In the heady days of the COVID-19 pandemic, the World Trade Organization (WTO) released a report on the pandemic’s effects on ecommerce. Titled “E-Commerce, Trade and the COVID-19 Pandemic,” the report revealed something that no retailer would be particularly surprised by: Social distancing and lockdown measures have driven consumers online. As a consequence, ecommerce is growing at an explosive rate.

According to the OECD2020年5月底,在线订单有更多的than doubled year over -on-year in North America and were up by 50% in Europe.eMarketer.com projectsthat by the end of the year, there will have been an 18% growth in the United States alone, with both the number of digital buyers and the average spending per buyer increasing.

People are passing their time in self-quarantine and protecting their family’s health by shopping online. The types of purchases vary widely, but computer accessories, medical goods (including pharmaceuticals and PPE), and leisure items (such as books, games, and puzzles) are dominating the market.

The WTO report also provided insight on the weaknesses of ecommerce that have been exposed by the pandemic—including in supply chain management—and what the market may look like moving forward.

Here are the key takeaways for ecommerce business owners, including implications for cross-border transactions.

Disruptions in manufacturing and international delivery

What the WTO report says:

- On manufacturing:“Manufacturing in many economies came to a halt as a result of the lockdowns, thereby resulting in a decrease in production and labor shortages in many countries. The pandemic has therefore brought to the fore the vulnerabilities of supply chains and tested the ability of businesses to adjust swiftly.”

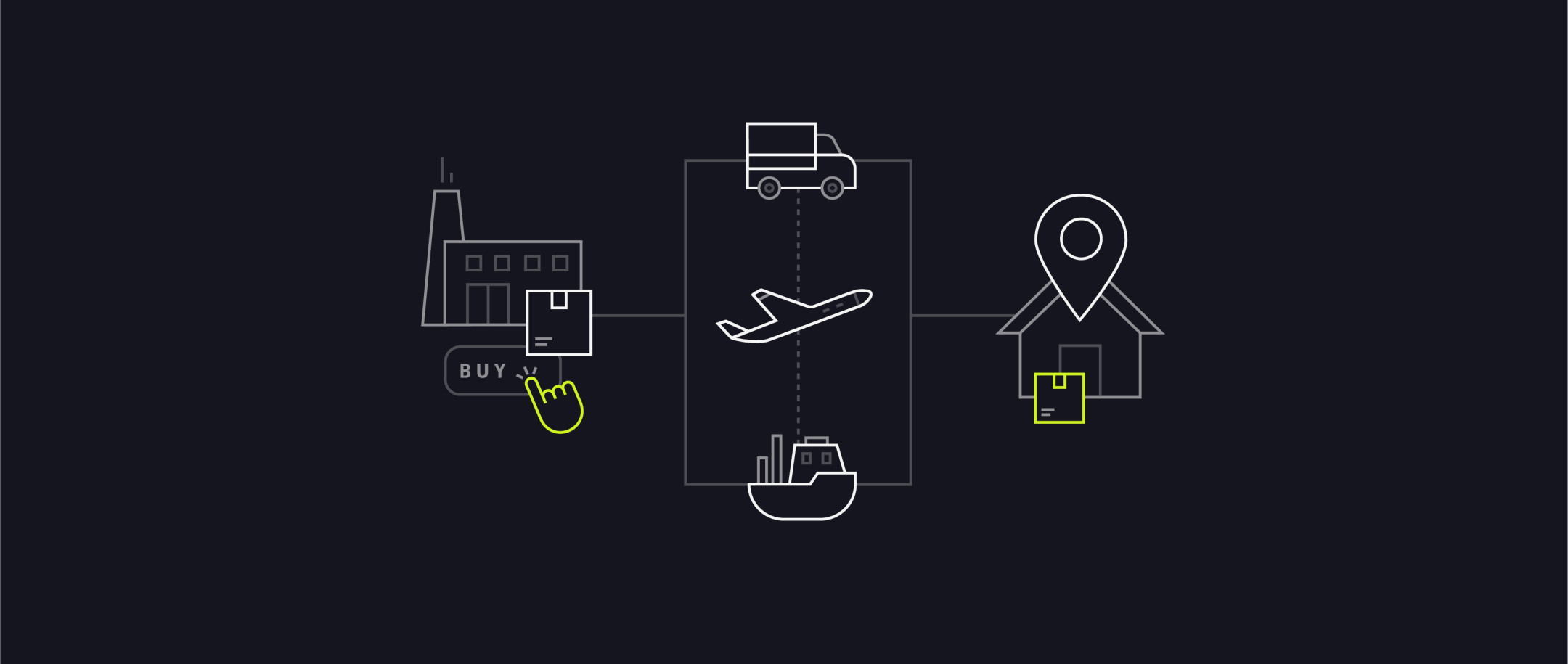

- On international transportation and delivery:“Online purchasing of goods has been subject to the samesupply chain bottlenecksas physical purchases. International transport and logistics services have been affected by the introduction of new health regulations, as these have severely disrupted most international means of transport – land, sea, and air cargo.”

What does this mean?In the first two months of the pandemic, more than a million passenger flights were cancelled—and in the process, so too was the primary means by which most postal shipments and small consignments are shipped. Capacity was dramatically reduced, while prices for B2C and B2B shipping transactions shot up. Meanwhile, container ship imports were held up at borders, where custom agencies have had lower availability of personnel but growing workloads.

Shipping problems were only further compounded by manufacturers closing down shop. The result: Both B2C and B2B customers were faced with delays and cancellations of their orders, even on the day of delivery.

In the months since the WTO report was released, we’ve seen manufacturing resume (although at lowered production rates) and airlines start flying again (although with reduced routes). We’re back in the game, but it likely will be years before shipping and manufacturing capacity is able to return to its former levels.

What does this mean for ecommerce? Well, it may be time to look closer to home.

“There’s going to be more restrictions on products shipped from China. The supply chain is going to be pushed more towards domestic manufacturing,” projects Ming Hu, professor of operations management at Rotman School of Management. Hu cites the example of 3M, which has增加了我们生产的N95防护口罩40%, rather than relying upon its factories in Asia.

There’s also a lesson to be learned about supply chains—and preparing for worst-case scenarios.

“Enabling agility along the supply chain to adapt is nothing new. COVID-19 just caught people off-guard,” says Juan Marcelo Gomez, an expert in supply chain management at the Ted Rogers School of Retail Management. “Going forward, a lot more weight has to be put on risk management.”

He suggests that where it’s possible, ecommerce businesses may even consider implementing their own delivery strategies, rather than relying on existing platforms.

Ultimately, the WTO report argues that more global cooperation is needed “to help facilitate cross-border movement of goods and services, narrow the digital divide, and level the playing field for small businesses.” But until the necessary policy change takes place to enable that, businesses will need to continue clearly communicating to customers potential for shipping delays or even cancellations.

Price gouging & product safety concerns

What the report says:“Several other ecommerce-related challenges have arisen or been further amplified during this pandemic. These include price gouging (i.e. increasing prices to unreasonably high levels), product safety concerns, deceptive practices, cybersecurity concerns, the need for increased bandwidth, and development-related concerns.”

What does this mean?For consumers, price gouging will likely be one of the most memorable aspects of online shopping during the pandemic.

One Toronto-based mom reports that in May, she “panic-ordered” baby food pouches online for $30 CAD—or at least that’s what she thought she was ordered. What arrived at her door was one singular pouch; a product that normally retails for between $1 and $3.

“It was 10 times the cost of one pouch at the grocery store. I was livid,” she says.

Price gougers weren’t the only ones seizing the opportunity, or preying upon fear and uncertainty—so were counterfeiters.

“Even before the coronavirus was unleashed on the world, it was estimated that by 2022, counterfeiting will be a $4.2 trillion industry, and global damage from counterfeit goods will exceed $323 billion,”writes Laura Urquizu, partner of Red Points, an online brand protection company, in FastCompany.

It hasn’t just been in PPE equipment (such as third-party sellers posing at 3M and selling overpriced fake masks)—counterfeit goods in the categories of apparel, cosmetics, toys, sporting goods, and home goods have surged.

For ecommerce businesses, this has implications—namely that there’s a continued need to earn and retain the trust of online shoppers, particularly those who may be new converts, such as the mom who ordered the baby food online.

SupplyChainDrive.com suggestssetting up a page on your website—or on your intranet for internal employees—that educates readers on how to identify authentic goods, or find reliable sources. Make sure that reviews for your products are easily accessible and ensure you are not reselling counterfeit goods.

Overall online interaction for consumers is up

What the report says:“The enforcement of social distancing, lockdowns and other measures has led consumers to ramp up online shopping, social media use, internet telephony and teleconferencing, and streaming of videos and films.”

What does this mean?Customers aren’t just shopping online—they’re also a captive audience. If you had any doubts that the potential for social media engagement was wavering, now is the time to put those doubts away.

For consumers who are wary of going to the mall or a store to test or handle a product before purchasing, online showcases—such as live events hosted on Facebook, Instagram, or even Zoom—give them a chance to see a product in action and ask questions. There’s also room for events that give consumers a chance to interact with brands in a way that was previously possible. (Think of book retailers, who are hosting online book clubs and book launches where readers can now talk directly with their favorite author.)

Taking it one step further, in China “livestream shopping” channels on Alibaba’s Taobao Live platform have flourished. Much like the home shopping channels you find on cable television networks, livestream shopping channels and apps showcase goods—but with more viewer interaction. (Reportedly, even farmers have been using the medium to sell produce.) According to China’s internet authority, 256 million people watched livestream sales channels last year.This year, sales are estimated to double to almost $143 billion.

If you have yet to host a live social media event, this may be the time to start. Now may also be time to consider investing in augmented-reality software, such as applications that make it possible for consumers to virtually try on new clothes or see what their kitchen would look like in a particular shade of paint.

Future of consumer shopping behavior

What the report says:“Going forward, the questions arise of whether the experiences from the COVID-19 pandemic will propel more consumers to change their shopping behaviors and patterns and increasingly resort to online purchases, and whether governments in these regions will prioritize and invest more in e-commerce and online-facilitating infrastructure and policies.”

What does this mean?Once malls reopen, will consumers return to them? Or will they continue to buy online?

“The pandemic made a large segment of the population realize how convenient it is to shop online. It was a test drive for customers,” says Ming. He, for one, believes that once consumers try the model, they’ll be sold.

Marcelo agrees, adding that the pandemic has demonstrated that your target audience may be wider than you think.

“Once you begin to change the behavior of people, it’s hard for them to change back,” he says. But, he notes, ecommerce should ideally just be part of an omnichannel experience for consumers. “COVID isn’t going away. It’s unpredictable. Businesses just need to step back and look at their overall plan and strategy and see how they can exploit ecommerce platforms like Shopify to better their businesses and reach consumers.”