Editor's Note: This post was originally published in December 2019 and has been updated for currency.

Consumers spent an estimated record high of $16.8 billion onBlack FridayandCyber Mondayin 2019. What will they spend in 2020? That’s an open question.

The unprecedented events of 2020 have had a major negative impact on the global economy, affecting everything from wages and job security toglobal supply chains。In this challenging economic climate and accompanying recession, shoppers are tightening their purse strings and brands need to consider ways they can lower the barrier to purchase.

Flexible payment options are a frictionless way to drive continued consumer spending in uncertain economic times. Buy now pay later makes it possible for consumers to immediately indulge while spreading payments out over time.

How does buy now pay later work?

It’s likelayawaybut better.

Buy now pay later solutions are integrated into online checkouts and let customers pay for products in installments. Though the financial terms can vary by company, each lets the consumer get what they want immediately and pay for it over time.

It’s an increasingly crowded space, as pioneers like Affirm, Klarna, Clearpay, and Afterpay now compete with similar solutions from PayPal and Square. In some cases, installments can be a money-saving alternative versus using a credit card, which on average, charges a17.14% annual interest rate。

Though credit card companies, and their banking partners, now offersimilar installment options, buy now pay later firms often tout their perceived advantages versus credit card late fees, penalties, and compounding interest, like:

- Some solutions will show consumers the total amount of interest they’ll pay

- Others charge at all, though they will owe late fees if deadlines are missed

- Some allow consumers to choose their repayment plan (e.g. four installments every two weeks)

- Others charge no interest if the item is paid in full within 6–12 months, or will extend payments over a at a reduced annual percentage rate

Importantly, buy now pay later options can reduce abandoned cart rates.

Research suggests that in 2018, shoppers left more than$34 billionin their online carts or nearly 7% of all digital commerce that year. If retailers provide additional financing options, or so the thinking goes, conversion rates will improve.

Despite an increasingly crowded field of competitors, there’s room to grow. Research indicates that more thanone-third of U.S. ecommerce brandsplan to offer purchase financing options in the next 12–24 months. This is on top of the more than30,000 merchantsthat use Afterpay, and the2,000that use Affirm, including Walmart.

Why shoppers buy now pay later

Buy now pay later options arose following the recession when banks reduced loans made to consumers. Theconvenience能够带回家购买,支付a fraction of the cost upfront is what draws many consumers to buy now pay later options. Buy now pay later satisfies two competing demands—the consumer’s desire for instant gratification, and the inability to pay upfront.

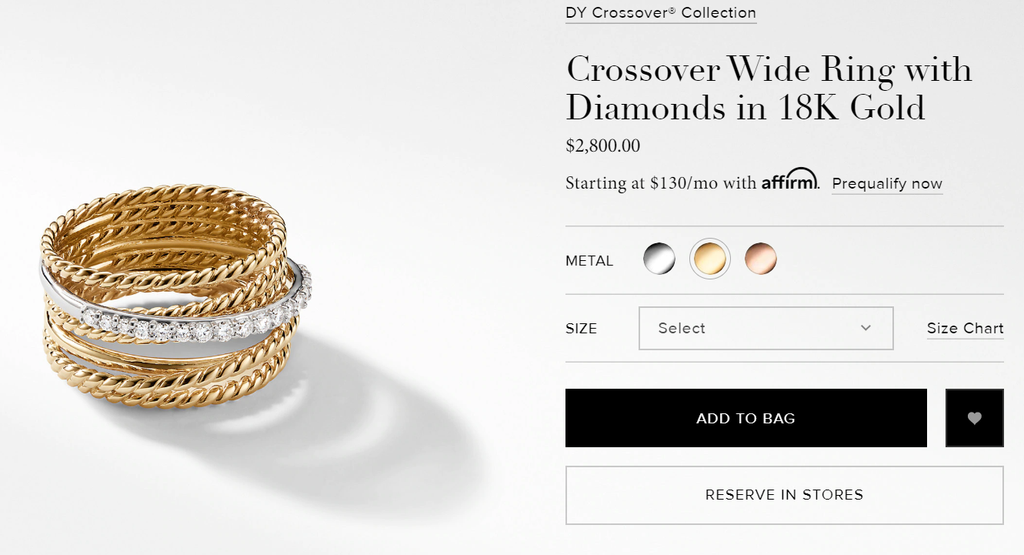

You might expect that buy now pay later options would only be used for big-ticket items like refrigerators, big-screen TVs, or mattresses. Buy now pay later is indeed well-suited for relatively expensive items, like this $2,800 ring:

In the luxury handbag space,multiple retailershave buy now pay later options on top brands. Some require a 25% down payment. Others charge no interest. Some have a set number of payments or a time-limited payment window, while others will let the consumer make as many payments as they need. EvenLouis Vuitton handbags are availablevia buy now pay later.

The buy now pay later option is increasingly drawing customers at lower price points, and can now be used to finance less expensive items like apparel, sneakers, cosmetics, and even something as basic asback-to-school supplies。For example, this $12 product that can be paid in four installments as part of a total order of only $35:

In case buy now pay later seems too good to be true, don’t forget that, as with any financed purchase option,missed or late payments will have negative consequencesfor consumers. Depending on the provider, missed or late payments can mean extra fees, interest charges, and even canceled promotional interest rates. And depending on the provider and plan chosen, these missed or late paymentscan even bring downa customer’s credit score. Suddenly, a purchase can turn out far costlier than anticipated.

Despite a strong U.S. economy before the pandemic, wages hadn’t kept pace with increases in housing prices, apartment rentals, and healthcare costs.

Consequently, consumers are increasingly borrowing money,$14.15 trillionat last count, to pay for everyday items and maintain amiddle-class lifestyle。Withpersonal incomes dropping 4.2% and disposable personal income decreasing 4.9%at the height of the lockdown, consumers are faced with having less to spend overall.

Thankfully, there’s hope for the next generation—younger adults were already carryingless credit card debtthan the average consumer before the pandemic, in part, because many are already saddled withstudent loan debt, and because they saw their parents struggle with debt during theGreat Recession。

The spending they are doing is being done increasingly online.

Adobe Analyticsexpects that by early October of this year, 2020 online sales will surpass the total of all online sales made in 2019.

Canadiandata suggeststhat while total retail sales fell by 17.9% between February and May as brick-and-mortar stores closed their doors, online sales surged 99.3% during the period.

With many consumers takinga cautious approach to spending, buy now pay later options will be increasingly attractive both in store, but especially online, as a means for consumers to get the goods they want at a time when they may not be able to pay for them outright, and when the high interest rates associated with credit card purchases are an unattractive option.

Why retailers offer buy now pay later

The buy now pay later industry is growing rapidly: Loan volume at Affirm topped$2 billionin 2018, and annualized underlying sales at Afterpay total more than$8.5 billion。Loan growth is the key metric by which investors measure these firms, but the real test is whether retailers benefit from offering installment solutions.

According toKlarna, the answer is yes. The company says adding financing at the checkout allows consumers to spread their costs over time and pay at their own pace. It also says financing increases the consumer’s purchasing power and results inmore sales。Klarna says brands offering installment financing find:

- A 58% increase in average order value (AOV)

- A 30% lift in checkout conversion rates

Likewise,Afterpaysays retailers using its payment option see improved purchasing frequency, loss rates, andcustomer lifetime value。在澳大利亚和新西兰,排版any says customers who joined Afterpay between 2015–2017 are now purchasing, on average, approximately 22x per year. Newer cohorts are following a similar upward trend, with the FY18 and FY19 cohorts purchasing, on average, 14x and 7x per year respectively.

Retailers offering Affirm, according to the company, can expect:

- A 20% increase in conversion rates

- An 87% increase in AOV

But despite the momentum, not everyone is as excited about the buy now pay later boom. Critics argue installments, even those that are creatively packaged and marketed, are little more thanstealth waysto hook young consumers into taking on more debt for items they don’t really need.

That said, with billions of dollars in loan volume and tens of thousands of brands offering installment financing, the option is unequivocally gaining traction. Not only is it helping brands increase sales, it’s literally helping already–indebted consumers get a better night’s sleep.

Mattress sales spike with installment financing

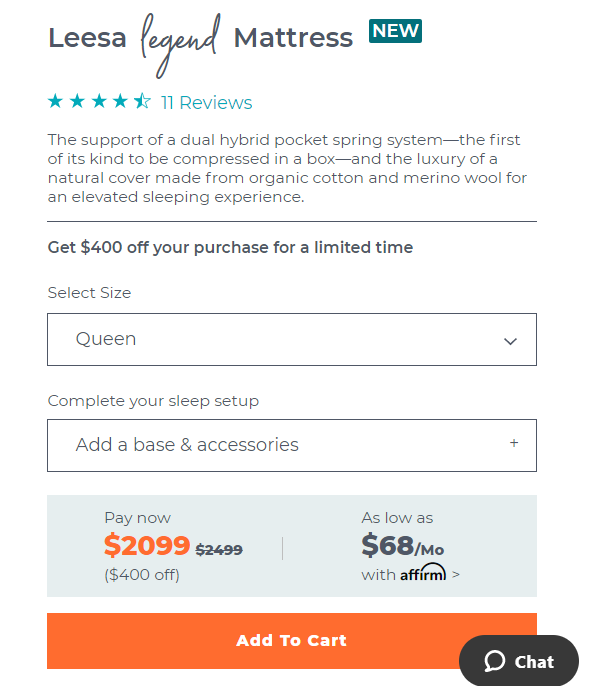

Leesa, a luxury mattress ecommerce firm, is a leader in the bed-in-a-box movement that has convinced consumers to buy beds online without first laying on them. But costing $1,000 apiece, buying a mattress outright is out of reach for some, especially younger consumers who are more likely to consider purchasing a mattress online.

It’s why Leesa partners with Affirm to offer installment financing. The company says that offering installments, especially to millennials, can be thedeciding factorthat determines whether a sale is made.

“Payments at thePOSis now a customer acquisition tool for us,” says Matt Hayes, a founding team member at Leesa and the company’s head of marketing. “Many people aspire to own one of our beds, but may be hesitant to pay $1,000 upfront.”

The company says Affirm allows its customers to buy beds they otherwise might not and pay over time. Importantly, Leesa says customers can see exactly how much they’ll be required to pay each installment prior to purchase.

In an A/B split test, Leesa says Affirm drove sales and influenced the consumer’s decision to purchase. When Leesa offered installment financing to customers, the company says it achieved the following results:

- An 8.3% increase in conversions

- An 8.7% increase in revenue per visitor

- A 4.5% increase in likelihood to add a mattress to the cart

“You can’t argue with stats when you’re running a controlled A/B test,” Hayes says. “We considered other options, like white-label offers from institutions that work with large companies. When it came down to it, the speed to market Affirm offers only sweetened our cost/benefit analysis.”

The future of buy now pay later

Buy now pay later isn’t new, it has just moved online. The data supports that offering installment financing increases sales. But interest and fees still apply, even if they are disclosed more transparently or less expensive than other forms of credit.

Competition in the space is intensifying. Point-of-sale (POS)installment offeringswill expedite the decision-making process that determines whether consumers qualify for credit in brick-and-mortar stores just as it has online. If installment options become ubiquitous, they’re less likely to give retailers an edge within their industry. It may also cause millennials, who are wary of taking on credit card debt, tooveruse creditand become more indebted.

Brands offering installment options must remain sober in their approach. Despitesincere intentions, customers who fall behind on payments can wind up with blows to theircredit score. Ultimately, this may reduce their lifetime value and result in little more than temporarily pulling sales forward. There’s also brand integrity risk if customers who miss payments see the retailer as complicit in theircrippling debt ordeal。

Risk aside, making it easier and more affordable to checkout is lifting retail sales. Especially for consumers low on cash following a holiday binge, installment financing offers a way for both the consumer and retailer to get what they want.

Read More

- What You can Learn from the Multibillion Dollar Success of Singles Day

- Boxing Day: The Post-Holiday Holiday

- People Need A Reason To Shop: Retail Leaders on What Drives Consumers

- 4 Brands Rethinking Black Friday Cyber Monday Retail Strategies

- What are the retail trends for 2023?

- Inventory Management Systems: What They Are, and Best Software for 2022