Cash is the lifeblood of every business—especially new and small businesses.

Limited or inconsistent cash flow is one of the most significant challenges that small businesses face. A study by US Bank shows that82% of small businessesfail because of cash flow issues. That’s why understanding andmanaging cash flowis a prerequisite for success.

To get a grasp of the cash flows going in and out of your business, you need a cash flow statement. If you’re having a hard time with financial statements, don’t worry: this guide will help you create a statement of cash flows that’s easy to understand and use.

Table of contents

什么是现金流量表?

Acash flow statementis a financial statement that summarizes the inflows and outflows of cash transactions during a given period of business operations.

The purpose of a cash flow statement is to record how much cash (or cash equivalents) is entering and leaving the company. Businesses use cash flow statements to get a detailed picture of their cash position, which is essential to a company’s financial health. You can prepare a cash flow statement in a spreadsheet, or find it in yoursmall business accounting software.

Try our free cash flow calculator

Give your business a financial health check and master your finances in five minutes or less with our free cash flow calculator.

Learn MoreMany small businesses fall into the trap of focusing too much on profit and loss, ignoring company cash flow in the process. Having a clear overview of cash flows will allow you to understand where money is coming from and how it is spent. Ultimately, this will help you make more informed business decisions.

The key elements of a cash flow statement

A cash flow statement typically includes three main components:

- Operating activities

- Investing activities

- Financing activities

Cash flow from operating activities

The operating activities in the cash flow statement include core business activities. In other words, this section measures the cash flow from a company’s provision of products or services. Examples of operating cash flows include sales of goods and services, salary payments, rent payments, and income tax payments.

Cash flow from investing activities

Investing activities include cash flows from the acquisition and disposal of long-term assets and other investments not included in cash equivalents. These represent long-term investments in the company’s growth. For instance, purchasing or selling physical property, such as real estate or vehicles, and non-physical property, like patents.

Cash flow from financing activities

Cash flows related to financing activities typically represent cash from investors or banks, issuing and buying back shares, and dividend payments. Whether you areraising a loan, paying interest to service debt, or distributing dividends, all of these transactions fall under the financing activities section in the cash flow statement.

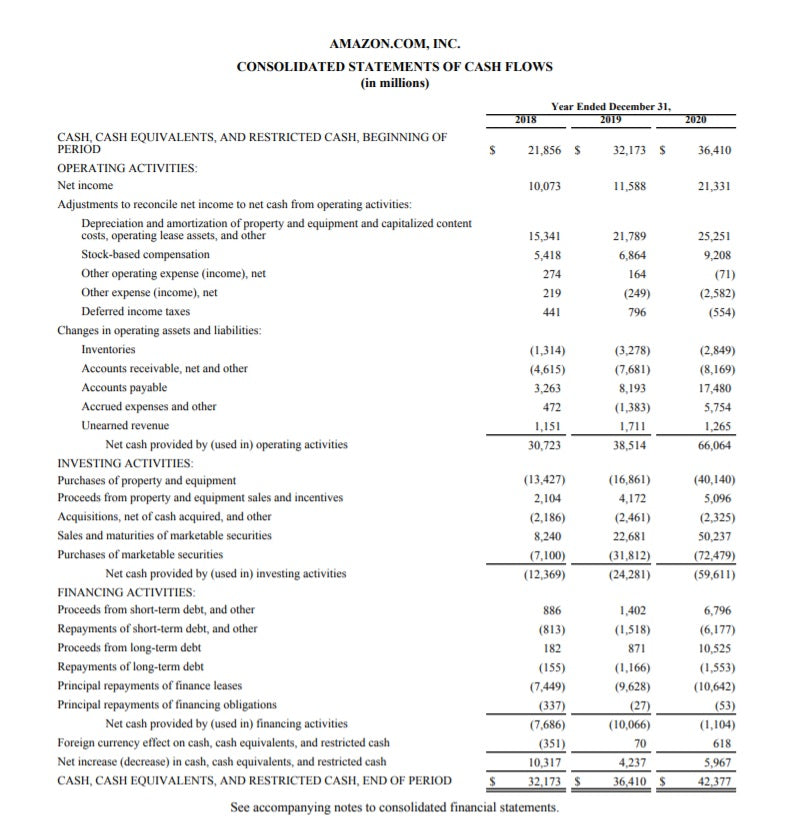

Here’s an example of Amazon’s cash flow statement from its2020 annual report. You can see the three main sections: operating activities, investing activities, and financing activities.

The cash flow statement starts with cash on hand and net income. After calculating cash inflows and outflows from operating activities, Amazon posted $66.06 billion in cash from operating.

Investing activities were -$59.61 billion, primarily due to purchases of property and equipment, as well as marketable securities. Financing activities were -$1.1 billion.

At the end of 2020, Amazon had $42.37 billion in cash on hand.

Image source:Amazon

Cash flows vs. other financial statements

Financial statementsare reports that summarize the financial performance of your business. A cash flow statement is one of the three main types of financial statements, alongside abalance sheetand anincome statement.

In a nutshell, an income statement measures revenue, expenses, and profitability. On the other hand, a company’s balance sheet shows the assets, liabilities, and shareholders’ equity. And finally, a cash flow statement records the increases and decreases in cash.

All three financial statements are different, but they are intricately linked. Net income from the income statement feeds into retained earnings on the balance sheet, and it is the starting point in the cash flow statement.

Here’s a comparison of the three financial statements:

| Income statement | Balance sheet | Cash flow | |

| Time | Period of time | A point in time | Period of time |

| Purpose | Profitability | Financial position | Cash movements |

| Measures | Revenue, expenses, profitability | Assets, liabilities, shareholders' equity | Increases and decreases in cash |

| Starting point | Revenue | Cash balance | Net income |

| Ending point | Net income | Retained earnings | Cash balance |

Source:Corporate Finance Institute

How to calculate cash flow

Now that we’ve covered the basics of a cash flow statement, let’s look at the two calculating methods: the direct method and the indirect method.

Direct method

The direct method includes all the cash inflows and outflows from operating activities, and is based on thecash basis accounting modelthat recognizes revenues when cash is received and expenses when they are paid. The direct method for cash flow calculation is straightforward, but it requirestracking every cash transaction, so it might require more effort.

Analyzing a cash flow statement requires understanding the context so you can make informed decisions. What stage is the business in? Is it a growing startup or a mature enterprise? The most important thing to remember is that a cash flow statement doesn’t reflect the profitability of your business, but rather the cash inflows and outflows.

Pros:

- Transparent

- Easy to understand

- Uses real-time figures

Cons:

- Takes more time and effort

- Can be an issue for businesses using accrual accounting (see below)

- Businesses using this method still need to reconcile net income with cash flow from operating activities

Indirect method

The indirect method calculates cash flow by adjusting net income based on non-cash transactions.This method is especially suitable for businesses usingaccrual accounting, where revenue is recorded when it is earned rather than when it is received. When using the indirect method, begin with the net income from your income statement, then make adjustments to undo the impact of accruals made during the period.

Pros:

- Easy to prepare

- Allows for reconciliation with income statement and balance sheet

- Discloses non-cash transactions

Cons:

- Lack of transparency

No matter which method you choose, only the operating activities section of your cash flow statement will be affected. The two other sections, cash from investing and financing activities, will remain the same.

In the following example, you can see that the indirect method uses net income as a base and adds non-cash expenses like depreciation and amortization. On the other hand, the direct method takes all cash collections from operating activities and subtracts the cash disbursements from operating activities, such as payments to suppliers and wages.

Indirect method |

Direct method |

||

Net income |

$400 |

Collections from customers |

$1,000 |

Adjustments |

Deductions |

||

Depreciation |

$100 |

Payments to suppliers |

($200) |

Amortization |

$100 |

Wages |

($200) |

Net cash from operating activities |

$600 |

Net cash from operating activities |

$600 |

How to read a cash flow statement

The goal of the cash flow statement is to show the amount of cash generated and spent over a specific period of time, and it helps businesses analyze the liquidity and long-term solvency.

When you summarize all cash transactions, you can get a positive or a negative cash flow.

- Positive cash flow意味着你有更多的钱比出去. This opens up opportunities for reinvesting excess of cash in business growth. However, positive cash flow doesn’t necessarily mean that your business is profitable. There are cases where the company has a negative net income, but it has a positive cash flow due to borrowing activities.

- Negative cash flow表明你的ve spent more cash than you’ve generated during a specific period of time. Negative cash flow isn’t necessarily a bad thing, especially if it results from investment in future growth. For instance, VC-funded startups often exhibit negative cash flow, or “burn rate,” as they work to gain market share, win customers, and generate higher long-term profits. However, if you have a negative cash flow in more than one accounting period, you should consider it a red flag for your business’s financial health.

Cash flow statement example (+ template)

Now it’s your turn. Here’s afree cash flow templateyou can customize to fit your needs.

First, fill in your starting cash balance. Then continue by adding the cash from the company’s operations and additional cash received from activities such as sales of current assets, new investment received, etc.

Next, subtract the expenditures from operations and additional cash spent, like repayment of current borrowing, long-term liabilities repayment, etc.

After calculating net cash flow, add the starting cash balance, and you’ll get the ending cash balance for the period.

Image source:Shopify

Image source:Shopify

You can also useShopify’s cash flow calculator方便地计算你的现金流和给你的business a financial health check in less than five minutes.

Cash flow statement FAQ

什么是现金流量表?

What are the 3 types of cash flow statement?

- Operating cash flow: reflects cash inflows and outflows from day-to-day business operations.

- Investing cash flow: reflects cash inflows and outflows from company investments.

- Financing cash flow: reflects cash inflows and outflows from financing activities, such as taking out loans, issuing bonds or stock, or repaying debt.

What is a cash flow example?

How do you prepare a cash flow statement?

- Start with net income: Subtract all expenses from sales or revenue to determine your company’s net income.

- Add non-cash expenses: These include depreciation, amortization and any losses from the sale of assets.

- Subtract changes in working capital: Working capital is the difference between current assets and liabilities, and may fluctuate from one period to the next.

- Add other cash items: These include dividends paid, interest paid, and any other cash investments or payments.

- Calculate cash flow: The number resulting from the above steps should give you the total cash flow for the period.