When starting a company, most entrepreneurs focus their creative energy on developing an idea and turning it into a sellable product. But before you can begin selling any product or service, you need to decide what it’s worth. This is where pricing strategy comes into play.

Read on to learn about the importance of competitive pricing, and how to choose the pricing model that’s best for your business.

What is pricing?

Pricing is the process of determining the monetary value assigned to a product, service, or offering. It involves considering factors such as production costs, market demand, competition, perceived value, and profit margins. Effective pricing strategies aim to strike a balance between attracting customers, maximizing revenue, and ensuring profitability for the business.

Similarly, when a product has a high price, a retailer may see fewer sales and “price out” more budget-conscious customers, losing market positioning.

Ultimately, every small-business owner must find and develop the right pricing strategy for their particular goals. Retailers have to consider factors like cost of production,consumer trends, revenue goals,funding options, and competitor product pricing. Even then, setting a price for a new product, or even an existing product line, isn’t just pure math. In fact, that may be the most straightforward step of the process.

That’s because numbers behave in a logical way. Humans, on the other hand, can be way more complex. Yes, your pricing method should start with some key calculations. But you also need to take a second step that goes beyond hard data and number crunching.

What is a pricing strategy?

定价策略是一种方法来确定price of a product. An effective pricing strategy takes revenue, profit, consumer behavior, andbusiness goalsinto account.

Choose the right price

Determine your markups and profit margin to set the perfect price and increase your bottom line with our product pricing calculator.

Learn moreThe art of pricing requires you to also calculate how much human behavior impacts the way we perceive price.

To do so, you’ll need to examine different pricing strategy examples, their psychological impact on your customers, andhow to price your product.

Shortcuts ✂️

Free Webinar:

Marketing 101

Struggling to grow sales? Learn how to go from first day to first sale in this free training course.

How to choose a pricing strategy

Whether it’s the first or fifth pricing strategy you’re implementing, let’s look at how to create a pricing strategy that works for your business.

Understand costs

To figure out your product pricing strategy, you’ll need to add up the costs involved with bringing your product to market. If you order products, you have a straightforward answer of how much each unit costs you, which is yourcost of goods sold.

If you create products yourself, you’ll need to determine the overall cost of that work. How much does a bundle of raw materials cost? How many products can you make from it? You’ll also want to account for the time spent on your business.

Some costs you may incur are:

- Cost of goods sold(COGS)

- Production time

- Packaging

- Promotional materials

- Shipping

- Short-term costs like loan repayments

Your product pricing will take these costs into account to make your business profitable.

Define your commercial objective

Think of your commercial objective as your company’s pricing guide. It’ll help you navigate through any pricing decisions and keep you heading in the right direction. Ask yourself: What is my ultimate goal for this product? Do I want to be a luxury retailer, like Snowpeak or Gucci? Or do I want to create a chic, fashionable brand, like Anthropologie? Identify this objective and keep it in mind as you determine your pricing.

Identify your customers

This step is parallel to the previous one. Your objective should be not only identifying an appropriate profit margin, but also what your target market is willing to pay for the product. After all, your hard work will go to waste if you don’t have potential customers.

Consider the disposable income your customers have. For example, some customers may be more price sensitive when it comes to clothing, while others are happy to pay a premium price for specific products.

Learn more:Finding Your Ideal Customer: How to Define and Reach Your Target Audience

Find your value proposition

What makes your business genuinely different? To stand out among your competitors, you’ll want to find the best pricing strategy to reflect the unique value you’re bringing to the market.

For example, direct-to-consumer mattress brand Tuft & Needle offers exceptional high-quality mattresses at an affordable price. Its pricing strategy has helped it become a known brand because it was able to fill a gap in the mattress market.

Learn more:What’s a Value Proposition? It’s What Your Business Does Better Than Anyone Else

6 common pricing strategies for small businesses

- Cost-plus pricing

- Competitive pricing

- Value-based pricing

- Price skimming

- Penetration pricing

- Keystone pricing

Once you’ve got the above items figured out, you’ll want to choose a pricing strategy. Here are some common tactics to get you started.

Cost-plus pricing: a simple markup

Cost-plus pricing, also known as mark-up pricing, is the easiest way to determine the price of a product. You make the product, add a fixed percentage on top of the costs, and sell it for the total.

假设你刚刚开始一个在线的t恤普杜拉。布OB欧宝娱乐APP辛ess and you want to calculate the selling price for a shirt. The cost for making the t-shirt are:

- Material costs:$5

- Labor costs:$25

- Shipping costs:$5

- Marketing and overhead costs:$10

You could add a 35% markup on top of the $45 total it cost to make your product as the “plus” of cost-plus pricing. Here’s what the formula looks like:

Cost ($45) x Mark up (1.35) = Selling price ($60.75)

- Pros:The upside of cost-plus pricing is that it doesn’t take much to figure out. You’re already tracking production costs and labor costs. All you have to do is add a percentage on top of it to set the selling price. It can provide consistent returns should all your costs remain the same.

- Cons:Cost-plus pricing doesn’t take into account market conditions such as competitor pricing or perceived customer value.

Competitive pricing: beating out the competition

As the name of this pricing strategy suggests,competitive pricingrefers to using competitors’ pricing data as a benchmark and consciously pricing your products below theirs.

This tactic is usually driven by the product value. For example, in industries with highly similar products where price is the only differentiator and you rely on price to win customers.

- Pro:This strategy can be effective if you can negotiate a lower cost per unit from your suppliers while cutting costs and actively promoting your special pricing.

- Cons:This strategy can be difficult to sustain when you’re a smaller retailer. Lower prices mean lower profit margins, so you’ll have to sell a higher volume than your competitors. And depending on the products you’re selling, customers may not always reach for the lowest-priced item on a shelf.

对于其他产品的横向压缩空气rison isn’t easily discernible, there’s a reduced need to enter into price wars. Leaning on brand appeal and focusing on a target customer segment alleviates the need to rely on competitor pricing.

Value-based pricing: customers perceived value of a product

Value-based pricing refers to setting a price based on how much the customer believes a product or service is worth. It’s an outward approach that takes your target market’s wants and needs into play. It’s different from cost-plus pricing, which takes the cost of products into its pricing calculation. Companies that sell unique or highly valuable products are better positioned to benefit from value-based pricing compared to ones that sell standardized, commodity items.

Customers care more about the perceived value of products (e.g., how they enhance self-image) and are willing to pay more for them.

Some general requirements for using value-based pricing include:

- A solid brand

- High-quality in-demand products

- Creative marketing strategies

- Good rapport with customers

- Stellar track record

Value-based pricing is common in markets where a product enhances a customer’s self-image or offers a unique life experience. For example, people normally assign high worth to luxury brands like Gucci or Rolls-Royce. This gives them the opportunity to apply value-based pricing to an item’s price. Companies must have a product or service that’s different from competitors.

- Pros:基于价值的定价更高的价格让你命令points for your items. Art, fashion, collectibles, and other luxury items often perform well with this pricing scheme. It also pushes you to create innovative products that resonate with your target market and increase brand value.

- Cons:It’s challenging to justify the added value for commodity products. You need to have a special product to apply value-based pricing. Perceived value is subjective and is influenced by many cultural, social, and economic factors that are out of your control. There’s no exact science for seeing a value-based price, so the price is often harder to set.

Price skimming: higher, short-term profits

A price skimming strategy refers to when an ecommerce business charges the highest initial price that customers will pay, then lowers it over time. As demand from the first customers is satisfied and more competitors enter the market, the business can lower prices to attract a new, more price-conscious customer base.

The goal is to drive more revenue while demand is high and competition is low. Apple uses this pricing model to cover the costs of developing a new product, like the iPhone.

Skimming is useful under the following conditions:

- There are enough prospective buyers that will buy the new product at a high price.

- The high price doesn’t attract competitors.

- Lowering the price only has a small impact on profitability and reducing unit costs.

- The high price is seen as exclusive and high quality.

Price skimming also works when there is product scarcity. For example high-in-demand low-supply products can be priced higher, and as supply catches up, prices drop.

- Pros:Price skimming can lead to high short-term profits when launching a new, innovative product. If you have a prestigious brand image, skimming also helps maintain it and attract loyal customers that want to be the first to get access/have an exclusive experience.

- Cons:Price skimming isn’t the best strategy in crowded markets unless you have some truly incredible features no other brand can mimic. It also attracts competition and can bother early adopters if you slash the price too soon or too much after launch.

Penetration pricing and discount pricing

It's no secret that shoppers love sales, coupons, rebates, seasonal pricing, and other related markdowns. That’s why discounting is a top pricing method for retailers across all sectors, used by 97% of survey respondents ina study from Software Advice.

There are several benefits to leaning on discount pricing. The more apparent ones include increasing foot traffic to your store, offloading unsold inventory, and attracting a more price-conscious group of customers.

- Pros:Discount pricing strategies are effective for attracting a larger amount of foot traffic to your store and getting rid of out-of-season or old inventory.

- Cons:If used too often, discount-based pricing could give you a reputation of being a bargain retailer and prevent consumers from purchasing your products at regular price. It also creates a negative psychological impact toward the consumer's perception of quality. For example, The Dollar Store and Walmart have low prices, but have perceived lower quality associated with their products, regardless of how valid that opinion is.

Apenetration pricing strategyis also useful for new brands. Essentially, penetration pricing involves selling at a lower price temporarily in order to introduce a new product and gain market share. The tradeoff of additional profit for customer awareness is one many new brands are willing to make in order to get their foot in the door

For more information on how to build a discount pricing strategy, read these related posts:

- How to Offer Retail Discounts Without Slashing Your Profits

- The Science of Sales: How to Move More Merchandise with Discounts

Keystone pricing: a simple markup formula

Keystone pricing is a product pricing strategy retailers use as an easy rule of thumb. Essentially, it’s when a retailer determines a retail price by simply doubling the wholesale cost they paid for a product to set a healthyprofit margin. There are a number of scenarios in which using keystone pricing strategies can result in a product being priced either too low, too high, or just right for your business.

Here’s an easy formula to help you calculate your retail price:

Retail price = [cost of item ÷ (100 - markup percentage)] x 100

For example, if you want to price a product that costs you $15 at a 45% markup instead of the usual 50%, here’s how you would calculate your retail price:

Retail price = [15 ÷ (100 - 45)] x 100 = $27

If your products have a slow turnover, have substantial shipping and handling costs, or are unique or scarce in some sense, then you might be selling yourself short with keystone pricing. In any of these cases, a seller could likely use a higher markup formula to increase the retail price for these in-demand products.

On the other hand, if your products are highly commoditized and easily found elsewhere, using a keystone pricing strategy can be harder to pull off.

- Pro:Keystone pricing works as a quick-and-easy rule of thumb that ensures an ample profit margin.

- Con:Depending on the availability and the demand for a particular product, it might be unreasonable for a retailer to mark up a product that high.

Other types of product pricing strategies

Manufacturer suggested retail price

As its name suggests (no pun intended), the manufacturer suggested retail price (MSRP) is the price a manufacturer recommends retailers use when selling a product. Manufacturers first started using MSRP as a pricing strategy to help standardize prices of the same product across multiple locations and retailers.

Retailers often use the MSRP with highly standardized products (i.e., consumer electronics and appliances).

- Pro:As a retailer, you can save yourself some time simply by using the MSRP when pricing your products.

- Con:Retailers that use the MSRP aren’t able to compete on price. With MSRPs, most retailers in a given industry will sell that product for the same price. You need to take into consideration your profit margins and cost. For example, your business may have additional costs that the manufacturer doesn’t account for, like international shipping.

Keep in mind that MSRP is a fairly niche pricing strategy. Although you can set whatever price you want, a large deviation from an MSRP could result in manufacturers discontinuing their relationship with you, depending on your supply agreements and the goal manufacturers have with their MSRP.

Dynamic pricing: adjusting price in response to variables

Ever try to get an Uber on a Friday night and notice the price is higher than usual? That’s dynamic pricing in action. Dynamic pricing is when a company continuously adjusts its prices based on different factors, such as competitor pricing, supply, and consumer demand. The goal is to increase profit margins for the business.

For brands like Uber, rider faredepends on variablesincluding time and distance of your route, traffic, and the current rider-to-driver demand. Prices are determined by rules or self-improving algorithms that take these variables into account when making pricing decisions.

- Pros:Dynamic pricing strategies allow retailers and brands to price products and services at scale, automatically, using machine learning. They can customize prices to meet current market conditions, save time with automation, and maximize profits.

- Cons:It can be difficult to manage as a small business and is a costly process. Dynamic pricing makes more sense for large retailers with thousands of SKUs across its ecommerce and retail stores. When dynamic pricing results in frequent price changes, consumers may respond negatively, which can lower revenue.

Multiple pricing: the pros and cons of bundle pricing

We’ve all seen this pricing strategy in grocery stores, but it’s common for apparel as well, especially for socks, underwear, and t-shirts. With the multiple pricing strategy, retailers sell more than one product for a single price, a tactic alternatively known as product bundle pricing.

For example, astudylooking at the effect of bundling products in the early days of Nintendo’s Game Boy handheld console found more units were sold when the devices were bundled with a game rather than sold on their own.

- Pros:Retailers use this strategy to create a higher perceived value for a lower cost, which ultimately can lead to driving larger volume purchases. Another benefit is that you can sell items separately for more profit. For example, if you sell shampoo and conditioner together for $10, you can sell them separately for $7 to $8 each, and that’s a win for your business.

- Con:Bundling reduces profits. If the bundle itself doesn’t increase sales volume, then you may come up short on profits.

Loss-leader pricing: increasing the average transaction value

We’ve all walked into a store lured by the promise of a discount on a hot-ticket product, but instead of walking away with only that product in hand, we end up purchasing several others as well.

If this has happened to you, you’ve gotten a taste of theloss-leaderpricing strategy. With this strategy, retailers attract customers with a desirable discounted product and then encourage them to buy additional items.

A prime example of loss-leader pricing strategy is a grocer that discounts the price of peanut butter and promotes complementary products, like loaves of bread, jelly and jam, or honey. The grocer might offer a specialbundle priceto encourage customers to buy these complementary products together rather than simply selling a single jar of peanut butter.

While the original item might be sold at a loss, the retailer can benefit from having anupsell/cross-sellstrategy in place to help nudge more sales. Loss-leading usually happens for products that buyers are already looking for, where demand for the product is high, driving more customers in the door.

- Pros:This tactic can work wonders for retailers. Encouraging shoppers to buy multiple items in a single transaction not only boosts overall sales per customer but can cover any profit loss from cutting the price on the original product.

- Cons:Similar to the effect of using discount pricing too often, when you overuse loss-leading prices, customers come to expect bargains and will be hesitant to pay the full retail price. You could also cannibalize revenues if you’re discounting something that doesn’t increase cart size or average order size.

Read more:Learn howbundling your productscan help you increase your retail sales.

Psychological pricing: use charm pricing to sell more with odd numbers

Studies have shownthat when merchants spend money, they’re experiencing pain or loss. So it’s up to retailers to help minimize this pain, which can increase the likelihood that customers will make a purchase.

Traditionally, merchants have used psychological pricing to soften the blow with prices ending in an odd number, like 5, 7, or 9. For example, a retailer would price a product at $8.99 instead of $9. From a customers' perspective, it looks like the retailer has slashed every cent possible off the price. Their brain reads $8.99 and sees $8, not $9, and makes the item seem more affordable.

In his bookPriceless, William Poundstone picks apart eight studies on the use of “charm prices” (i.e., those ending in an odd number) and found that they increased sales by 24%, on average, when compared to their nearby “rounded” price points.

But how do you choose which odd number to use in your pricing strategy? The number 9 reigns supreme in most cases. Researchers atMIT and the University of Chicagoran an experiment on a standard women’s clothing item with the following prices: $34, $39, and $44. Guess which one sold the most?

That’s right—items priced at $39 even outsold their cheaper counterparts priced at $34.

- Pro:Charm pricing allows retailers to trigger impulse purchasing. Ending prices with an odd number gives shoppers the perception that they’re getting a deal—and that can be tough to resist.

- Con:At times, charm pricing can seem gimmicky to shoppers and decrease trust between you and them, while a simple whole-dollar price is clean and perceived as transparent.

Learn more:Psychological Pricing: What Your Prices Really Say to Customers

Premium pricing: above competition pricing

Here, you take the pricing strategy from above and go to the other end of the spectrum. Brands benchmark their competition but consciously price products above their own to make themselves seem more luxurious, prestigious, or exclusive. For example, a premium price works in Starbucks’ favor when people pick it over a lower-priced competitor, like Dunkin’.

A study on pricing strategy by economistRichard Thalerlooked at people hanging out on a beach wishing for a cold beer to drink. They were offered two options: purchasing a beer at either a rundown grocery store or a nearby resort hotel. The results found that people were far more willing to pay higher prices at the hotel for the same beer. Sounds crazy, right? Well, that’s the power of context and marketing your brand as high end.

Be confident and focus on the differentiated value you provide to customers and ensure you are still providing value. For example, high customer service, appeasing branding, etc., will provide customers the necessary value to justify higher prices.

- Pro:Premium pricing strategy can work its halo effect on your business and products: consumers perceive that your products are better quality and more premium compared to your competitors due to the higher price.

- Cons:Premium pricing strategy can be difficult to implement, depending on your stores’ physical locations and target customers. If customers are price sensitive and have several other options to purchase similar products, the strategy won’t be effective. This is why it’s crucial to understand your target customers and domarket research.

Read more:Learnhow to conduct market researchso you can better understand how to price your products, identify your target customers, and discover the quirks of your chosen niche.

Anchor pricing: creating a reference point for shoppers

Anchor pricing is another product pricing strategy retailers have used to create a favorable comparison. Essentially, a retailer lists both a discounted price and the original price to establish the savings a consumer could gain from making the purchase.

Creating this kind of reference pricing (placing the discounted and original prices side by side) triggers what’s known as the anchoringcognitive bias. In astudy from economics professor Dan Ariely, students were asked to write down the last two digits of their Social Security number and then consider whether they would pay that amount for items they didn’t know the value of, such as wine, chocolate, and computer equipment.

接下来,他们被要求竞标这些物品。阿里ly found that students with a higher two-digit number submitted bids that were 60% to 120% higher than those with lower numbers. That's due to the higher price “anchor,” i.e., their Social Security number. Consumers establish the original price as a reference point in their minds, then “anchor” to it and form their opinion of the listed marked-down price.

The other way you can take advantage of this principle is to intentionally place a higher-priced item next to a cheaper one to draw a customer’s attention to it.

Many brands across various industries use anchor pricing to influence customers to purchase a mid-tier product.

- Pro:If you list your original price as being much higher than the sale price, it can influence a customer to make a purchase based on the perceived deal.

- Con:If your anchor price is unrealistic, it can lead to a breakdown of trust in your brand. Customers can easily price-check products online against your competitors with aprice comparison engine—so ensure your listed prices are reasonable.

Economy pricing: for low production costs and high volume sales

An economy pricing strategy is where you price products low and gain revenue based on the sales volume. It’s typically used for commodity goods, such as groceries or drugs, where the company doesn’t have a big brand to support its marketing. The business model relies on selling a lot of products to new customers on a consistent basis.

The formula for economy pricing is:

Production cost x Profit margin = Price

- Pros:Economy pricing is easy to implement, can keepcustomer acquisition costs低,对客户提供价格sensitiv有益ity.

Cons:The margins are typically lower, you need a steady flow of new customers all the time, and consumers may not perceive the products to be high quality.

The Shopify guide to shipping and fulfillment

Boost customer satisfaction while driving sales growth for your ecommerce business with an effective shipping and fulfillment strategy. Use this guide to create a plan that covers all aspects of shipping and fulfillment, from how much to charge your customers to choosing the right fulfillment method.

Get our shipping and fulfillment guide delivered right to your inbox.

Almost there: please enter your email below to gain instant access.

We'll also send you updates on new educational guides and success stories from the Shopify newsletter. We hate SPAM and promise to keep your email address safe.

Pricing strategy examples

Premium pricing: Gucci

One of the top luxury brands in the world,Gucciapplies premium pricing to its products due to its superior quality. The Italian fashion house is a successful manufacturer of high-end leather goods, clothing, and other fashion products.

Key attributes include:

- High-quality goods

- Groundbreaking creativity and innovation

- Customization

Its products are unique in style and design, and made for wealthy consumers. The brand name associated with this prestige image allows Gucci to command high prices. You’ll also notice Gucci items are usually never on sale through official retailers, which upholds the brand’s image as a distinguished and respectable brand.

Value-based pricing strategy: Fashion Nova

Global fashion brandFashion Novahas made a name for itself through influencer marketing. The brand works with different women from around the world to showcase its clothing online in luxurious locations and styles.

Seeing its clothes on familiar women in high-end places makes Fashion Nova a status symbol for buyers. Women who purchase from the brand feel like it adds value to their life, which allows Fashion Nova to price its products however it wants.

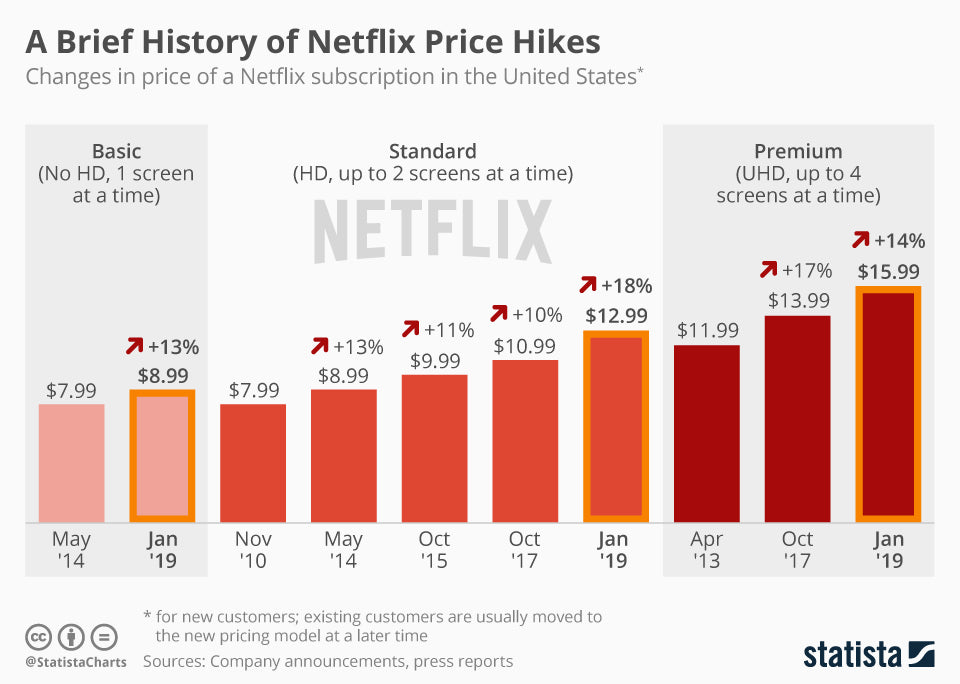

Penetration pricing strategy: Netflix

Netflixis a primary example of a brand using penetration pricing to eliminate competitors. In the late 1990s, DVD rentals were becoming popular, with Blockbuster controlling the market. You can probably recall the unforgettable Blockbuster smell of popcorn, plastic, and carpet cleaner.

然而大片有两个主要缺陷:滞纳金limited selections. Netflix offered a solution. Customers could order DVDs online through the standard pay-per-rent model, with a better movie selection and no late fees. In 2000, you could rent four movies at a time without return dates for less than $16 per month. The average movie watcher could pay under one dollar per DVD, compared to Blockbuster, which charged $4.99 per three-day rental.

After Netflix wiped out Blockbuster (and other competitors, like Hollywood Video), it eventually raised its prices to maximize profit margins. The low price point let people try the service and get familiar with the brand, which helped Netflix launch its online streaming service in 2007.

Competitive pricing strategy: Costco

If there's one thing you know aboutCostco, it’s the discounts you receive on all types of products: bread, vegetables, giant lobster claws, seven-pound tubs of Nutella, expensive bottles of scotch, and even the four-person steam sauna.

The brand uses a competitive pricing strategy based on market conditions to determine prices. It aims to offer the lowest possible prices for bulk and wholesale purchases compared to other grocers and retailers in the market. Shoppers get the discounts through a Costco membership, which has a near90% renewal rate.

Find the best pricing strategy for you

There’s never a black-and-white approach to setting an effective pricing strategy. Not every pricing strategy will work for every kind of retail business: everyentrepreneurwill need to do their homework and decide what works best for their products, marketing strategy, and target customers.

Now that you have a deeper understanding of the different pricing strategies available for retail businesses, you can make more informed choices and create morepersonalized shopping experiencesfor buyers by giving them the best price possible.

Ready to create your first business? Start your free trial of Shopify—no credit card required.

Pricing strategies FAQ

What is a pricing strategy?

Why is a pricing strategy important?

What are examples of pricing strategies?

- Keystone pricing

- Multiple pricing

- Penetration pricing

- Loss-leading pricing

- Psychological pricing

- Bundle pricing

- Economy pricing

- Cost-plus pricing

- Premium pricing