Insurance is a tricky topic, especially when it comes tostarting a business. The products are complex, and it’s easy to feel intimidated by the jargon.

On the other hand, insurance is an important way to protect your business, and if you ever end up relying on commercial insurance, it can be the difference between an unfortunate situation and a total disaster.

Getting the lay of the insurance landscape before you sit down to talk to a professional can help you both understand the process and understand which insurance products your business might need as it grows.

And if you’re still feeling intimidated at the thought, remember: When it’s used correctly, commercial insurance is just another product you buy, and what you need depends entirely on your business. And you already know and understand your business.

Why do online retailers need small business insurance?

If you sell products online, you need business insurance to protect yourself financially and legally. Insuring your business lowers your risk and protects your inventory and employees against worst-case scenarios, like supply chain issues or on-site injuries.

Revenue is a good way to evaluate if you’re ready to think about commercial insurance, but there are other factors to consider as well.

Insurance, at its core, is a way to minimize risks in your business.

Insurance, at its core, is a way to minimize risks in your business, and there are some risks that wouldn’t be covered through your existing personal insurance policies—like protecting your inventory.

If your inventory is in your garage or office at home, your homeowner’s policy doesn’t cover it. Business insurance is also asmall business tax deductionyou can take to lower your tax liability.

Other reasons you need business insurance are:

- To protect your customers and employees if a product injures them

- To protect against cyberattacks and data breaches that expose customers’ sensitive data

- To protect against lawsuits from breach of contract with clients or vendors

- To protect your business in the face of supply chain issues

- To protect your business against broken or stolen inventory at your warehouse or in-transit

At certain stages of your business, you’ll without a doubt need commercial insurance because you’ll be faced with contractual obligations to buy it.

If you’re working with a fulfillment center or selling to a major retailer, like Amazon, they might specify you need a certain amount of liability insurance, property insurance, or other types of commercial insurance.

Whether it’s a clear-cut choice or not, if you decide you need ecommerce business insurance, your next step is figuring out where and how to buy it.

What kinds of insurance you need for an ecommerce business

Once you’ve found a broker to work with, they’ll sit down with you to look over your business and figure out where it’s exposed to potential risks, while helping you find the right amount of insurance coverage to mitigate those risks.

However, being an informed consumer of financial products is important, especially when it comes to your business.

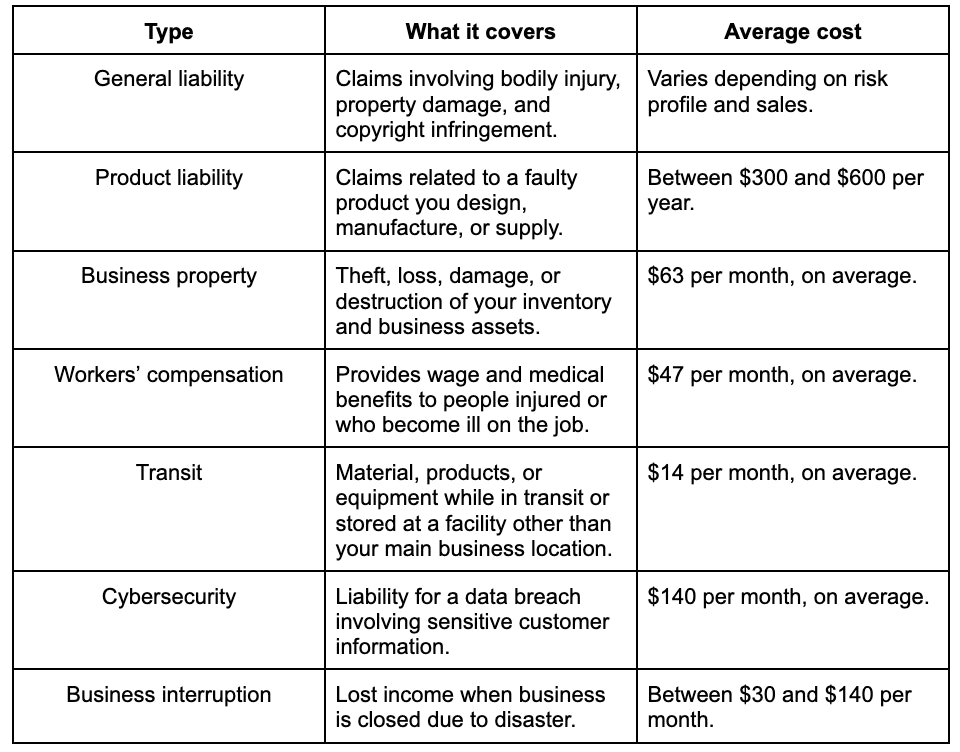

For ecommerce businesses, especially ones that are just getting started, here are seven main types of insurance you’ll need to consider—although there are others you’ll need as well—and your broker will be able to help you determine which ones are a fit for you.

1. General liability

When you get homeowners insurance, it protects you if someone gets injured while they’re on your property—that’s an example of liability insurance.

When it comes to your business, liability insurance usually covers you in case someone gets injured while using your product, no matter where they are. It’s the first line of defense against damaging business exposures.

General liability insurance covers three main things:

- Anybodily injury claimsmade by customers or people that interact with your business, such as delivery people.

- Anyproperty damage claimsas a result of interacting with your business.

- Anyclaims of slander, libel, or copyright infringementmade against your business.

And before you think that no one could possibly hurt themselves using your products, Carl Niedbala, co-founder and COO atFounder Shield, shares that liability coverage is important for almost every type of product business.

“A liability insurance policy protects you if a third party gets injured either by interacting with your people at your company or your product,” Carl says. “The classic example is a young child choking on a component part of the plastic toy that you sell.”

But it doesn’t just apply to toys and products with small parts.

“Another prime example would be an allergic reaction to whatever material you’re using in your clothing, or an injury from certain makeup components interacting badly with someone's skin,” says Carl.

Liability isn’t something that’s limited by product category. Even if you think there’s no basis for someone claiming they were harmed by your product, that’s not a good reason to skip liability insurance.

“The thing you have to remember about this is that even if a legal claim is not well-founded, someone still has to pay for those legal fees for the claimant to go away, right? That’s where insurance kicks in,” says Carl.

Your next question is probably, “But how much is this going to cost me?” Liability insurance is usually priced based on your volume of sales and the products you’re selling. Higher risk products like fireworks are probably going to come with a higher liability insurance price tag, as will a higher volume of sales.

Price:Varies depending on risk profile and sales.

2. Product liability

Product liability insurance will cover any compensation you have to pay out if someone gets injured by a faulty product that your business designs or manufactures. It’s similar to general liability, but more focused on design and manufacturing flaws.

If your product sells any products to customers, you risk causing injury or damage to someone else’s property. For example, say a customer gets sick from eating food processed at your commercial kitchen—they can sue your business.

Product liability insurance covers:

- A customer’s medical bills to treat the injury

- Legal fees and costs related to trial

- Settlements paid out

Without product liability insurance, you’d need to pay for these costs out of pocket. This type of insurance also covers claims related to:

- Defective design, like missing safeguards or accidentally designing a dangerous product

- Hidden defects like toxic chemicals or food

- Failure to warn, which means not giving enough instruction or warning for product use

Insurance companies offer it as a standalone policy and as an add-on to your general liability insurance.

Price:Between $300 and $600 annually.

3. Business property insurance

如果你销售实体产品,你还需要sure those physical products just in case something goes wrong—but commercial property insurance doesn’t just cover inventory.

“Property insurance covers any theft, loss, or partial or complete damage or destruction of your business inventory and business property,” says Carl. “Just picture if you’re doing $30,000 in sales—if your house burns down and all of your inventory is in there, that’s a devastating loss. That’s where property insurance kicks in.”

In that case, property insurance would also cover any equipment that was damaged as well, and cover the full cost of replacing those items.

It’s important to note that your existing homeowners policy would cover your personal items, but likely wouldn’t cover anything related to your business. If you run your business from home, it’s important to have both aspects covered, unless you could replace all of the inventory and equipment out of pocket.

The other important thing to remember is that your property insurance will cover the replacement cost of your items, not the retail value.

“这将不管你把改过的y. You just need to show proof of the replacement cost. A classic example we deal with all the time is where people have laptops for their business and someone breaks into their office or home and steals the laptop. If you have a 2020 Macbook, you can’t buy a 2022 Macbook Pro. Insurance will cover the cost of replacing what you have.”

Luckily, since part ofbookkeepingfor yourecommerce businessis keeping accurate records of what you spent to acquire your inventory and your equipment, you should have no problem supporting any insurance claims that come up.

When you buy property insurance, your broker will work with you to tally up the total value of the property you’re insuring. That number is the primary variable that will impact your insurance premiums, so you’ll pay less to insure $5,000 worth of inventory and equipment than you would to insure $50,000.

Price:$63 per month on average.

4. Workers’ compensation

Workers’ compensation insurance providers wage and medical benefits to people who get injured on the job. It also pays death benefits to the family of someone who dies on the job. Workers’ comp benefits aren’t available to people who get hurt off the job.

Almost every state requires a business to have workers’ compensation insurance. If you don’t have it in a required state, you could face a hefty fine. Your state government also determines how much coverage, wage, and medical benefits a worker receives.

Workers’ comp insurance often often covers:

- Medical expensesassociated with a work-related injury, such as emergency room visits, surgeries, and prescriptions

- Lost wagesif they need time off to recover from a work-related injury or illness

- Ongoing careif the injury or illness is so severe they need multiple treatments

- Funeral costsin the event an employee loses their life on the job

- Repetitive injuries,like carpal tunnel syndrome, which takes years to develop and requires ongoing treatments and bills

- Disability,so when an employee is temporarily or permanently disabled, workers’ comp helps pay medical bills and replace lost wages

Let’s say, for example, a warehouse employee strains their back while lifting a heavy box—your workers’ comp policy would cover related medical costs.

Price:$47 per month, on average.

5. Transit insurance (or inland marine insurance)

Transit insurance, or inland marine insurance, is a type of insurance you’d need only in a fairly specific business context. However, it’s a type of insurance that can become highly relevant to ecommerce and physical product businesses as they grow.

当内陆水运保险保护你的库存n it’s being shipped in large batches and is of high value. It helps replace covered property if damage is caused by theft, fire, water, wind, or hail. Some policies also cover loss due to accidents or mishandling.

Inland marine insurance covers:

- Goods and property in transit

- Electronics

- Computer, video, sound, or radio equipment

- Fine art and collectibles

- Medical diagnostic equipment

- Trade show exhibits

Let’s say you’ve got a big batch of inventory and you’re sending it to a fulfillment warehouse to streamline your shipping process. You send it out and you’re happy to have checked that item off of your to-do list, but the next day you get word that there was an accident en route, and 75% of the inventory that you shipped is damaged beyond repair.

当你工作与供应商、仓库或distributors, as basic as it sounds, you need to read and understand your contracts to figure out where you’re covered by their insurance and where you aren’t.

“Generally speaking, warehousing companies will require their customers to get their own coverage,” says Carl. “It’s very rare that I see a warehouse say ‘Yeah, we’ll totally cover your property, no need to buy your own insurance.’”

An insurance broker can help you find coverage to manage that risk if you need it. They’ll also be able to work with you to determine other coverage you need as an ecommerce business.

Price:$14 per month on average.

6. Cybersecurity insurance

Digital security is atop riskevery ecommerce store faces. Hackers can steal customer information or credit card information, or install malicious software on someone’s computer. As an online business, you’re responsible for safeguarding customers’ sensitive data.

That’s where cyber liability insurance comes in. This type of insurance covers you from any lawsuits, legal penalties, customer settlements, and fines related to a data breach or cyberattack. It also covers expenses to investigate the issue and restore lost data and funds related to the attack.

Cybersecurity insurance varies depending on the policy you choose, but typical covers:

- Loss of revenue due to a breach

- Loss of transferred funds

- Cyber extortion

- Data loss and recovery costs

- PR management after breach

- Investigating and notifying customers of breach

- Forensic consulting costs to prevent future breaches

Price:$140 per month on average. Varies depending on risk profile and coverage.

7. Business interruption insurance

Business interruption insurance replaces income lost if your business stops operating due to direct physical loss or damage. This type of insurance would reimburse policy holders for any costs related to natural disasters or fires, and also cover the rebuilding of any lost facilities. It’s often sold as an extension of an existing policy.

Business interruption coverage includes, but is not limited to:

- Loss profits.A policy will reimburse you for any profits potentially earned if the event didn’t happen.

- 固定成本。This includes operating costs and other business expenses.

- Training costs.If you replace machinery and need to retrain employees, business interruption insurance may cover it.

- Employee wages.Business interruption insurance will help you make payroll if you don’t want to lose employees during a shutdown.

- Taxes.Coverage of taxes is essential if you want to avoid penalties. This coverage ensures you pay taxes on time.

- Loan payments.Business interruption coverage can also help you make monthly loan payments if you’re not generating income.

Price:Between $40 and $130 per month, but costs more for high-value, high-risk businesses.

How much is insurance for an online business?

The average online business owner spends between $350 and $900 for a $1 million general liability policy each year. It’s hard to pin down an exact number, however, because your business insurance costs depends on various factors, like:

- Potential risk

- Business location

- Claim history

- What you sell

- Number of employees

- Annual business income

- Business assets

Your total cost also depends on how many policies you need. For example, if you’re a new ecommerce business, you may not invest in business interruption insurance until you have more cash flow. Whereas a mid- to large size business with a fully operating warehouse and multiple employees will definitely want to cover their facilities.

The greater your risk, the more insurance coverage you’ll need, resulting in a higher cost. If you’re a small ecommerce business that makes and sells products from home, your insurance costs will be much lower than a massive online business with employees and warehouses.

To understand the cost of ecommerce business insurance, contact potential providers to get a personalized quote for your business.

Learn more:The Entrepreneur’s Guide to Small Business Finance

How to buy ecommerce business insurance

- Evaluate your risks

- Choose the right types of insurance

- Get quotes

- Compare policies

- Buy and renew annually

1. Evaluate your risks

To know what insurance you need, you’ll need to evaluate the different risks unique to your business. The bigger your ecommerce company, the more risky your business operations will be. In this case, you’ll require different types of insurance. If you’re a home-based ecommerce business, you’ll likely need less coverage.

Most risks are unique to your business and its location. However, there are some things to think about:

- Accidents that might occur in your business

- Natural or unplanned disasters that could affect your business

- The amount of employees you have

- Lawsuits your business my face

Once you know the risks you’ll face, you’ll have a better idea of what kind of protection you’ll need.

2. Choose the right types of insurance

Commercial insurance comes in many forms, but not every business needs the same coverage. Your needs will vary depending on your business. Start with a basic policy, such as general liability, product liability, and business property insurance, and add on additional coverage later.

Consider bundling multiple types of insurance for your online store with abusiness owners policy (BOP). You can customize your BOP to meet your business’s needs, but it usually includes general liability insurance, commercial property insurance, and business interruption insurance.

3. Get quotes

Now that you know what types of insurance you need, it’s time to shop around for quotes. Get quotes from various insurance companies so you can compare and find the best deals.

You can get quotes through a broker or a marketplace, or by reaching out to insurance companies directly.

Broker

Insurance is one of those purchases that can be much easier with the help of a trusted professional. While it can be tempting to apply a bootstrapper mentality to your insurance purchases, it may not even save you money in many cases.

If you got a policy online and then you went to a broker and got the exact same policy, the cost to you should be the same. The difference is the agent will get a commission of a portion of your premium, but if you didn't work with an agent, then the whole amount just goes to the insurance company.

There are some places where brokers can add additional charges on top of the products they sell, called “broker fees,” so it’s important to do your research and understand how insurance sales are regulated in your area. However, even if additional fees are legal in your area, your broker has to clearly disclose their commission structure and fees in writing.

It’s important to do your research and understand how insurance sales are regulated in your area.

To find the right insurance broker for you, it’s time to do a bit of legwork.

- Ask small business owners and mentors in your field for recommendations.When you’re asking for recommendations, your best sources will be people who have been through a similar stage of business and in a similar line of business. If you can’t find anyone who fits the bill, you can expand to your broader network of business owners for recommendations.

- Find companies that specialize in commercial insurance.Ideally, you want someone who really understands the products and the scope of what you need, so the person who sold you personal insurance, like your car insurance, likely isn’t the best fit.

- Ask key questions as you interview potential brokers.You’ll want to find out if they’ve worked with and understand the needs of ecommerce businesses, and whether they can only sell products from certain companies. You’ll be able to find the best options if your broker can provide quotes from multiple companies, not just one or two.

Marketplace

A broker may not be right for your business. Using an online marketplace for business insurance might help in this case. It’s a more hands-on approach, but may be faster if you need coverage quickly.

Online insurance exchanges partner with top companies and provide quotes from many providers so you don't have to contact them individually. The marketplace just requires information about your business and the insurance you need, and multiple quotes will be generated from their partners.

Two top online insurance marketplaces include:

Direct

如果你正在寻找简单的保险或have an insurance provider in mind, it's fine to contact them directly to learn what they offer, get a quote, and decide if it's right for your business.

4. Compare policies

The next step is to compare the quotes and choose which policy and provider works best for your business. Review each quote carefully, ask questions, and perhaps even consult with your advisers.

Consider the following when comparing quotes:

- Policy coverage

- Limits of liability

- Premium and deductibles

- Payment terms

- Provider rating and reviews

- Customer service

Finding a business insurance policy that fits your needs from a reputable carrier, with the coverage you need, at a reasonable price, should be your goal.

5. Buy and review annually

最后一步是购买你的政策或policies. Once you’ve done this, learn when payments are due, how to claim a refund from your provider, and how to contact customer service if necessary. Most insurance companies let you pay, file claims, contact support, add additional insureds, or request a certificate of insurance online.

Make sure to review your policy and decide if it needs to be adjusted or changed periodically.

Finding the best ecommerce insurance for your online store

While buying insurance might not seem like a strategic activity, working with a broker who understands the specifics of your industry can be a good time to sit down and plan for the next phase of your business.

“Going through the insurance process is actually very good for young companies, because the questions that are asked in the process are important ones that aren’t always prioritized, like ‘What’s the model? What’s our future plan?’” says Carl. “It’s actually a healthy process to look at your company from a risk-management perspective, even at an early stage.”

There are always going to be some risks involved in running a business, but identifying and mitigating them is something you do on a daily basis as an entrepreneur. Working through the process of buying commercial insurance with an informed broker can help you find and manage risks you might not have planned for in the first place, and take those worries off your plate.

After all, there’s a big difference between putting your all into a business and realizing it won’t work out, and shutting your doors because of a preventable issue with damaged inventory.

This post is for informational purposes only and does not constitute legal or financial advice.