Most businesses were woefully underprepared for the massive supply chain disruptions triggered by COVID-19.

According to theAssociation for Supply Chain Management, 66% of respondents reported “some or major” supply chain disruptions.

Hit particularly hard were retailers: Glossy recentlyreportedthat mounting debt and supply chain problems led cosmetics giant Revlon into bankruptcy in June 2022, after narrowly escaping it in 2020.

But looking back on these disruptions only helps if it prepares brands for the next supply chain challenges. What areecommercecompanies and retailers doing to improve supply chain planning? Below, we’ll explore the top trends in supply chain management (SCM) and what you can do to learn from them.

12 supply chain trends to watch

Trend #1: Micro-fulfillment to optimize the last mile

The “last mile” is to supply chains what the fourth quarter is to a sporting event: the critical final stage. Last-mile costsrepresent 41% of the total supply chain costsin shipping. Recent trends have only exacerbated this fact, with shippersraising prices on the last mile.

How are grocery and retail brands responding to these increasing last-mile costs? By taking the last mile into their own hands.

According to Maggie M. Barnett, COO ofShip Hero, omnichannel retailers are curtailing the impact of global supply chain disruptions via “micro-fulfillment,” handling fulfillment directly with supplies from alocal warehouse. Then, retailers offer an option like buy online, deliver from store, orbuy online, pickup in-store.

Micro-fulfillment is a new trend, but it’s picking up more steam as we move closer to peak season.

Maggie M. Barnett, COO of Ship Hero

In 2021, Targetemployed micro-fulfillment strategieslike adding local distribution centers. This helped fuel a 45% increase in drive-up pick-up orders in 2021, prompting the company to add 18,000 parking spaces for pick-ups nationwide.

Trend #2: Elevating supply chain executives to the C level

Last year,Modern Retail called the role of supply chain specialist“the hottest job in retail.”

It’s about time. Pre-pandemic,78%的执行者reported lack of visibility into inventory. And 50% said they didn’t have the platforms in place to expand fulfillment options.

Aftermassive disruptions in the supply chainhit in 2020 and 2021, executives realized where they’d gone wrong: They needed to invest in executives whose sole focus is overseeing operations and fulfillment in the supply chain.

Carmel Hagen, the founder of baking brand Supernatural, hired a head of operations to facilitate its new relationships with Amazon and Whole Foods. According to Hagen, the move didn’t come a moment too soon.

“Technically, the right time to make the operations hire was probably three to six months before I got there,” Hagen told Modern Retail. “But I knew for su

re it was time.”

Growing egg-wrap brand Egglife has invested in its supply chain leadership as well. With a goal ofdoubling production in 2022, Egglife brought in Cynthia Waggoner, formerly of Kraft Foods, as a lead supply chain officer. It anticipates hitting those goals this year.

Trend #3: Preparing for new risk events

An old axiom says that while the best time to plant a tree was 20 years ago, the next best time is now.

That’s the approach companies are taking with unexpected supply chain disruptions. It’s already too late to deal with 2022—but it’s not too late to put a new plan on paper.

According to theAssociation for Supply Chain Management (ASCM) 2021 Disruption Report, only about 40% of companies had real-time data and inventory monitoring before COVID. About three times as many businesses wanted to implement a new supply-chain disruption plan than those that didn’t.

Aviation, an industry hit particularly hard by travel restrictions and supply chain disruptions, is changing how it prepares for these events. According toNathan Winkle of Thoroughbred Aviation, that means ordering parts in advance to prevent supply disruptions.

“It pays to order needed parts well in advance—months, not weeks,” says Winkle.

In short, companies are prepping for the next COVID-19, even if it never comes. ASCM notes there are more companies implementing disruption response plans than companies withanyplans before COVID.

Trend #4: Integrating flexible contracts

Companies with huge, static orders on the books quickly learned the value of flexibility in 2020.

Flexible contracts split supply orders up into smaller blocks, giving the buyer the option to change orders as demand shifts. Making fewer static commitments in the form of fixed, long-term contracts with suppliers means more adaptability.

“Flexible contract manufacturing enables companies to replace more of their traditional fixed cost base with variable costs to adapt to changing demand,” saysJeff Langely of KPMG Australia.

In a Forrester Consulting study ordered byKPMG, 80% of organizations reported that the responsiveness of their supply chain and operations is their biggest priority in the coming year.

Trend #5: Increasing inventory reserves

增加库存储备就像雨天fund, offering flexibility to companies facing unexpected surges in demand.

According toMcKinsey, 47% of companies amid the COVID pandemic (May 2020) planned to increase inventory supplies. Within the past 12 months, the number of companies planning on doing the same has increased to 60%.

But there’s more complexity required than simply increasing inventory. Companies also have to find newsourcesof this inventory, often turning to regional sources rather than relying on global shipping.

Consider the health care industry, saysMcKinsey,应用广泛的一系列措施es” to meet supply demands: medicine, masks, and other critical supplies.

About 60% of health care respondents reported reorganizing supply chains toward regional sources, and it worked. The industry eventually adapted to shifting demand.

Regionalization remains a priority for most companies. Almost 90 percent of respondents said that they expect to pursue some degree of regionalization during the next three years, and 100 percent of respondents from the healthcare and engineering, construction, and infrastructure sectors said the approach was relevant to their sector.

McKinsey, 2021

Trend #6: Investing in supply chain agility

Not all supply chain remedies are quite so surgical. A healthy supply chain sometimes requires organizational-level improvements to business agility: your company’s ability to adapt and respond to rapid change.

Surveys suggest improvementsin companies’ “decisions making” speed at a rate of five to 10 times when focusing on agility. Those without the agility focus improved by only two times.

Some business leaders report that business agility and a responsive supply chain aren’t two separate ideas but inextricably linked ideas. That’s been the case at Henkel’s laundry and home care business, where chief supply chain officer Dirk Holback says agility investments paid off during the pandemic.

[Henkel has] invested in setting up the right organization, rebuilt our footprint, implemented digital, and developed sustainability capabilities. … [I]n April of last year, when the first demand shocks hit our system, we introduced a new element in our S&OP [sales and operations planning] process in just a few days—basically a daily management of capacity and demand by country supported by some digital capabilities using our existing analytics platform.

Dirk Holbach, chief supply-chain officer at Henkel

Trend #7: Investing in customer experience

The most obvious and public-facing consequence of poor supply chain management?

Unhappy customers.

This shows in the stats:Forrester predictsbrands will lose 50% of sales on back-ordered products. The only remedy? Companies that can provide a customer experience satisfying enough to make up for late deliveries.

Some brandshave gotten proactive with the customer-facing approach.Lenovo’ssolution: broadening the breadth of its customer insights. It’s expanded to multiple channels, like customer surveys and customer sentiment from social media.

According toSupply Chain Management Review, the goal is to identify the core problems behind customer sentiment challenges.

Bettercustomer servicedoes more than dissolve customer anger. At Lenovo, even though these new investments are customer-facing, the new approach to customer data had a demonstrable impact on the supply chain.

Overall, the company improved how many products are delivered on time by 6%. It provided customer experience professionals more insight into thesourcesof late-delivery problems.

The objective of these sensing activities is to identify an opportunity or root cause of a problem, then enable employees to take action.

—Supply Chain Management Review

Better equipped to address specific order issues, customer service was the tail that wagged the dog of the supply chain.

Trend #8: Improving supply chain forecasting

Forecasting economic trendsis like forecasting the weather. No one has a crystal ball.

According toMcKinsey, 32% of businesses (the highest among all answers) blamed poor forecasting for their COVID-related supply chain woes. In the “consumer goods” category, only inventory issues weighed higher.

To improvesupply chain forecasting, some companies have had to think outside the box.Harvard Business Reviewrecounts the story of a global food firmthat invested in anonymous phone tracking data to sense how many people were congregating in hotels and restaurants.

The data was an unprecedented look into consumer behavior for the firm. But it also yielded results. The firm created a “panic index” to track consumer sentiment across multiple channels—from social media to anonymous phone data.

How well does it work? According toHarvard Business Review, the panic index outperformed demand estimates from customer-facing sales reps.

Trend #9: Investing in analytics

Data from theUniversity of Texas–Austin suggestsa simple improvement in “data usability” can give some companies a 10% increase in revenue.

But while data usability usually translates to improving sales and marketing processes, it can also provide more flexibility with supply chains. Predictive analytics, along with advances in big data and robotics, will have a significant impact on retailers.

“Another trend this year is focused on the need for better quality data, not necessarily more data,” says Maggie Barnett. “It’s becoming increasingly more important to have quality data at your disposal, especially on the warehouse floor. With the widespread application of automation, AI, and other technologies, it’s critical to have data that can help those technologies become even more efficient and intelligent.”

Are you leveraging data to help predict where inventory demand will be highest? Are you using your data to identify ways to optimize your warehouse space? Take a closer look at the data you have access to and then analyze how to best put it to work!

Maggie M. Barnett, COO ofShip Hero

Trend #10: Investing in air shipping

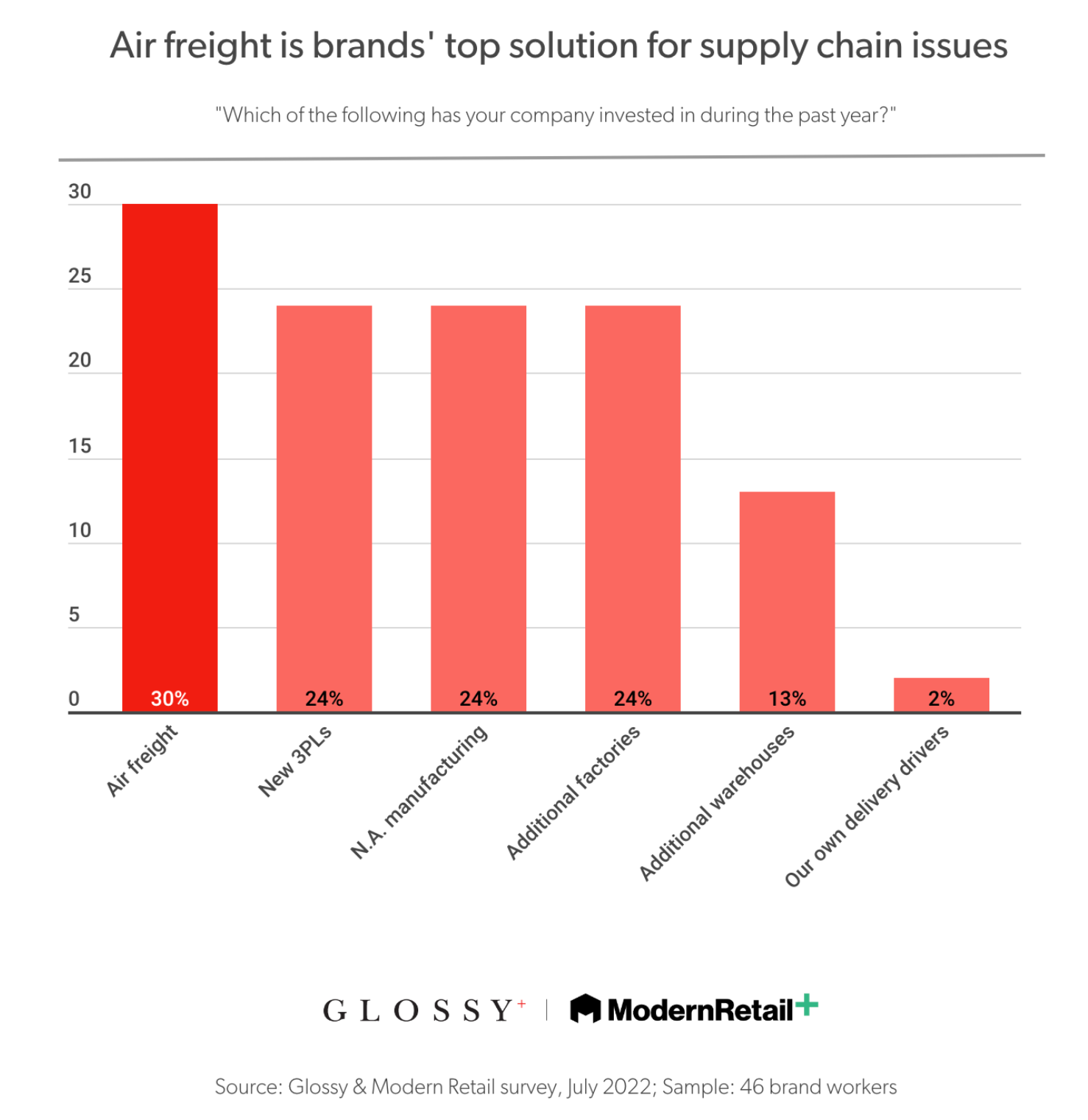

New Glossy and Modern Retailresearchfound that brands are looking to air shipping as a supply chain solution. In a survey of 46 brand executives, 63% of respondents said they’re investing in new supply chain technology to help combat delays.

The number one logistics-related investment brands are making is in air freight. Over 30% of brands surveyed invested in air shipping between 2021 and 2022.

Air shipping is faster and more efficient than shipping by sea, but it is more costly. Logistics companyFreightospenned that a $200 ocean shipment would be roughly $1,000 if shipped by air.

However, air shipping costs are significantly cheaper than they were pre-pandemic. Supply chain trade publication Freightwaves found that while shipping by air is three to five times more expensive than sea shipping, it used to be15 timesmore expensive.

Trend #11: Sustainable procurement

B2B buyers have set their eyes on sustainable procurement. Amazon Business’ 2022 State of Business Procurement Report found that63% of B2B buyerssayimproving sustainabilityin their purchasing practices is a top goal.

The pandemic has also accelerated online purchasing. By the end of 2022, some 68% of buyers plan to make 40% more of their purchases online, up from 56% in 2021. Buyers’ are investing in new technology like automated approval workflows, expense management controls, and guided buying capabilities to meet goals and improve operations.

While improving efficiency is a core focus, social responsibility was also reported as a top priority for procurement teams.

For retailers, digital procurement investments will continue to evolve during 2023, allowing companies to easily search and buy from you and providing visibility into your products. Procurement officers are looking to buy from companies that align with their budget and core values.

Trend #12: Evolving inventory management

Volatile shipping delays, increasing raw material costs, and dealing with overstock are causing retailers to look atinventory managementdifferently. Major US ports are still struggling.CNBC reportsthat ocean carriers are canceling sailings due to congestion, and container volume from China is in a downward trend.

In response, retailers are leveraging techniques like:

- Cutting SKUs

- Promotions

- Price hikes

Women’s intimates brand Lively has been “laser-focused” on making sure top sellers are in stock, prioritizing its top 10 items,Modern Retail reports. It’s also reduced inventory by cutting down on launches and designing products that will be in demand via customer feedback.

Other brands, like Weezie Towels, don’t plan to cut SKUs, but will focus on bundling top-selling products. The core theme? Being in touch with what customers expect from your brand and producing those items, be it top sellers or new lines.

The importance of a future-proof supply chain strategy

The world is changing. Not in the typical “COVID changed everything” sense, either. Instead, COVID highlighted an issue that already exists: the tide of globalization is waning.

“Not so long ago,”writesForbes, “about 70% of world trade was carried out through global value chains spanning multiple industries and dozens of countries.”

But by 2019,Forbesreports, global trade growth was already showing signs of slowing. 2016’s Brexit and trade protectionism in the US meant that COVID was not the spark of deglobalization, but rather the final nail in the coffin.

能否经得住时间的考验的增刊ly chain, however, gives companies a moat against these global dynamics. In that sense, the COVID-19 pandemic was a warning shot across the bow—a wake-up call for the realities of supply chains in the 21st century.

With more dynamic and flexible supply chain strategies in place, companies can begin reaping the incentives immediately:

- Cost savings.For example,Louis Vuitton’s 100,000-square-foot factory in Texas美国市场定位其供应链。ob欧宝娱乐app下载地址一个side effect: with transportation prices up in 2022, regional supply hubs like this also reduce the impact of inflation on long supply chains. More on this in the next section.

- Better inventory data.Companies can incur millions of dollars in expenses due to delays, shortages, and inventory stockouts without emphasizing the quality of their supply data. On the other hand, investments in real-time supply chain visibility can reverse this trend.

- Risk management.一个recent studysuggests that only 10% of supply chain professionals now feel “extremely unprepared.” Why? Companies that remade their supply chains after the COVID-19 pandemic are better prepared for the next black swan event.

Strategies and best practices for future-proofing your supply chain

Strategy #1: Localize your supplies

When Louis Vuitton built a 100,000-square-foot factory in Texas, it wasn’t necessarily because it liked barbecue.

The leather-goods manufacturing shop trains and hires its own leather employees, creating leather goods with the “Made in USA” label attached. Given many of the brand’s properties are in France, Louis Vuitton’s stateside investment means there’s one less ocean to travel every time a new product ships to the American market.

If you want to invest in the efficiency of the supply lines between you and your customers, set up local delivery with yourShopify presence.

Strategy #2: Prepare for new risk events

After the shock of COVID-19, some companies are investing new money into real-time data monitoring to track upcoming shifts in demands.

To better keep track of your inventory and your industry, Shopify Plus can help youmonitor launchpad eventsorread up on your latest analytics(including Live View) to see where the winds are pointing.

Strategy #3: Diversify your supply chain

In investing, experts say spreading your money around reduces risk. It’s the same with supply chains: the more options you can turn to, the steadier your inventory will be.

When we reviewed thebest supply chain best practices from companies like Deloitte and UPS, one of our key takeaways was simple: check on the health of your current suppliers. Who’s supplying the suppliers, and what are their vulnerabilities?

最后,寻找可行的选择供应商add diversity to your supply chain, stabilizing your options when a crisis hits. Andbrowse third-party fulfillment providersto select one that will make your agile supply chain more resilient.

Strategy #4: Invest in the customer experience

If customers were always 100% patient, supply chain issues might not seem so damaging. You could simply send out an apology email when a product is out of inventory and say, “We’ll send it as soon as we can.”

Ultimately, customers have finite patience. That makes your supply chains a vital part of thecustomer experience.

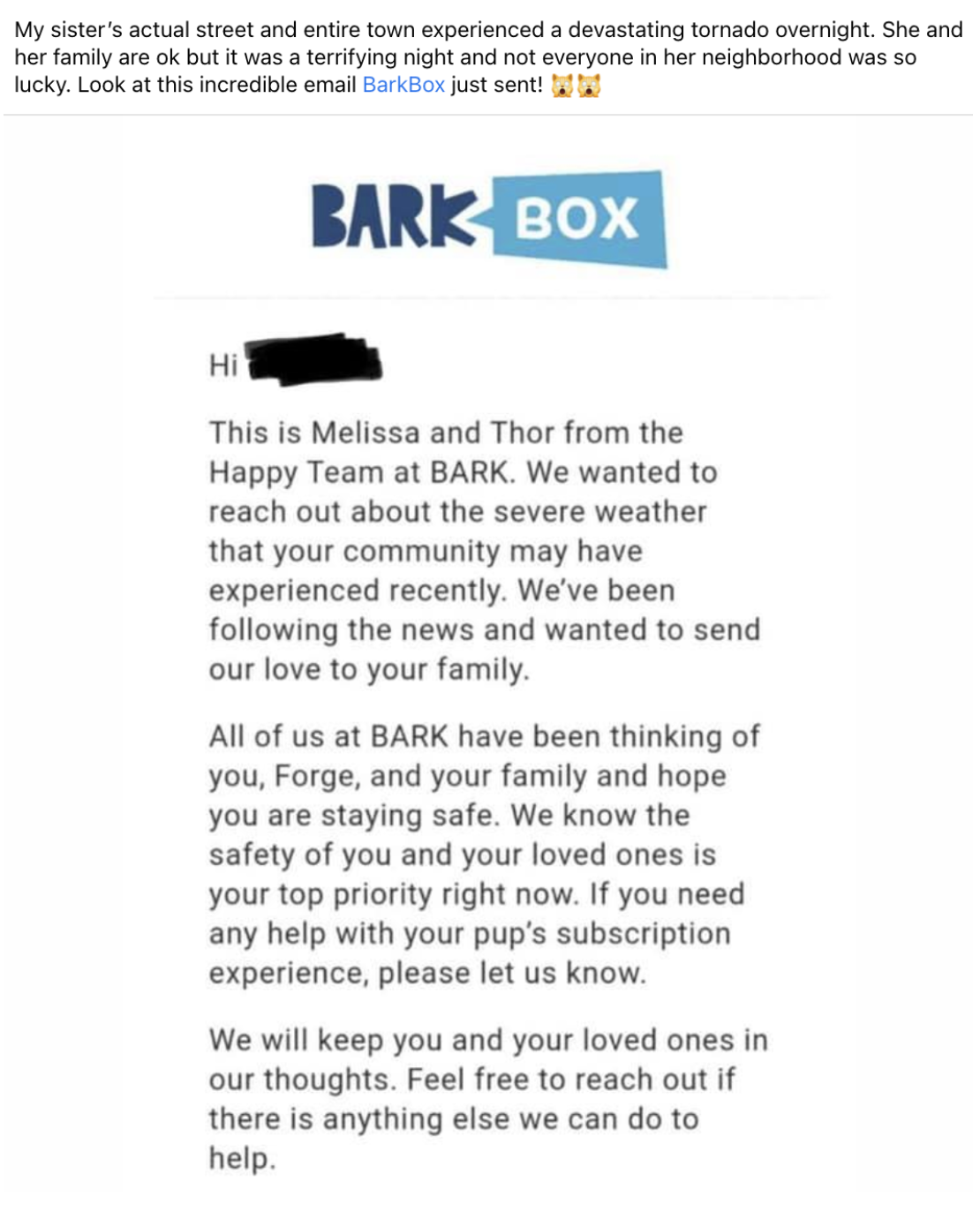

Consider what Barkbox did when a customer had the ultimate “supply chain disruption”: a tornado hitting their home. Barkbox reached out with a personal note:

Don’t hide your supply chain issues from your customers. Instead, be proactive and reach out to customers in a way that lets them know when supply chain disruptions are out of your hands.

Strategy #5: Invest in analytics

Sometimes you don’t know your supply chain vulnerabilities until you can see your data right there in black and white. That requires an investment in the analytics that driveallof your numbers.

Take theShopify data analytics coursefrom the Shopify Plus Academy to learn how to uncover insights into every aspect of your business—not just the supply chain.

Strategy #6: Hire a supply chain specialist

The hottest job in retail is a supply chain specialist. The past few years have exposed the downfalls of the modern supply chain, forcing retailers and brands to hire experienced leaders for their logistics operations.

As your brand expands into multiple retailers that need managing, logistics become more difficult. Hiring supply-chain-focused roles can help better manage supply and manufacturer connections, problem-solve supply chain issues, and create excellent vendor relationships.

Strategy #7: Invest in automation

一个way you can take proactive action during an era of disruption is through automation. Supply chain leaders are increasingly investing in new technologies to fill the gaps humans can’t manage.

Supply Chain Brainreportson three ways supply chain leaders use artificial intelligence and automation.

- Building a digital twin.Retailers are creating a digital supply chain replica, including all assets, warehouses, and materials, and acting out “what if” scenarios to improve planning. For example, if there is political unrest or a factory closure overseas, the digital twin can predict how it will impact the supply chain.

- Utilizing the internet of things (IoT).Retailers also use self-reliant, internet-connected devices to gather data, monitor supply chains, and reduce risk. With IoT, you can get real-time data on product locations, improve inventory tracking, build fully automated warehouses, and speed up the process of loading and unloading goods.

- Harnessing machine learning.You can use machine learning for endless reasons. These systems quickly analyze swaths of data, recognizing patterns and trends so you can make adjustments as needed. For example, you could determine the most cost-effective transportation routes in a region, factoring in fuel costs, vehicle usage, and risk of theft or damage. It helps you keep products in stock during high demand.

Despite struggles with demand planning due to supply chain delays, Old Navy isleaning on technologyto speed up production and improve efficiency. The retailer adopted a digital tool to “innovate more rapidly with suppliers and significantly reduce product design and development timelines,” CEO Sonia Syngal said on aQ4 call in March.

Automation doesn’t mean reducing your workforce, however. The goal is to help your supply chain flow more smoothly and enhance resilience.

Strategy #8: Clear dated products regularly

Excess inventory is a common problem amongst retailers, due to extended transit times. Nike recently reported that inventory levels were up by65%over the last quarter, CFO Matt Friend said on a recent call with analysts.

Friend said the company would tighten spending in the second half of the year and liquidate excess inventory more aggressively beginning in Q2. The retailer will focus on new product flow to strategic partners and Nike Direct, the brand’s DTC branch. If you’re struggling with shipping delays and factory shutdowns, lean on promotions to clear excess products and reduce holding costs.

Strategy #9: Collaborate with manufacturers

Everyone is feeling the effects of supply chain volatility, even your manufacturers. In these times, it’s critical to maintain an open line of communication and find ways to collaborate with stakeholders across your supply chain.

以女性的亲密的服装品牌崇拜我为example. The retailer wanted to create a more sustainable product production pipeline. It even started an evaluation process called the Green Adore Me Manufacturer Evaluation in 2019 to qualify suppliers.

Adore Me quickly realized its Sri Lankan manufacturer MAS Holdings, which works with brands like Nike, Lululemon, Patagonia, and Everland, had already implemented greener initiatives throughout its 15 facilities. The standards enacted helped Adore Me meet its goals.

“MAS is a new kind of partner for Adore Me, with a partnership structure instead of the traditional supplier brand relationship,” VP of Strategy Ranjan Roy toldGlossy.

Connect with suppliers and let them know your plans. Even if you look to nearshore, keep them in the loop. Suppliers may be able to help you out in unexpected ways, like providing blank products to print in other production bases.

What to expect in 2023

Retailers have had it rough throughout 2022. From shipping delays to cost increases for raw materials (cotton hit a 10-year high in May), and dealing with overstock, challenges seem to be the new normal for the supply chain.

Asurveytaken of US supply chain executives found that more than half of executives don’t expect a return to “normal” until the first half of 2024, while 22% expect disruptions to continue until the second half of 2023.

When asked what could bring supply chain costs under control and mitigate uncertainty, the responses were:

- An end to the war in Ukraine (32%)

- Lowering fuel costs (20%)

- Outlawing supply chain profiteering and corruption (21%)

- Raising interest rates quickly and significantly to halt inflation (10%)

Craig Fuller, CEO at FreightWaves, believes supply chains are never returning to “normal.” He writes in arecent article, “Historical models no longer work—as the world becomes far less predictable, peaceful, and safe—and supply chains are far more exposed to supply and demand shocks.”

In the meantime, retailers are doing their best to manage an uncertain trade environment by opening new factories, bringing manufacturing closer to end shoppers, and exploring new types of shipping.

Future-proofing your supply chains for the challenges ahead

There is no 100% “future-proof”supply chain. But given the industry's resilience and digital transformation over the past few years, you might not need one.

Building reliable relationships with a diverse list of supply chain partners and logistics providers—especially if they’re local—can serve as an “emergency valve” that gets you through the next supply crisis.

And you don’t need a crisis to justify the investments you make. Today’s retailers find that enhancing supply chain resilience can help hedge against other challenges, like higher transportation costs.