Pricing a productis one of the cornerstone decisions you’ll make as a business owner. The pricing model you choose impacts virtually every part of your business.

它还会影响你的客户。价格的敏感度is one of thekey factorssurrounding companies’ pricing choices. Customers are well informed about their purchases now, and they are sensitive to price because they want the maximum benefits for their money and time.

That’s why it’s all too easy to get stuck on your pricing strategy when you’re launching a new business or product, but it’s important not to let the decision stop you from launching. The best pricing dataentrepreneurscan get is from launching and testing with real customers. Market research plays a role of course, but at the end of the day, your pricing needs to be based on what your customers are actually willing to pay.

All that said, choosing a pricing model can be tricky. That’s why we created this guide, which covers everything you need to know about how to price a product, and also goes over important components of an effective pricing strategy and popular pricing models used in business today.

Product Pricing Guide Shortcuts ✂️

Choose the right price

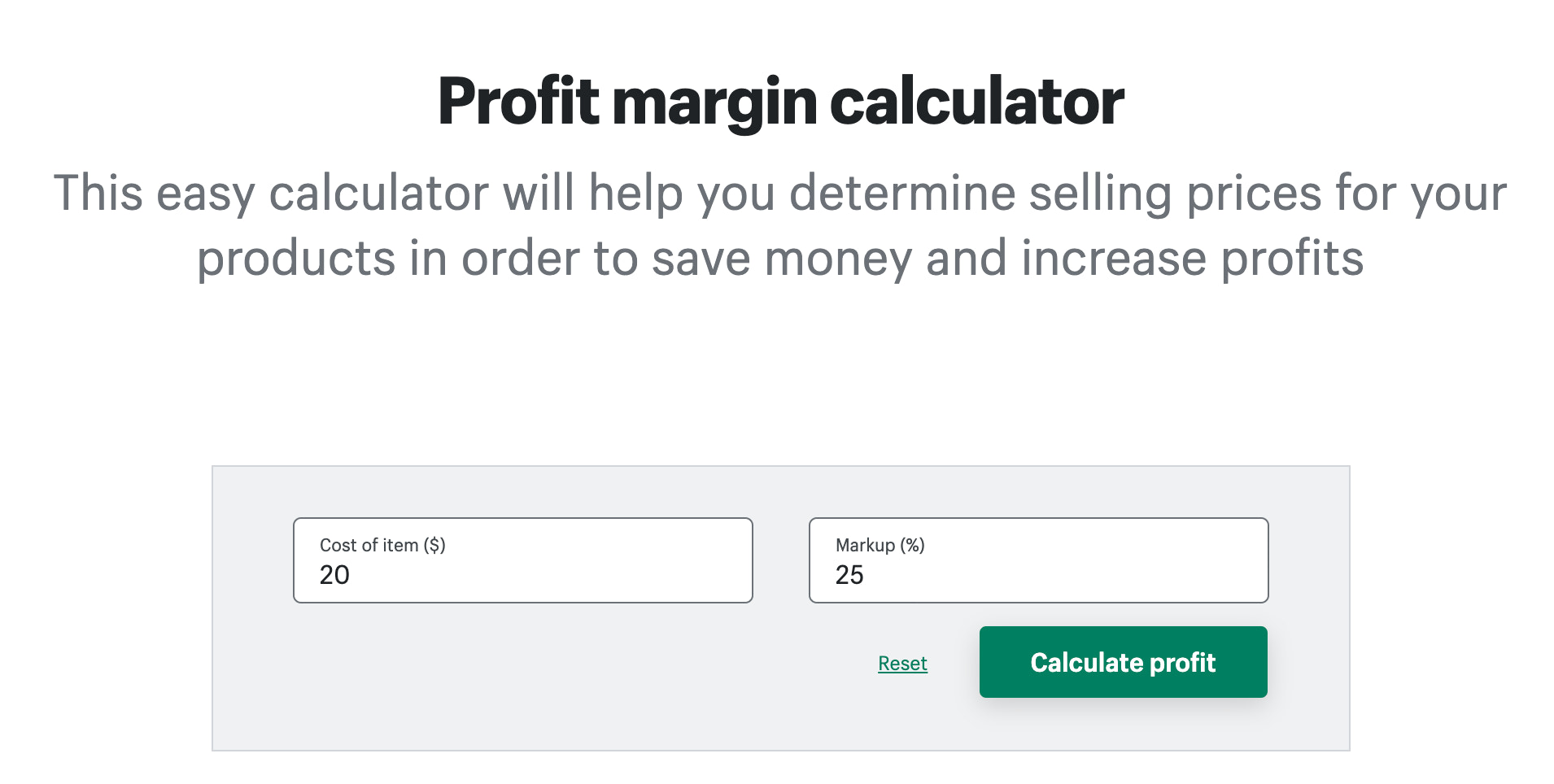

Determine your markups and profit margin to set the perfect price and increase your bottom line with our product pricing calculator.

Learn moreWhat is product pricing?

Product pricing is the process of determining the quantitative value of a product based on both internal and external factors. Product pricing has a direct impact on the overall success of your business, from cash flow to profit margins to customer demand.

Pricing strategiesdiffer based on industry, target customers, and even cost of goods. In ecommerce for example, subscription-based pricing models are common. In more competitive markets, competitive pricing is often the way to go.

我该如何price my products?

There’s no shortage of advice about product pricing. Some of the advice is great, some of it … not so much. Fortunately, there’s a simple way to price products so you sell profitably. By using thorough market research and understanding your ideal customers, you can land on a pricing strategy and final price that works for you.

Pricing touches everything from your business finances to your product’s positioning in the market, with considerations like whether it’s a timeless, bespoke, or a short-livedtrending product. It also factors into how you make a profit selling ononline selling sites. It’s a key strategic decision you need to make for your business, and it can be just as much an art as it is a science.

But it’s not a decision you only get to make once.

If you’re trying to find the retail price of your product, there is a relatively quick and straightforward way to set a starting price.

To set your first price, add up all of the costs involved in bringing your product to market, set yourprofit marginon top of those expenses, and there you have it. This strategy is calledcost-plus pricing, and it’s one of the simplest ways to price your product.

If it seems too simple to be effective, you’re half right—but here’s how it works.

Pricing isn’t a decision you only get to make once.

Why this pricing model works

The most important element of your pricing strategy is that it needs to sustain your business. Your selling price needs to be able to keep you in business.

If products are set at a high price and potential customers don’t buy, you’ll lose market share. If you set your prices too low, you’ll be selling at a loss, or at an unsustainable profit margin. This makes it challenging to grow at scale. Of course, sometimes it may make sense to sell a particular product at a lower price if you find this increases your customer’s lifetime value, but this should always be done strategically.

There are other important factors that your pricing needs to account for, like how you’re priced in relation to your competitors,consumer trends, and what differentpricing strategiesmean for your business and your customers’ expectations. Your existing customers can also give you insight into whether or not you can raise your prices. You can start testing a higher price to a small segment of your existing customers and see how they react.

But before you can worry about choosing your product's selling price, there are a few other important things to consider.

How to price your product

There are three straightforward steps to calculating a sustainable price for your product.

1. Add up your variable costs (per product)

An effective pricing strategy comes down to understanding your costs. If you order products, you’ll have a straightforward answer as to how much each unit costs you, which is yourcost of goods sold.

If you make your products, you’ll need to dig a bit deeper and look at a bundle of your raw materials, labor costs, and overhead costs. How much does that bundle cost, and how many products can you create from it? That will give you a rough estimate of yourcost of goods soldper item.

However, you shouldn’t forget the time you spend on your business is valuable, too. To price your time, set an hourly rate you want to earn from your business, and then divide that by how many products you can make in that time. To set a sustainable price, make sure to incorporate the cost of your time as a variable product cost.

At the end of the day, the price you choose should be what your target customers will pay on a consistent basis. Market research plays a critical role in your step. It’s important you know how much your customers are willing to pay before jetting to your competition.

| Cost of goods sold | $3.25 |

| Production time | $2.00 |

| Packaging | $1.78 |

| Promotional materials | $0.75 |

| Shipping | $4.50 |

| Affiliate commissions | $2.00 |

| Total per-product cost | $14.28 |

In this example, your total per-product cost is $14.28.

2. Consider your profit margin

Once you’ve got a total number for your variable costs per product sold, it’s time to build profit into your price.

Let’s say you want to earn a 20% profit margin on your products on top of your variable costs. When you’re choosing this percentage, it’s important to remember two things:

- You haven’t included your fixed costs yet, so you will have costs to cover beyond just your variable costs.

- You need to consider the overall market and make sure your price range still falls within the overall “acceptable” price for your market. If you’re two times the price of all of your competitors, you might find sales become challenging, depending on your product category.

Once you’re ready to calculate a price, take your total variable costs and divide them by 1 minus your desired profit margin expressed as a decimal. For a 20% profit margin, that’s 0.2, so you’d divide your variable costs by 0.8.

In this case, that gives you a base price of $17.85 for your product, which you can round up to $18.

Target price = (Variable cost per product) / (1 - your desired profit margin as a decimal)

3. Don’t forget about fixed costs

Variable costs aren’t your only costs.

Fixed costs are the expenses that you’d pay no matter what, and that stays the same whether you sell 10 products or 1,000 products. They’re an important part of running your business, and the goal is that they’re covered by your product sales as well.

When you’re picking a per-unit price, it can be tricky to figure out how your fixed costs fit in, which is why testing different price points is key.

A simple way to approach this is to take the information about variable costs you’ve already gathered and set them up inthis break-even calculator spreadsheet. To edit the spreadsheet, go to File > Make a copy to save a duplicate that’s accessible only by you.

It’s built to look at your fixed costs and your variable costs in one place, and to see how many units you’d need to sell of a single product to break even at your chosen price.

These calculations can help you make an informed decision about the balance between covering your fixed costs and setting a manageable and competitive price.

Find out everything you need to know aboutperforming a break-even analysis, including what to watch out for and how to interpret and adjust based on your numbers.

Using a product pricing calculator

使生活更轻松,使用产品定价它tor to find a profitable selling price for your products, which can be incredibly helpful for seeing how different price points may affect your business.

Shopify’s利润率计算器is a great way to figure this out. It uses a cost-plus pricing strategy that takes the total costs to make your product, then adds a percentage markup to determine the final selling price.

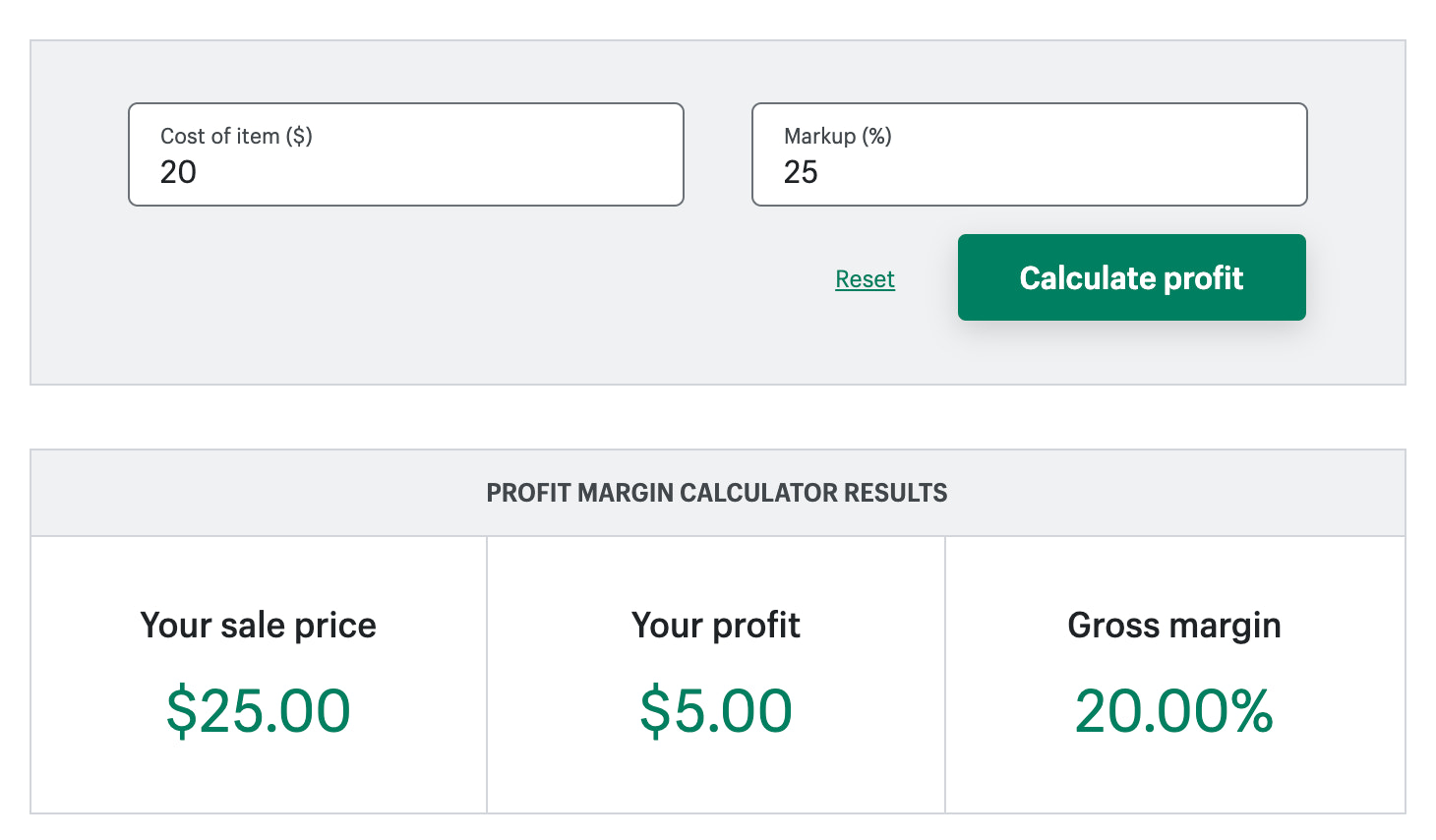

To start, simply enter your gross cost for each item and what percentage in profit you’d like to make on each sale. Let’s say it costs $20 to get your item on the shelf and you want to mark up the price by 25%.

After inputting your numbers, click “Calculate profit.” The tool will run those numbers through its profit margin formula to find the final price you should charge your customers. You’ll see in the example below that the sale price is $25, your profit is $5, and gross margin is 20%.

Play around with the numbers to find the perfect price point for your customer base and bottom line. If you can charge a higher price, increase your markup. From there, you can effectively set prices and start profiting off each sale.

Test different pricing strategies

Don’t let fear of choosing the “wrong” price hold you back from launching your store. Pricing decisions will always evolve with your business, and as long as your price covers your expenses and provides some profit, you can test and adjust as you go. Run aprice comparisonto see how your strategies stack up against similar products.

In ecommerce specifically, value-based pricing is a common pricing model. With value-based pricing, you price your products based on the perceived value of the products and services you offer.

Wondering what kind of promotional materials you might need for your products? One of the most common ones in an ecommerce context is marketing materials or additional gifts to level up yourecommerce packaging and unboxing experience.

Taking this approach will give you a price you can feel confident about, because the most important thing when it comes to pricing is being sure your pricing helps you build a sustainable business. Once you have that, you can launch your store or your new product, offer lower prices on discounts, and use the feedback and data you get from customers to adjust your pricing structure in the future.

Ready to create your business? Start your free trial of Shopify—no credit card required.

Product pricing FAQ

How much profit should I make on a product?

What is a good price for a product that costs $10 to produce?

How can I find out how to price a product?

What factors should be considered when pricing a product?

- The total costs of running your business including fixed and variable costs

- Competitors’ pricing

- Market demand

- Target customers spending power

- The value of your product