This post is for information only. You are responsible for reviewing and using this information appropriately.This content doesn’t contain and isn’t meant to provide legal, tax, or business advice.*

There’s an abundance of information out there about how to start a business. Sometimes, all you need is a simple, straightforward step-by-step guide to take you from square one directly to your goal. That’s what we’ll do in this post: show you the six steps it takes to create an LLC.

How to start an LLC in 6 (+1) steps in 2023

- Choose a name for your LLC

- Obtain your EIN and check tax requirements

- Prepare an LLC operating agreement

- Open a bank account for your LLC

- File the required paperwork

- Create and launch a website for your LLC

- Extra: Register to do business in other states (if relevant)

1. Choose a name for your LLC

Thename of your LLCis the first contact many have with your brand, and you want it to make a good initial impression.

Naming your online storemay take some time—the perfect name doesn’t come to everyone overnight. Sometimes it requires lots of brainstorming and even collaboration. There are also lots of free tools, likeShopify’s business name generator, to get your creativity flowing.

Once you’ve landed on a name, check to ensure someone else hasn’t claimed it first. Many states have business directories you can search. You’ll also want to look outside your state, especially if you plan to sell to a wide audience. Scan Google, social media, andavailable domain namesto see what’s out there.

2. Obtain your EIN and check tax requirements

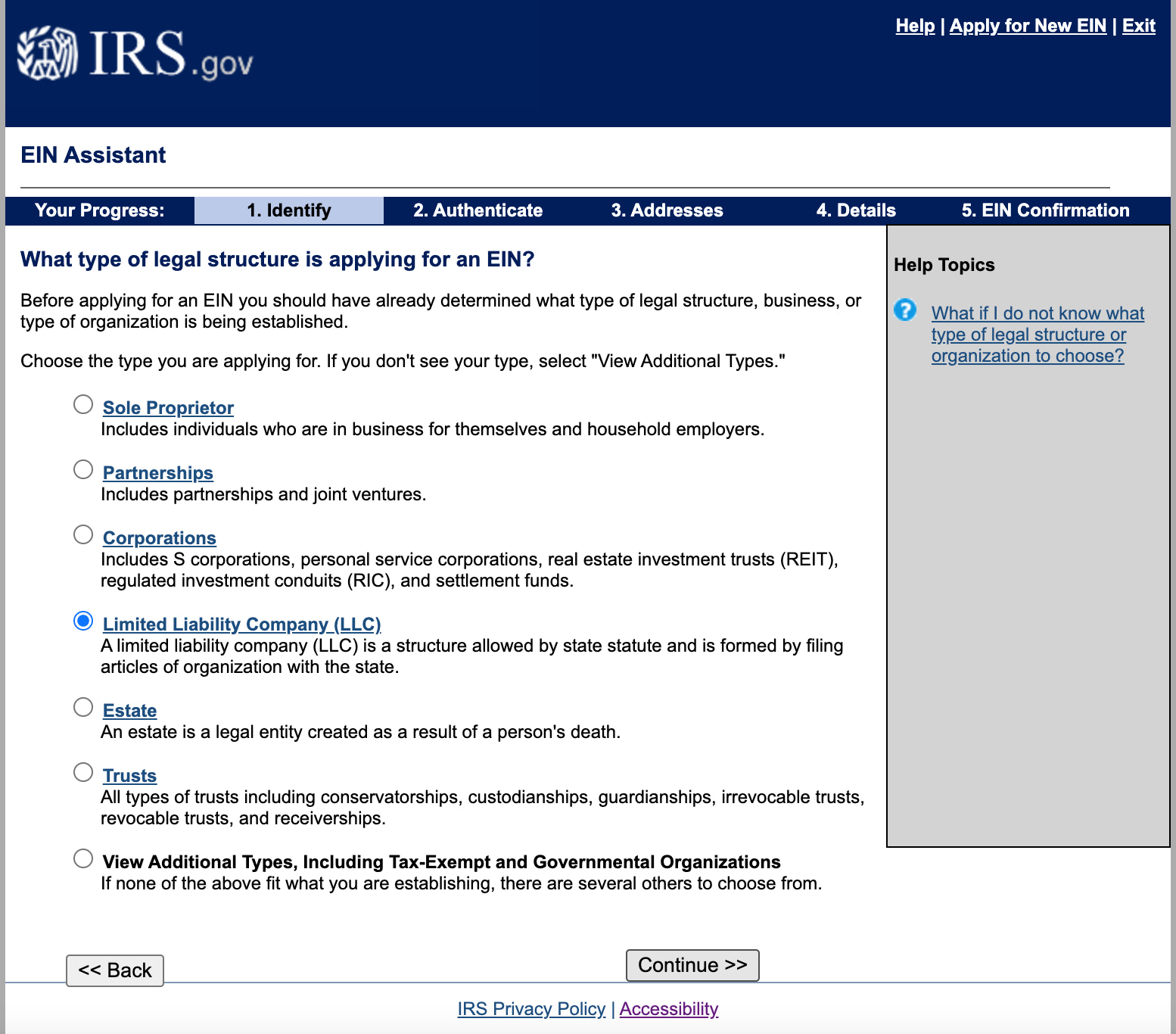

Your federal employer identification number (EIN) separates your personal identity from your business identity. It acts like your business’s social security number (SSN), so to speak. In other words, it’s a unique numerical combination the government uses to identify your LLC.

To get an EIN,go to the IRS websiteand fill out an application via online form. Theprocessis free, takes under 15 minutes, and is completely online. You’ll get your EIN immediately upon completion.

You also need to inform yourself of any tax obligations. This includes income tax,sales tax,use tax, value-added tax (VAT), and other potential tariffs.

3. Prepare an LLC operating agreement

An LLC operating agreement is a written contract where members of an LLC can define specific responsibilities, compensation, equity, and more. Members of an LLC can customize various terms to be more specific to the needs of the business.

Some states require this document when filing your LLC. And even though it’s not mandated in every state, it can be helpful—particularly for multi-member LLCs. An operating agreement provides a clear approach to how profits and losses are handled, along with the rights of each member.

You can write the operating agreement yourselves or, better yet, start with a template or hire a registered agent service or attorney to do it for you.

4. Open a bank account for your LLC

It’s easier to keep personal andbusiness financesseparate.Separating your financesalso provides more protection to your personal assets. You’ll need your business information, including your EIN, to open a business bank account.

5. File the required paperwork

Depending on the location and nature of your business, you may have to file additional paperwork as part of yourarticles of organization. Additional LLC formation documents could include:

- Permits andbusiness licenses, especially for food-based businesses

- Workers’ compensation if you’re hiring employees

- Insurance policies required to operate legally

- 你的公司经营管理ing agreement

See our state-specific LLC guides:

- How to start an LLC in Alabama

- How to start an LLC in Arizona

- How to start an LLC in Arkansas

- How to start an LLC in California

- How to start an LLC in Colorado

- 如何开始一个公OB欧宝娱乐APP司在康涅狄格州吗

- How to start an LLC in Delaware

- How to start an LLC in Florida

- How to start an LLC in Georgia

- How to start an LLC in Hawaii

- How to start an LLC in Idaho

- How to start an LLC in Illinois

- How to start an LLC in Indiana

- How to start an LLC in Iowa

- How to start an LLC in Kansas

- How to start an LLC in Kentucky

- How to start an LLC in Louisiana

- How to start an LLC in Maryland

- How to start an LLC in Massachusetts

- How to start an LLC in Michigan

- 如何开始一个LOB欧宝娱乐APPLC在明尼苏达

- How to start an LLC in Mississippi

- How to start an LLC in Missouri

- How to start an LLC in Montana

- How to start an LLC in Nebraska

- How to start an LLC in Nevada

- How to start an LLC in New Jersey

- How to start an LLC in New Mexico

- How to start an LLC in New York

- How to start an LLC in North Carolina

- How to start an LLC in North Dakota

- How to start an LLC in Ohio

- How to start an LLC in Oklahoma

- How to start an LLC in Oregon

- How to start an LLC in Pennsylvania

- How to start an LLC in Rhode Island

- How to start an LLC in South Carolina

- How to start an LLC in South Dakota

- How to start an LLC in Tennessee

- How to start an LLC in Texas

- How to start an LLC in Utah

- How to start an LLC in Virginia

- How to start an LLC in Washington

- How to start an LLC in West Virginia

- How to start an LLC in Wisconsin

- How to start an LLC in Wyoming

6. Create and launch a website for your LLC

When you’re ready to share your new business with the world, you canlaunch and promote your online store. We’ve created anonline store launch checklistto help you remember everything from marketing to inventory to fulfillment. Drive traffic to your site tomake your first sale, and invest insmall business loansto grow your business.

Extra: Register to do business in other states (if relevant)

Once you have your EIN and business name, it’s time to officially register everything.Registering your businessis a fairly straightforward process, though there may be extra steps required for merchants operating in certain industries, like food and beverage or CBD. You may also need toget a business license, depending on your niche and location.

Why form an LLC: pros and cons

When it comes tosole proprietorships versus LLCs, sole proprietorships have an advantage of simpler tax filing over other business structures—owners pass business taxes through as part of their personal tax return, and income is only taxed once.

The downside of a sole proprietorship is that since the business and its owner are legally considered the same entity, owners are 100% responsible for any debts or lawsuits incurred by the business, potentially putting personal assets at risk.

Meanwhile, whencomparing LLCs to corporations, both offer protections of owners’ personal assets. Corporations can offer public stock options as well as enjoy taxation flexibility. However, corporations are typically more complex to form and operate, as they have additional paperwork, a board of directors, and shareholder meetings.

Pros of starting an LLC

Someadvantages of incorporating as an LLC包括:

- Protection. Establishing an LLC creates a legal separation between business and owner, similar to a corporation—offering business owners a layer of personal asset protection.

- Convenience. It’s a relatively simple and inexpensive process to become an LLC.

- Validation. Starting an LLC can impact you as an entrepreneur, making it a great first step to making your ecommerce venture official. It also legitimizes your brand in the eyes of potential customers.

- Capital. Legitimizing your business can also boost your ability to secure outside funding, such as loans or investors—and even business partners down the line.

- Taxes. LLCs can choose how they want to be taxed. No other entity type comes with this choice. And—unless you elect to be taxed as a C corporation—your LLC is taxed as a pass-through entity, bypassing the federal corporate tax rate of 21%. So instead of paying corporate taxes and personal income tax, LLC members take profit shares and pay personal income tax on the earnings.

Cons of starting an LLC

On the other hand, there are also disadvantages to LLCs:

- Startup costs. Forming an LLC usually comes with a small incorporation fee. You might also have the expense of hiring a tax professional to handle the formation paperwork.

- Protection exceptions.While LLC members’ personal assets are considered to be separate from the business, and thereby protected from any litigation involving the business, a judge may rule otherwise. It’s important to separate personal and business finances and operations, as well as avoid committing fraud.

- Taxes. LLC owners are subject to self-employment taxes in addition to income tax. Thefederal self-employment tax ratefor 2022 was 15.3%.

- Paperwork. Being part of a member-managed LLC partnership adds an extra layer of paperwork to your taxes. You’ll need to file an IRS K-1 form, and each member must file a Schedule K-1 (Form 1065).

- Dissolution and reformation. If you or a member moves states, you might be required to dissolve and reform your LLC. This requires paperwork and potential fees.

Different types of LLCs

Single-member LLC/sole proprietorship

Single-member LLCsand sole proprietorships have one owner. While single-member LLCs can hire employees, sole proprietors don’t have that option. Owners can avoid double taxation by passing business taxes through as part of their personal tax return. Sole proprietorships don’t offer any personal liability protection.

General partnership

Ageneral partnershipis an informal business arrangement where two or more people agree to own and operate the LLC equally. This means they evenly divide all profits and losses. Each partner is legally considered the same entity as the business, meaning there’s no personal liability protection in a general partnership—but partners can pass business through on their personal tax return.

Family limited partnership

Family limited partnerships, or FLPs, are formed by family members who combine resources to establish and operate a business. FLPs typically have two different types of owners—general partners and limited partners. General partners are responsible for operation, whereas limited partners don’t have any management responsibility, but can still buy into the business to get income. These are a popular choice for families who want to pass down generational wealth.

Series LLC

A series LLC is a type of business structure that allows an owner to separate business assets and operations into different subsets, called series. A series LLC allows each subset to function as a regular LLC while also protecting the individual series from any liabilities that another one might incur. Not all states allow series LLCs, so be sure to check with your local legislature.

L3C company

An L3C, or low-profit limited liability company, is a hybrid structure that combines elements of an LLC and a nonprofit business. While L3Cs are allowed to generate a profit, this income must be used to benefit a charitable cause. Not all states recognize this business structure.

Member-managed LLC or manager-managed LLC

Member-managed and manager-managed LLCs, unsurprisingly, refer to how an LLC is managed. A member-managed LLC is when all owners, also called members, share responsibility for day-to-day operations. Member-managed LLCs are common with small to midsize businesses. Manager-managed LLC structures are more common for larger-sized businesses, or with owners who want a less active management role. In this case, members might either designate one or more members to handle day-to-day activities—or hire employees to take on these responsibilities.

*Requirements are updated frequently and you should make sure to do your own research and reach out to professional legal, tax, and business advisers, as needed. Businesses outside of New York will have different steps and requirements. To sell products using the Shopify platform, you must comply with the laws of the jurisdiction of your business and your customers, the Shopify Terms of Service, the Shopify Acceptable Use Policy, and any other applicable policies.

Ready to create your business? Start your free trial of Shopify—no credit card required.

How to start an LLC FAQs

How much does it cost to start an LLC?

It costs between $40 and $500 to start an LLC, depending on the state’s filing fee. You can also hire business incorporation and registration services or an attorney to help with the process, with costs ranging from around $100 to a few thousand, depending on location and complexity.

What are the steps to getting an LLC?

- Choose a name for your LLC

- Obtain your EIN and check tax requirements

- Prepare an LLC operating agreement

- Open a bank account for your LLC

- File the required paperwork

- Create and launch a website for your LLC

What are the tax benefits for an LLC?

- LLC members take profit shares and pay personal income tax on the earnings, avoiding double taxation.

- LLCs can choose how they want to be taxed.

- LLCs can be taxed as pass-through entities, bypassing the federal corporate tax rate of 21%.

What’s the difference between a single-member and member-managed LLC?

A single-member LLC has one owner, while a member-managed LLC has multiple owners. Single-member LLC owners can run the business how they choose, while member-managed LLC owners share responsibility for day-to-day operations and decisions.

What’s something you need to consider as a single owner of an LLC?

- How you choose to be taxed.

- Personal liability protection.

- 你计划如何发展你的业务。

- Whether you will hire employees.