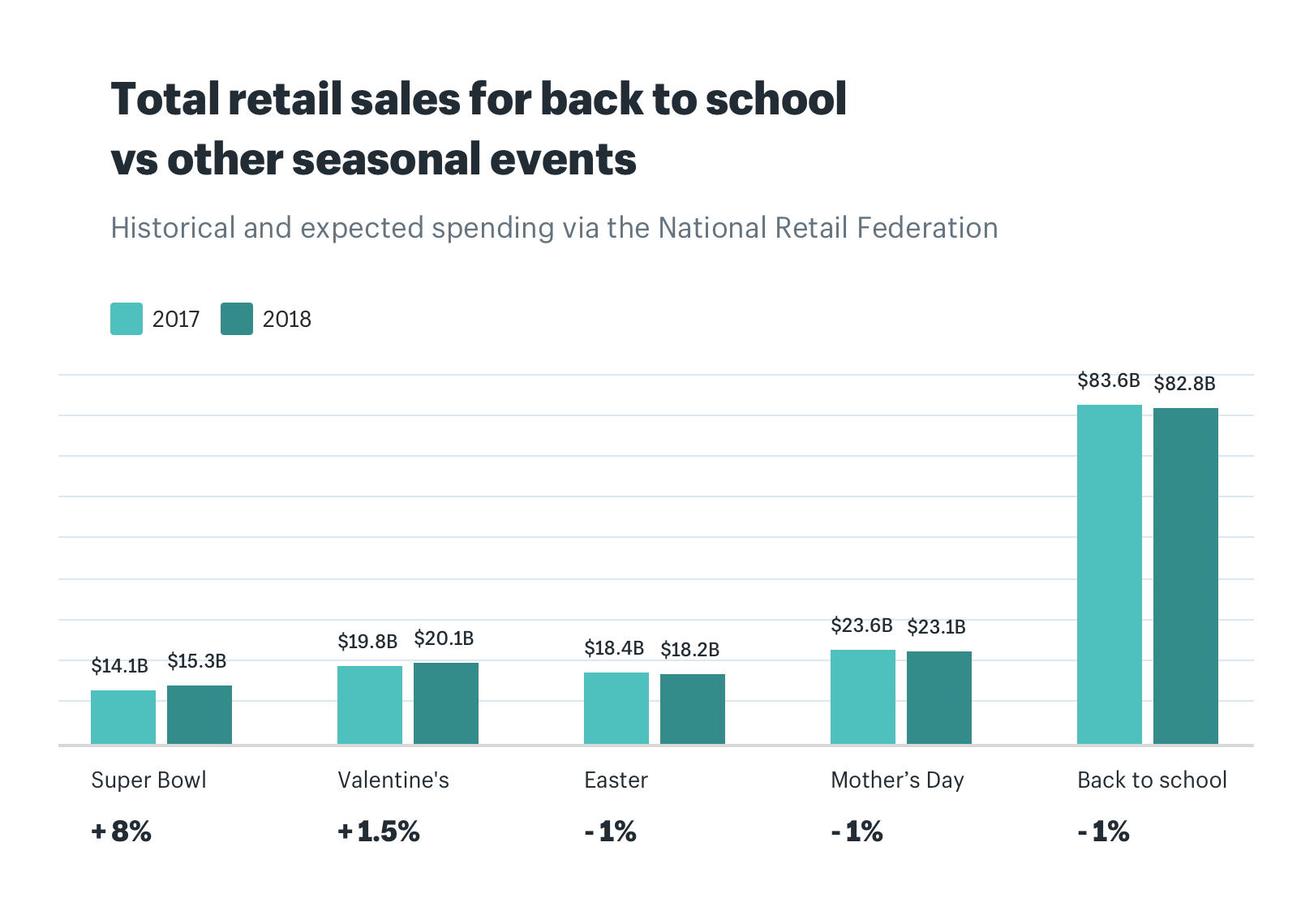

Projections from the National Retail Federation had already placed total retail sales at $82.8 billion, a 1% reduction from 2017. Even with that marginal slump, back-to-school shopping was still expected to be the second biggest shopping season of the year, outpaced only by Black Friday Cyber Monday:

The question is: did ecommerce make the grade?

According toAdobe Digital Insights and Internet Retailer, back-to-school online shopping generated a record $58.1 billion. Labor Day alone cleared $2.1 billion in online sales — the first one-day holiday to surpass $2 billion outside of the Nov-Dec holiday season.

Behind those big numbers lay four trends that are not only reshaping back-to-school shopping but also other major online events — most notably the impending holiday season:

- Mobile Sales Lag, Except On …

- Ecommerce Grows, Especially for the Young

- Back to School Peaks Late, Goes International

- Automation Saves Time and Helps Sell More, Faster

- Back-to-School Ecommerce: Infographic✏️

Mobile Sales Lag, Except On …

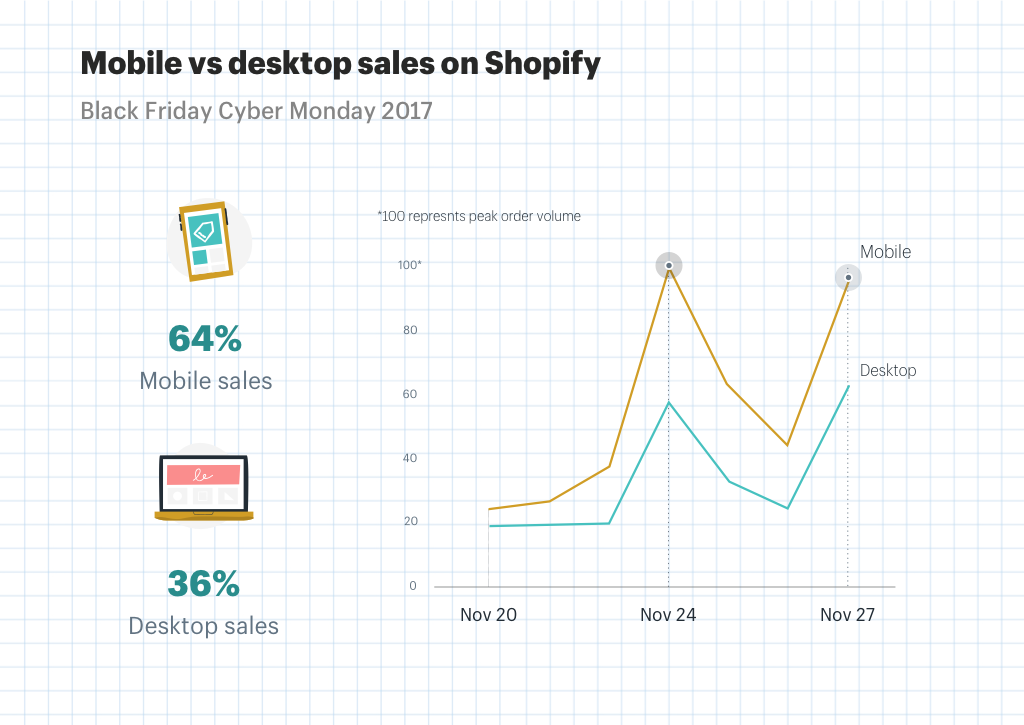

WhileAdobe Digital Insightsreported that online consumers bought roughly two-thirds of their back-to-school items via desktop (25% was purchased via smartphones); mobile sales growth surged ahead of desktop sales year-over-year (YoY) for Shopify sites.

Deloitte’s 2018 surveyfound that consumers intended to shop (e.g. research and get price comparisons) more on their mobile devices for back to school items this year: 53% in 2018 versus 49% in 2017.

Meanwhile, Adobe Digital Insights reported that just 33.8% of online sales came from mobile devices for the ecommerce industry as a whole in 2018.

The majority of back to school items were still bought via desktop …

Mobile purchases via smartphone devices generated $14.5 billion during the season, with a conversion rate of 1.24% and average order value of $111. Tablets generated $5.1 billion in online purchases, with a 2.34% conversion rate and $125 average order value per cart.

While the overall retail industry saw mobile transactions trail desktop sales, the story was a lot different for Shopify sites …

Mobile orders accounted for 66.5% of all sales on Shopify sites during back-to-school online shopping — growing 59% year-over-year in total sales. Desktop orders grew 29% year-over-year, yet only represented 33.5% of Shopify merchant sales in 2018.

Since mobile sales also outperformed desktop sales on Shopify sites during Black Friday Cyber Monday 2017, it’s safe to say that focusing on a mobile-first ecommerce design and UX strategy pays off for businesses in a significant way.

There’s still time to ensure your ecommerce site captures and converts mobile customers effectively during the 2018 holiday shopping season.

Refer to this post for tips and mobile-first customer strategies:The Future of Mobile Commerce: 10 Trends, 37+ Stats & Three Case Studies.

Ecommerce Grows, Especially Among the Young

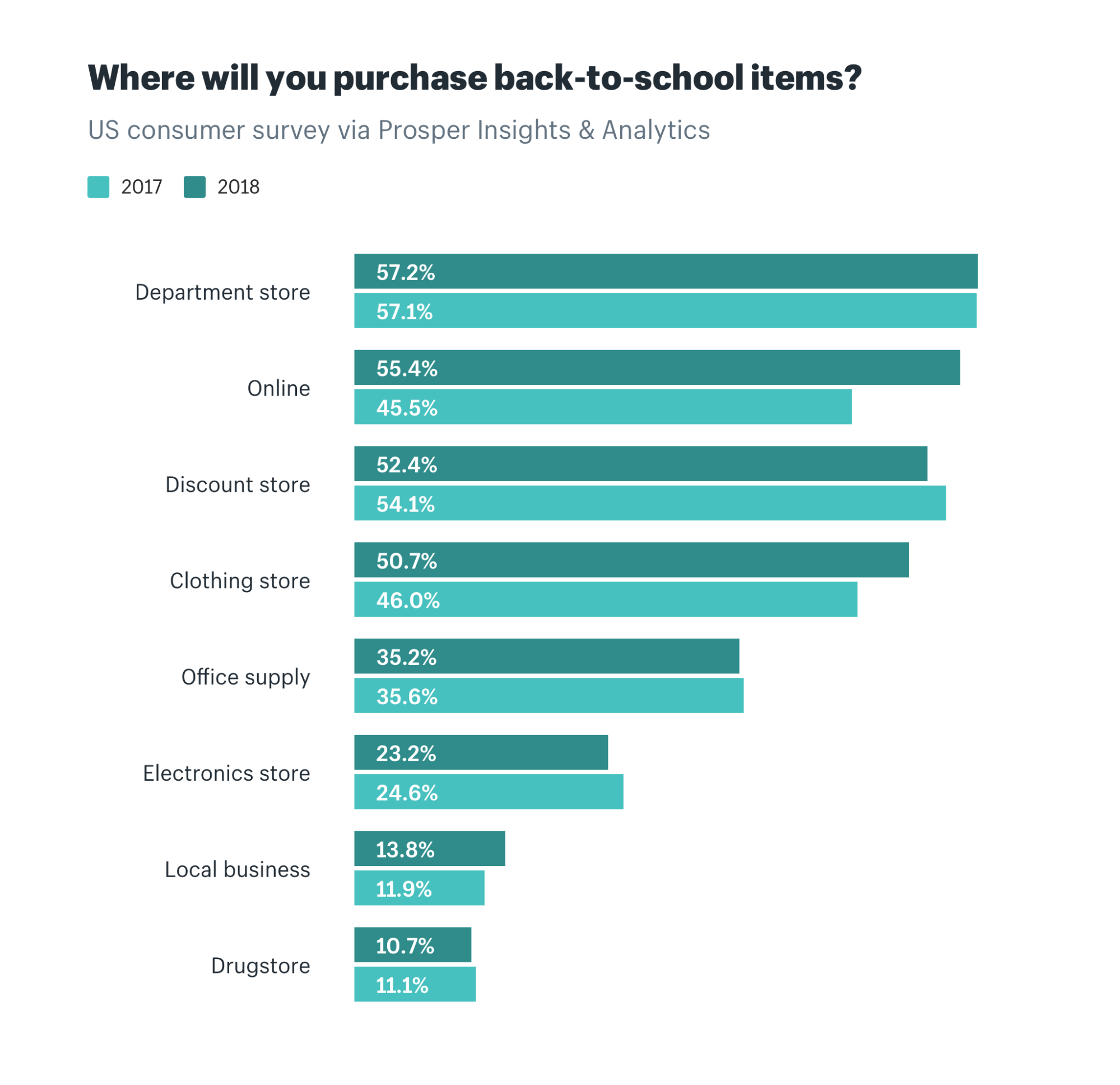

According toProsper Insights & Analytics, 55.4% of consumers were set to buy products online this year, representing a ~10% growth year-over-year for ecommerce, the largest jump for any shopping channel:

Clothing stores and local businesses also saw year-over-year growth, while other industry category sales stayed flat or receded slightly.

Back to College Shoppers Were Bullish on Ecommerce

While online retailers were the preferred choice for back-to-college consumers in 2018, they also shopped at:

- Online retailers: 49%

- Department stores: 40%

- Discount stores: 35%

- Office supply stores: 31%

- College bookstores: 30%

Online retailers were the second preferred destination for consumers shopping for back-to-school (K-12), behind department stores:

- Department stores: 57%

- Online retailers: 55%

- Discount stores: 52%

- Clothing stores: 51%

- Office supply stores: 35%

Amazon Prime Day Kicked Off the Season in a Major Way

As perNRF’s 2018 study...

- 67% of college shoppers planned to start early

- Most back to school shoppers (77%) planned to start at least three weeks before school began, up from last year’s 74% and 64% ten years ago

- 89% of back-to-school and college shoppers still had half or more of their purchases left to complete at the time of the study in late June and early July; more than half of them were waiting for the best deals for the items on their lists

Online consumers were especially active at the beginning of 2018’s back to school shopping season on Amazon Prime Day on July 16th, which was Amazon’s biggest global sales day ever — larger than Black Friday 2017.

Sales also spiked at the end of the season with big in-store and online promotions over Labor Day weekend.

According toCNBC, small and medium-size businesses notably crushed the [Prime] day, collectively making over $1 billion in sales via Amazon.

Amazon Prime members were also more likely to shop online versus the general population during the back-to-school season — an indication that these customers are poised to buy from your sites, too.

To attract and convert those heavy online shoppers into loyal customers, businesses must up theirmulti-channel sales gameto both compete on Amazon and maximize sales success during Prime Day 2019 and Black Friday Cyber Monday 2018.

For tips and strategies on how to increase your Amazon sales during the holiday shopping period, read:Multi-Channel Ecommerce: Are eBay & Amazon the Enemy?

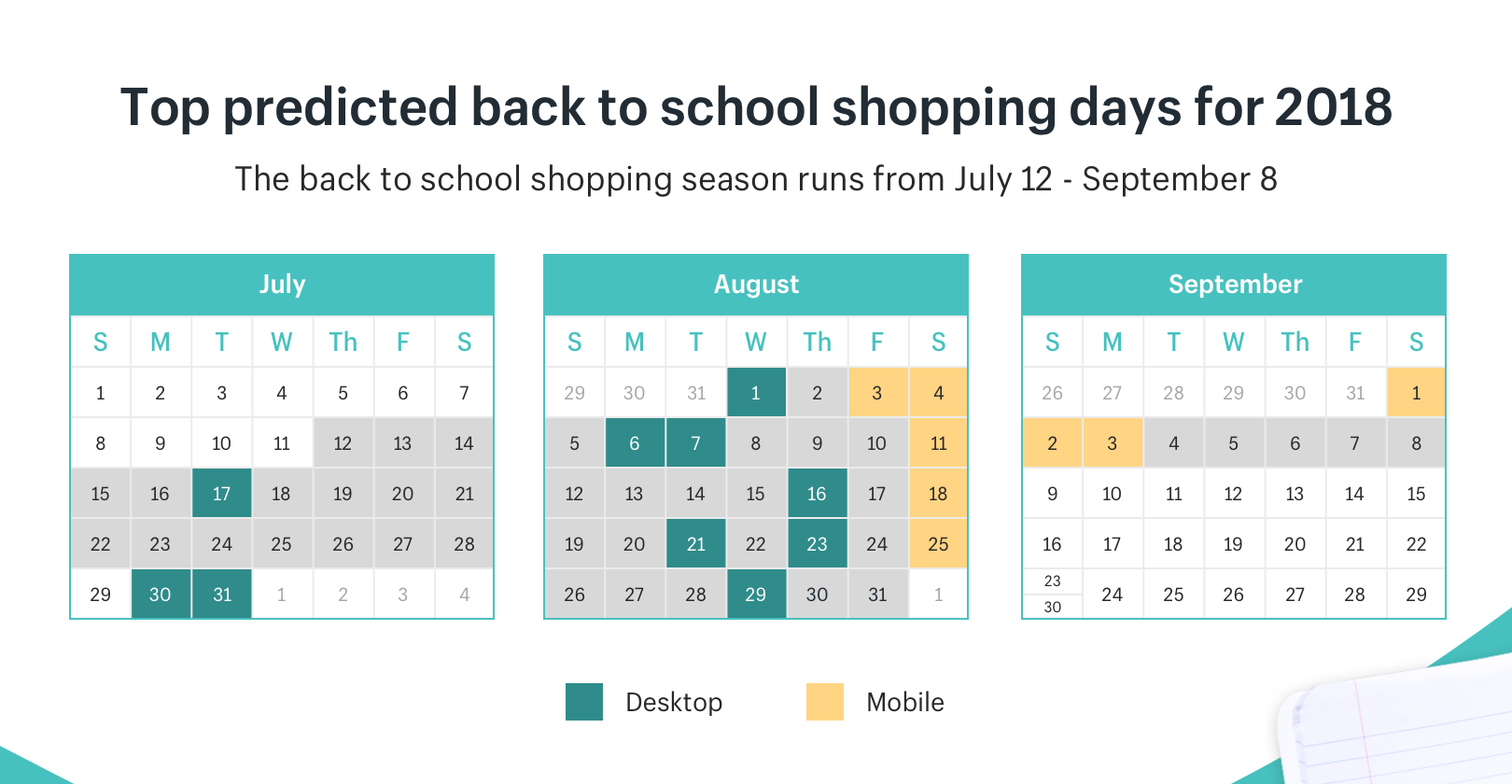

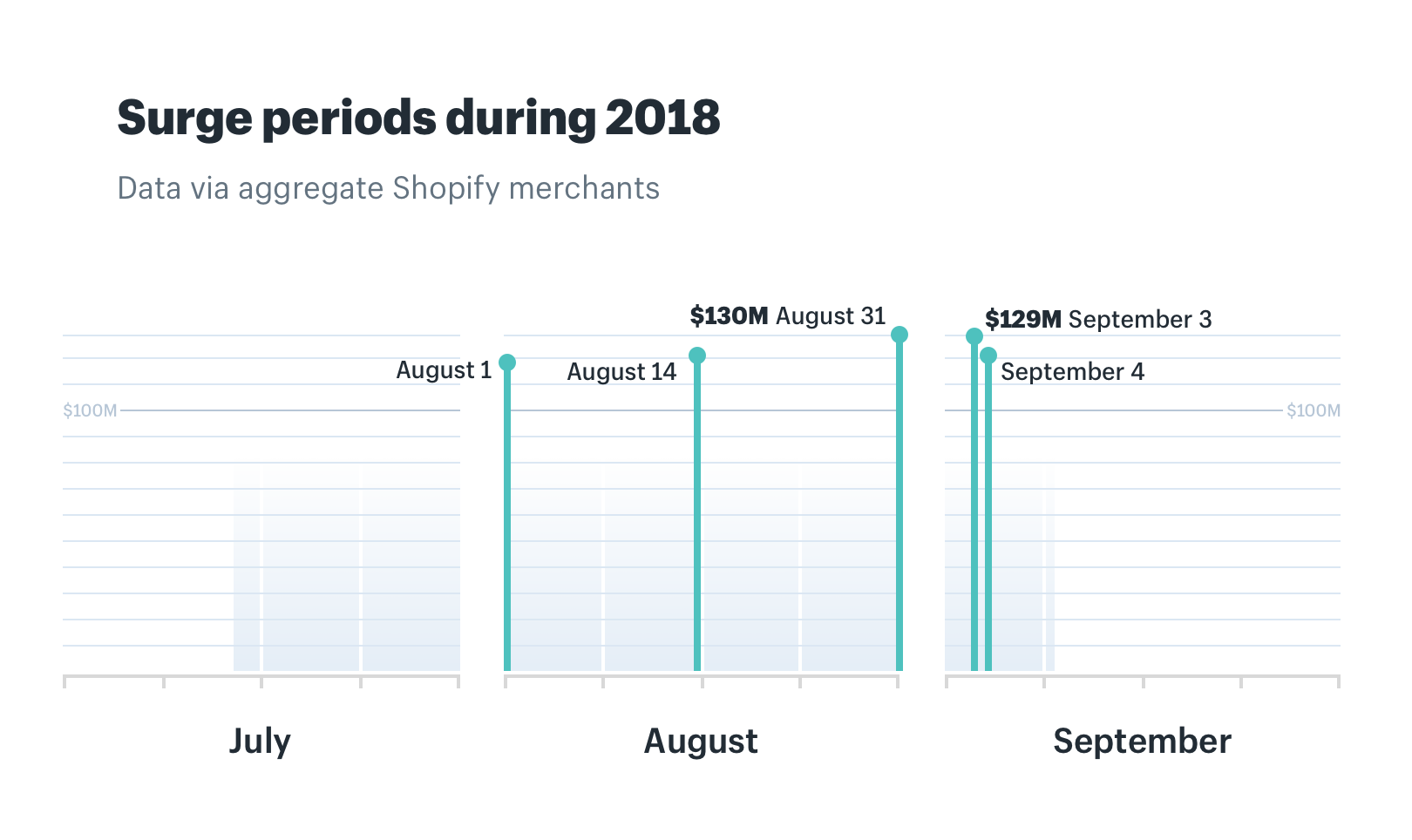

Back to School Peaks Late, Goes International

Ecommerce businesses on Shopify saw consistent surges each weekend over the shopping season, with the highest surges on Aug 31st and Sept 3rd (Labor Day) — similar to the results for the retail industry as a whole.

Each of those days brought in ~$130 million on Shopify sites.

Shopify merchants processed and shipped back to school orders to major cities all over the globe — as they did during Black Friday Cyber Monday 2017.

Top purchasing cities by number of orders on Shopify:

- London, UK

- New York, US

- Los Angeles, US

- Chicago, US

- Brooklyn, US

- Houston, US

- Singapore

- Toronto, CA

- San Diego, US

- Miami, US

Perhaps the most surprising result of this global expansion is the number one position of London and the number seven position of Singapore. Both indicate the growing reach of ecommerce in the UK and APAC.

Automation Saves Time and Helps Sell More, Faster

Shopify’s trifecta of ecommerce automation tools — includingLaunchpad,FlowandScripts— helped merchants to grow sales on autopilot, plus streamline back-end workflows during the busy 2018 back-to-school shopping season.

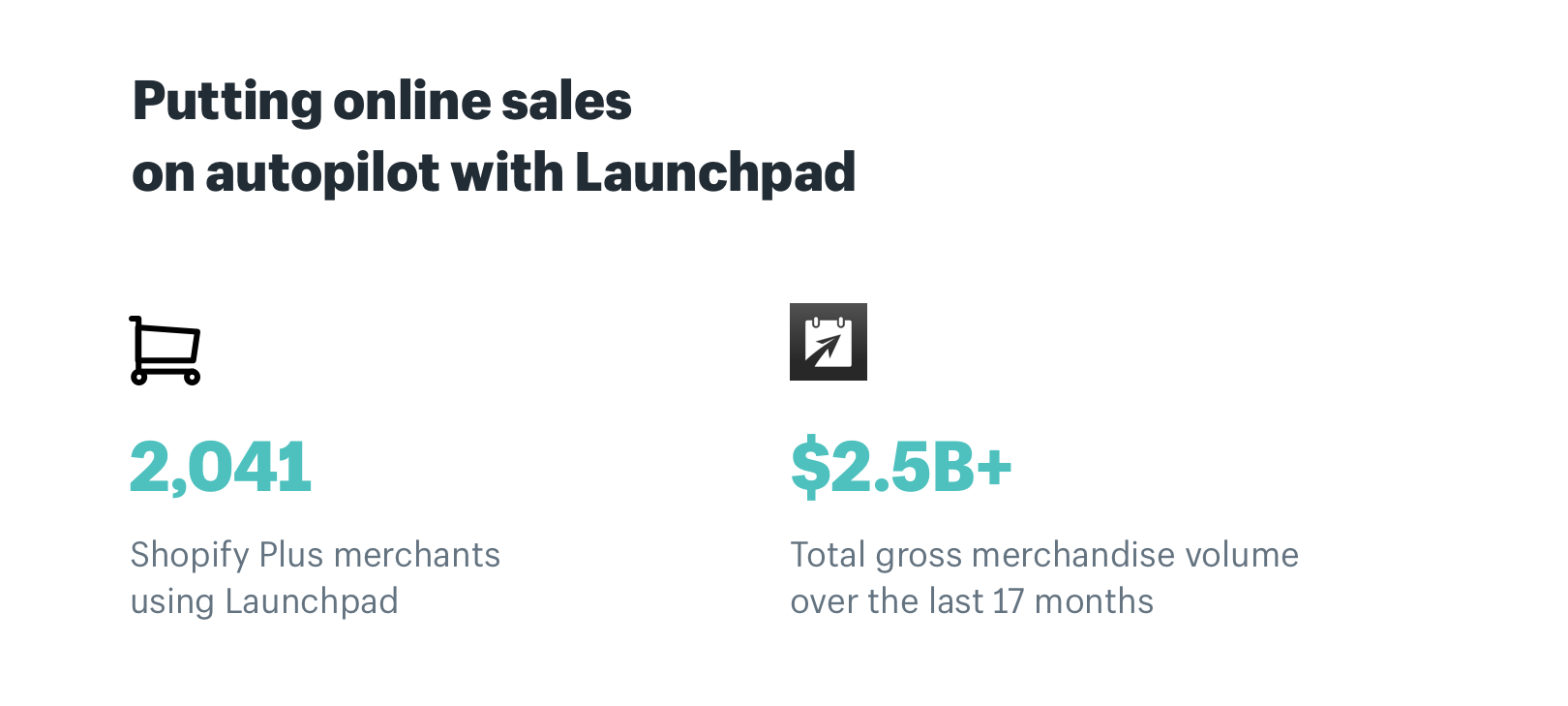

With regards to Launchpad, in particular — having been made available exclusively to Shopify Plus businesses less than two years ago — the overall numbers are incredibly strong …

Using Launchpad, alongside Flow and Scripts, enables ecommerce businesses to reallocate their team’s time spent manually uploading sales promotions on the day of a sales event, or repetitive tasks like reviewing high-risk orders or segmenting customers.

Dormify,一个宿舍家具网站针对科尔ege students, was an early Launchpad adopter — using it to schedule and extend sales events during last year’s Black Friday Cyber Monday shopping season and beyond.

We’ve run over 100 sales events using automation and are on track to 2X revenue in 2018 as we become a true omni-channel brand.

Thanks to Launchpad:

“We’re able to take an hour chunk out of one day and just get it done in advance, schedule it and everyone can go home and sleep well at night,” says Lauren Ulmer, Director of Product at Dormify.

To maximize your success, plus save sleep and stress during the biggest shopping season of the year, check out these posts which outline how other Shopify Plus merchants are offloading millions of business decisions and selling on autopilot with ecommerce automation:

- Ecommerce Agency Automation: Saving Time, Selling More & Launching Faster

- Selling $2 Billion on Autopilot: Less Effort, More Growth via Ecommerce Automation

- Automated Commerce: 2,328 Businesses Offloaded 200M Decisions & 1.6M Hours

B2S Lessons for 2018 & Beyond

While the second largest shopping season of 2018 is over, your plans are likely in full swing to have your most successful Black Friday Cyber Monday to date.

You still have time to exceed those expectations if you take advantage of some of the back-to-school ecommerce insights and tips we’ve provided with regards to crafting mobile-first user experiences and ecommerce automation tools in this post.

Here are additional ideas and recommendations from Shopify Plus merchants and team members on how to maximize online sales during the upcoming holiday shopping season:

- 10 Ecommerce Insights From the Co-Founder Who 10Xed His Black Friday

- Holiday Ecommerce 2018: 15 Marketing Strategies from +$1B in Online Sales

- Black Friday Ecommerce: 27 Ideas, Tips & Strategies to 3X-10X Holiday Sales in 2018

More campaigns, faster

找到out the secret weapon thousands of high-growth brands are using to make this Black Friday their best ever. Download ourexclusive ebookfor a behind-the-scenes look …

Back-to-School Ecommerce 2018: Infographic

Read More

- Multi-Channel Management: Delighting Customers and Increasing Profits

- Artificial Intelligence: Armageddon or Nirvana? Experts Predict What Happens Next

- How Beard & Blade Doubled Its Wholesale Ecommerce a Year after Replatforming from Magento

- 3 DTC Brands on How They Build Customer Loyalty

- Warning: Most Conversion Optimization Tips Are BS (Here's Why!)

- The 1 Rule for Building a Billion-Dollar Business

- The Dirty Little Secret Traditional Enterprise Software Companies Don't Want You Knowing

- Reimagining Racial Equity in the Fashion Industry

- Stop Trying to Increase Your Conversion Rates

- 11 Ecommerce Checkout Best Practices: Improve the Checkout Experience and Increase Conversions